A survey of U.S. consumers from Morgan Stanley found that while Nike remained the most dominant athletic shoe and apparel brand among U.S. consumers, Adidas and Puma may be gaining ground at Nike’s expense.

The survey of 1,500 U.S. consumers, ages 15-to-54, who had bought athletic shoes or apparel in the last 12 months, was conducted in April and compared to similar surveys the investment firm conducted in 2013, 2018 and 2019. The study was supported by Morgan Stanley’s internal AlphaWise research team.

The study pointed out that although Nike is the leading athletic shoe and apparel brand in the U.S. with a market share of 18 percent compared to 7 percent for Adidas, the survey found Adidas is the favorite athletic shoe and apparel brand in the U.S. after having demonstrated consistent gains in its survey history.

Adidas also edged out Nike for its number one name ranking on awareness, ownership, LTM (last twelve months) purchase incidence, and NTM (next twelve months) purchase intent. Morgan Stanley wrote, “While feedback from U.S. retailers remains mixed on Adidas, the survey suggests that consumers have been more and more appreciative of the brand, a key surprise for us.”

Puma was also one of the few brands to expand share versus past surveys across several key metrics.

Adidas Tops Nike As U.S. Consumers Favorite Athletic Footwear Brand

Of the 24 athletic shoe brands analyzed in the study, Nike maintained its status as the most currently owned, purchased in the LTM and the brand to be purchased in the NTM among U.S. consumers.

However, Adidas moved past Nike in becoming U.S. consumers’ favorite brand and made inroads across four additional key metrics: Currently Owned, Purchased in the LTM, To Be Purchased in the NTM, and Most Recognized. Nike mostly ceded share across all those key metrics.

Puma has also notably shown momentum in athletic footwear, establishing itself as a solid athletic shoe brand among U.S. consumers via increased Awareness, Ownership, Purchased in the LTM, and To Be Purchased in the NTM in the 2021 survey compared to 2019.

Among other brands, Skechers has confirmed its position as a stable top three-to-five U.S. athletic shoe brand, with consistent Awareness, Ownership, LTM purchase incidence, NTM intent-to-purchase, and favorite ranking results across surveys. While Under Armour has increased its U.S. athletic shoe brand awareness across 2018, 2019 and 2021 surveys. 2021 Ownership, LTM purchase incidence, NTM intent-to-purchase, and Favorite Ranking reverted to below 2018 survey levels, suggesting some brand erosion.

In its April 2021 survey, 34 percent of respondents cited Adidas as their favorite athletic shoe brand, up from 22 percent in 2019, 18 percent in 2018 and 9 percent in 2013. Nike was cited by 24 percent of respondents as their favorite footwear brand, down from 31 percent in 2019, 32 percent in 2018 and 31 percent in 2013.

The remaining favorite athletic footwear brands in the Top 10 ranking in its April 2021 survey were Skechers, 6 percent; Jordan, 5 percent; New Balance, 5 percent; Asics, 4 percent; Brooks, 2 percent; Converse, 2 percent, Puma, 2 percent; and Reebok, 2 percent.

Adidas, Lululemon And Puma Gain Mindshare In Athletic Apparel

Of the 29 athletic apparel brands analyzed, Adidas has become U.S. consumers’ favorite athletic apparel brand and the leading brand for Awareness, Ownership, and LTM purchase incidence. Nike remains a close second across the measures, and consumers indicated Nike is the number one brand to be purchased in the NTM. Similar to athletic shoes, Puma has established itself as a solid athletic apparel player among U.S. consumers, seemingly at the expense of Champion.

Lululemon delivered consistent results across 2018, 2019, and 2021 surveys in athletic apparel. Under Armour stands out for its across-the-board declines on the five key metrics in the 2021 survey, most of which represented the worst declines in the peer set.

The April survey found 24 percent cited Adidas as their favorite athletic apparel brand compared to 14 percent in 2019, 12 percent in 2018 and 8 percent in 2018. Nike was cited as a favorite by 23 percent in the latest survey, down from 24 percent in 2020, 24 percent in 2019 and 26 recent in 2018.

The remaining favorite athletic apparel brands in the Top 10 ranking in its April 2021 survey were Under Armour, 8 percent; Champion, 4 percent; Lululemon, 4 percent; Columbia, 3 percent; Puma, 3 percent; Asics, 2 percent; Athleta, 2 percent; and Fila, 2 percent.

Updating its stock ratings, Morgan Stanley raised its estimates and upgraded its ratings on Adidas to “Equal-weight” and Puma to “Overweight,” based on the survey results. The investment firm wrote, “North America represents an important source of potential revenue and margin improvement for both European groups. The survey suggests growing momentum with U.S. consumers and leaves us incrementally positive on both brands.”

Forecasts and price targets on Nike were trimmed as the survey suggested: “The competitive landscape in the U.S. is changing and potentially out of Nike’s favor.” However, Morgan Stanley kept its “Overweight” rating on the stock as historical EPS misses versus expectations by Nike “have proven short-lived,” the potential payoff of its “early innings” direct-to-consumer (DTC) strategy and Nike’s relative stock underperformance in 2021.

On Under Armour, Morgan Stanley said the survey suggested that the brand’s “affinity has faded among its core U.S. audience, a cause for concern.” However, the investment firm kept its “Equal-weight” rating partly because Under Armour’s stock reflected growth concerns.

Other key findings from the study include:

- Strong Underpinnings For Activewear Growth. Participation increased across all athletic activities versus its 2019 survey, and activewear wardrobe penetration appears set to remain high despite consumers returning to work as pandemic restrictions ease. Morgan Stanley wrote, “Athleticwear now comprises 40 percent of U.S. consumer wardrobes, and they are increasingly using athletic shoes and apparel for casual wear and athletics. Broader health and wellness and fashion casualization trends appear intact.”

- Shifts In Consumer Behavior Could Bode Well For Margins. Athletic shoes and apparel purchases have “meaningfully” migrated online, and 40 percent of consumers are using apps, confirming their viability for brand engagement. And the move to online channels “appears sticky” per expectations over the next twelve months. Further, consumers seem less price-sensitive as the survey showed the “price” metric had fallen to number four for both athletic shoes and apparel behind comfort, quality and fit. Morgan Stanley wrote, “These behavioral changes could sustain industry-wide gross margin strength in the medium term similar to what we’ve seen in the last three quarters.”

- Athletic Shoes And Apparel Retailers Losing Share To Amazon And Brands: Amazon now ranks number one among athletic shoe and apparel retailers by a wide margin. Amazon’s purchase share expanded by 14 points in athletic shoes and 13 points in athletic apparel versus 2019, while nearly all specialty footwear retailers, department stores, off-price retailers, and hardline & broadline retailers in its survey saw declines. Morgan Stanley wrote, “Additionally, consumers browsed and purchased athletic shoes and apparel directly from Nike and Adidas at a higher rate than retailers, brand peers and online marketplaces in the LTM, except for eBay, suggesting consumer propensity to shop directly with athletic’s two major brands.”

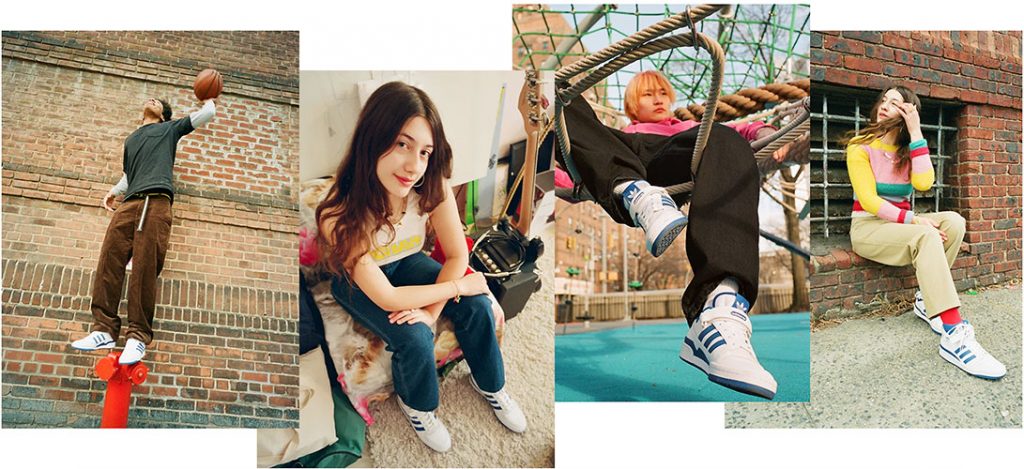

Photos courtesy Adidas