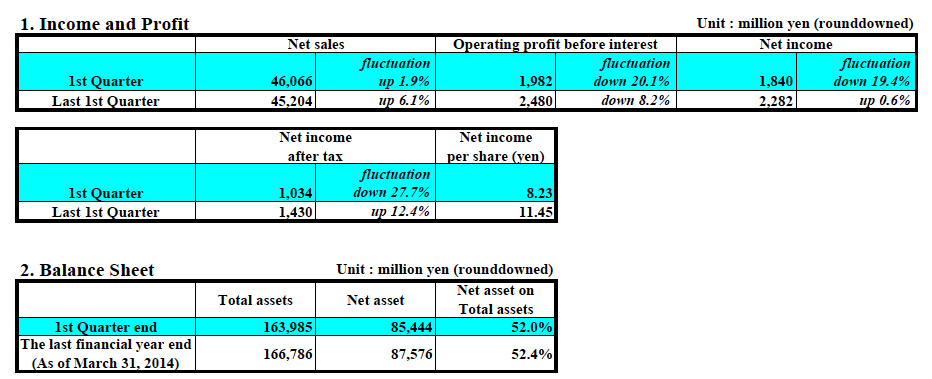

Mizuno Corp. reported revenue in its first quarter ended June 30 reached ¥46.1 billion ($451 mm), up 1.9 percent compared with the same period in the previous fiscal year as running offset a poor golf performance. Operating profits were down 20.1 percent.

Highlights of the quarter include:

・ Revenue totaled ¥46.1 billion, up 1.9 percent compared with the same period in the previous fiscal

year.

・ Operating profit stood at ¥1.98 billion, down 20.1 percent. Ordinary profit totaled 1.84 billion yen, down

19.4 percent. The quarterly net income was 1.03 billion yen, down 27.7 percent.

・ Running-related products continued their solid showing in all areas, but the increase in revenue

was marginal in part due to a reactionary decline following a rush in demand ahead of the

consumption tax hike specific to Japan. Also, operating profit fell on an increase in marketing

expenses.

・ Meanwhile, manufacturing costs at overseas production sites dropped, improving the gross margin

by 0.4 point.

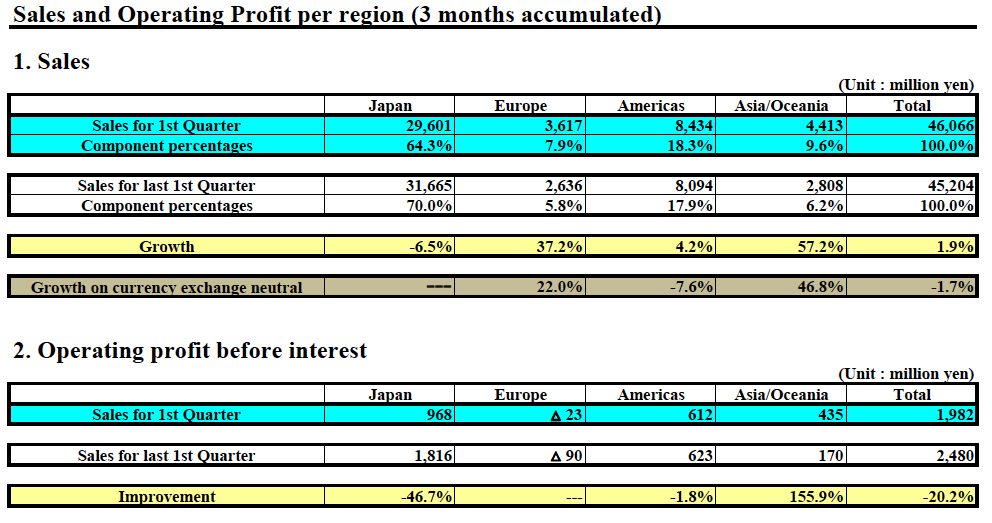

Main regions

Europe

・ The business related to running-related products remained healthy. The product lineup was

expanded by mirroring the diversifying population of runners, with a boost seen from sales

promotion initiatives at the Hamburg Marathon, where Mizuno became a sponsor for the first time.

・ Indoor sports business revenue rose as brand recognition got a push, especially in the handball

market.

・ Results for golf were bleak, as orders for custom fitting did not stage any growth.

・ Revenue ultimately increased 37.2 percent.

The Americas

・ The volleyball business performed well, and while its 16 percent growth in revenue is about to make it the

pillar of the business, the running and golf businesses especially struggled with the impact from

inclement weather, such as heavy snowfall, due to the record cold wave.

・ Revenue ended up 4.2 percent higher, which partly reflected the impact of the major weakening of the

yen on the foreign exchange conversion rate.

Japan

・ The shoes business in the health arena, such as running and walking shoes, performed well.

Apparel products were also strong.

・ The results of the sports facilities business, which has been expanding, grew from the previous

year partly because of an increase in construction projects and as the operation business were

robust.

・ Meanwhile, mid-priced products, especially in golf and baseball, were sluggish in part due to the

consumption tax hike.

・ Revenue fell 6.5 percent partly given the impact of transferring the agency business in the Asian region

which had been conducted in Japan until the previous fiscal year to two consolidated

subsidiaries.

Forecast for Fiscal 2014

・ Revenue: ¥195.0 billion; operating profit: ¥8.0 billion; ordinary profit: ¥8.0 billion; net

income: ¥5.0 billion. No changes were made from its prior guidance.