Japan-based sporting goods powerhouse Mizuno Corporation reported profits rose 6.5 percent in its fiscal year ended March 31, as sales grew 4.6 percent, with both marking record results. In the Americas region, sales advanced 6.2 percent on strength in golf and volleyball, while operating profits improved 18.3 percent.

Total sales in the year were ¥240,335 million, up 4.6 percent year-over-year (y/y), operating profit was ¥20,777 million, up 20.2 percent y/y; ordinary profit was ¥21,352 million, up 10.7 percent y/y; and profit attributable to owners of parent was ¥15,243 million, up 6.5 percent y/y. Mizuno noted that all were record highs.

Mizuno said, “During the fiscal year under review, the Japanese economy maintained a gradual recovery trend. This was primarily thanks to improved employment and income conditions and continued strong consumption by inbound tourists. Overseas economies have also continued to recover, although there are signs of a standstill in some regions. Meanwhile, the global economic outlook is uncertain due to factors such as the impact of the U.S. tariff and trade policies and increasing geopolitical risks.

“Thanks to the global sport events that took place, the sport market has enjoyed growing opportunities for a wide range of sports. Meanwhile, the expansion of the sport market for outdoor personal sports such as golf, which continued to expand since the COVID-19 pandemic, has been steady.

“Under such circumstances, the Group’s sales in Japan remained robust in competitive sports products, including football, volleyball, and racket sports, and sales of the work business remained strong. Overseas business performance also expanded, driven in part by the improvement of gross profit margin, in addition to the continued growth in sales of products for competitive sports such as football and Sportstyle shoes.”

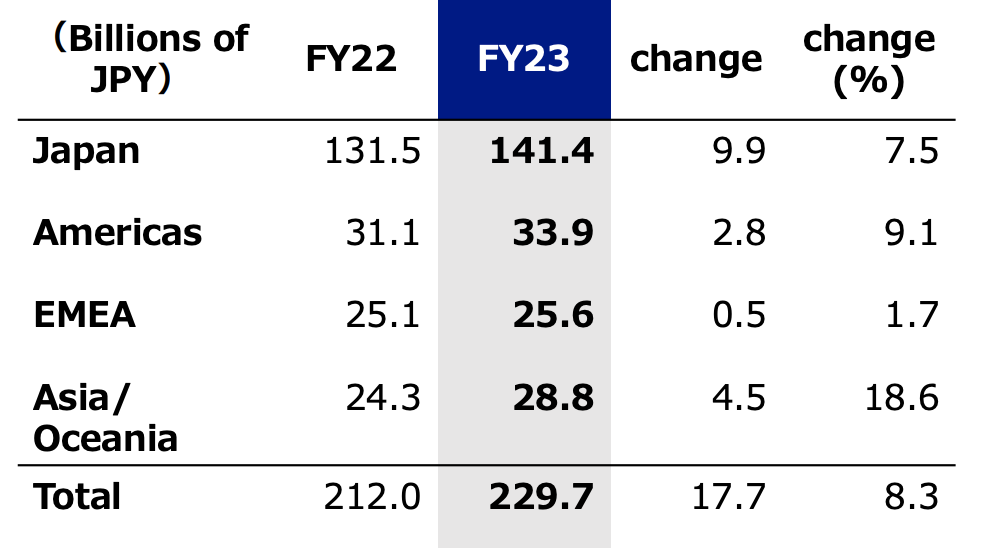

Regional Performance

In the Americas region, net sales were ¥35,986 million, up 6.2 percent, and operating profit was ¥2,766 million, up 18.3 percent. Mizuno said in its statement, “In the Americas, sales of iron clubs, main products of golf, continued to be strong, although there is a sense of a lull in the expansion of the golf market, which has continued over the past few years. In the products for competitive sports, sales increased, especially in volleyball. In addition, gross profit margin improved thanks to progress in optimizing inventory levels.”

In its home market of Japan, Mizuno recorded net sales of ¥147,291 million, up 4.2 percent and operating profit of ¥13,265 million, up 10.2 percent, achieving record-high levels. Mizuno said, “In Japan, sales of products for competitive sports, such as volleyball and racket sports, increased, and sales of the football business and Sportstyle shoes business, which are the focus of our business expansion efforts in this region, continued to remain strong. In addition, the work business, which is our non-sports business, continued to enjoy growth. In spite of downward pressures on profit due to the foreign exchange, sales through a direct-to-consumer (DTC) channel increased, especially in Sportstyle shoes, boosting gross profit margin.”

In Europe, net sales decreased 7.1 percent y/y to ¥23,743 million while operating profit climbed 28.4 percent y/y to ¥678 million. Mizuno said, “In Europe, the football business and Sportstyle shoes business, which are the focus of our business expansion efforts in this region, enjoyed growth. Additionally, sales of products for competitive sports, such as volleyball, also increased. Gross profit margin of running shoes, which is one of our main products, improved, reflecting our efforts to improve the margin.”

In the Asia and Oceania region, sales were ¥33,314 million, up 15.5 percent. Operating profit was ¥4,038 million, up 76.9 percent, both marked record-high levels. Mizuno said, “In Asia and Oceania, the football business, which is the focus of our business expansion efforts in this region, experienced growth in South Korea and Southeast Asia. Furthermore, sales of products for competitive sports, such as racket sports and volleyball, also increased. Sales of Sportstyle shoes significantly increased as well.”

Outlook

For the current year ending March 31, 2026, Mizuno’s forecast calls for sales of ¥260,000 million (up 8.2 percent y/y); operating profit of ¥22,500 million (up 8.3 percent y/y); ordinary profit of ¥23,000 million (up 7.7 percent y/y); and profit attributable to owners of parent of ¥16,500 million (up 8.2 percent y/y).

Mizuno said, “Japan’s economy is expected to continue moderate growth, driven by factors such as increased personal consumption due to wage increases, expansion of inbound demand, and so on. Overseas economies are also projected to continue their growth trajectory, although there will be variations in the pace of growth among different countries and regions. However, the global economic outlook is uncertain due to factors such as increasing geographical risks and the impact of the U.S. tariff and trade policies.”

Image courtesy Mizuno Corp.