Economic activity in the U.S. manufacturing sector contracted in September for the sixth consecutive month and the 22nd time in the last 23 months, say the nation’s supply executives in the latest Manufacturing ISM Report On Business. The report was issued by Timothy R. Fiore, CPSM, C.P.M., chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee.

Fiore reported that the Manufacturing PMI registered 47.2 percent in September, matching the figure recorded in August. He said the overall economy continued in expansion for the 53rd month after one month of contraction in April 2020. (A Manufacturing PMI above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy.)

But the New Orders Index remained in contraction territory, Fiore noted, registering 46.1 percent, 1.5 percentage points higher than the 44.6 percent recorded in August. The September reading of the Production Index (49.8 percent) is 5 percentage points higher than August’s figure of 44.8 percent.

The Prices Index also went into contraction (or ‘decreasing’) territory for the first time this year, registering 48.3 percent, down 5.7 percentage points compared to the reading of 54 percent in August.

Among other indices:

- The Backlog of Orders Index registered 44.1 percent, up 0.5 percentage point compared to the 43.6 percent recorded in August.

- The Employment Index registered 43.9 percent, down 2.1 percentage points from August’s figure of 46 percent.

- The Supplier Deliveries Index indicated slowing deliveries, registering 52.2 percent, 1.7 percentage points higher than the 50.5 percent recorded in August. Fiore noted that the Supplier Deliveries index is the only ISM Report On Business index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases.

- The Inventories Index registered 43.9 percent, down 6.4 percentage points compared to August’s reading of 50.3 percent.

- The New Export Orders Index reading of 45.3 percent is 3.3 percentage points lower than the 48.6 percent registered in August.

- The Imports Index remained in contraction territory in September, registering 48.3 percent, 1.3 percentage points lower than the 49.6 percent reported in August.

“U.S. manufacturing activity contracted again in September, and at the same rate compared to last month,” Fiore said in his report. “Demand continues to be weak, output declined, and inputs stayed accommodative.”

He said demand slowing was reflected by the (1) New Orders Index remaining in contraction territory, (2) New Export Orders Index contracting at a faster rate, (3) Backlog of Orders Index staying in strong contraction territory, and (4) Customers’ Inventories Index indicating customers’ inventories were “about right.”

Output (measured by the Production and Employment indexes) continued in contraction with mixed results: Employment shrunk at a faster rate while production approached expansion, with levels on par compared to August.

Panelists cited continuing efforts by their companies to right-size workforces to levels consistent with projected demand.

Inputs — defined as supplier deliveries, inventories, prices and imports — generally continued to accommodate future demand growth, with inventories returning to low levels and suppliers showing some difficulty in meeting customer needs.

“Demand remains subdued, as companies showed an unwillingness to invest in capital and inventory due to federal monetary policy — which the U.S. Federal Reserve addressed by the time of this report — and election uncertainty,” Fiore explained.

Fiore also said production execution stabilized in September:

“Suppliers continue to have capacity, with lead times improving and shortages reappearing. Seventy-seven percent of manufacturing gross domestic product (GDP) contracted in September, up from 65 percent in August,” he noted. “The share of manufacturing sector GDP registering a composite PMI calculation at or below 45 percent (a good barometer of overall manufacturing weakness) was 41 percent in September, an 8-percentage point increase compared to the 33 percent reported in August. Only one of the six largest manufacturing industries — Food, Beverage & Tobacco Products — expanded in September, compared to two in August.”

The five manufacturing industries reporting growth in September are: Petroleum & Coal Products; Food, Beverage & Tobacco Products; Textile Mills; Furniture & Related Products; and Miscellaneous Manufacturing. The 13 industries reporting contraction in September — in the following order — are: Printing & Related Support Activities; Plastics & Rubber Products; Wood Products; Apparel, Leather & Allied Products; Primary Metals; Transportation Equipment; Nonmetallic Mineral Products; Electrical Equipment, Appliances & Components; Paper Products; Machinery; Chemical Products; Fabricated Metal Products; and Computer & Electronic Products.

September 2024 Manufacturing Index Summaries

Manufacturing PMI

The U.S. manufacturing sector contracted for the sixth consecutive month in September, as the Manufacturing PMI registered 47.2 percent, the same reading as in August. A reading above 50 percent indicates that the manufacturing sector is generally expanding; below 50 percent indicates that it is generally contracting.

“After breaking a 16-month streak of contraction by expanding in March, the manufacturing sector has contracted the last six months. Of the five subindexes that directly factor into the Manufacturing PMI, only one (Supplier Deliveries) was in expansion territory, the same as in August. The New Orders and Production indexes remained in contraction but moved upward in September. Of the six biggest manufacturing industries, only one (Food, Beverage & Tobacco Products) registered growth,” said Fiore.

However, a Manufacturing PMI above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy. Therefore, the September Manufacturing PMI indicates the overall economy grew for the 53rd straight month after last contracting in April 2020.

“The past relationship between the Manufacturing PMI and the overall economy indicates that the September reading (47.2 percent) corresponds to a change of plus-1.3 percent in real gross domestic product (GDP) on an annualized basis,” said Fiore.

New Orders

ISM’s New Orders Index contracted in September for the sixth consecutive month, registering 46.1 percent, an increase of 1.5 percentage points compared to August’s figure of 44.6 percent. The New Orders Index hasn’t indicated consistent growth since a 24-month streak of expansion ended in May 2022. A New Orders Index above 52.3 percent, over time, is generally consistent with an increase in the Census Bureau’s series on manufacturing orders (in constant 2000 dollars).

“Of the six largest manufacturing sectors, two (Computer & Electronic Products; and Food, Beverage & Tobacco Products) reported increased new orders. Panelists noted a continued level of uncertainty and concern about a lack of new order activity — with a 1-to-1.5 ratio of positive comments versus those expressing concern — and their confidence in the future economic environment remains at its lowest levels since the coronavirus pandemic recovery. Many comments noted that companies’ focus is now on 2025 business planning as they await the impacts of lower interest rates and the U.S. election results,” Fiore detailed.

The two manufacturing industries that reported growth in new orders in September are: Computer & Electronic Products; and Food, Beverage & Tobacco Products. The 11 industries reporting a decline in new orders in September — in the following order — are: Plastics & Rubber Products; Printing & Related Support Activities; Paper Products; Primary Metals; Wood Products; Nonmetallic Mineral Products; Transportation Equipment; Machinery; Electrical Equipment, Appliances & Components; Miscellaneous Manufacturing; and Chemical Products.

Production

The Production Index continued in contraction territory in September, registering 49.8 percent, 5 percentage points higher than the August reading of 44.8 percent. An index above 52.2 percent, over time, is generally consistent with an increase in the Federal Reserve Board’s Industrial Production figures. Of the six largest manufacturing sectors, three (Computer & Electronic Products; Food, Beverage & Tobacco Products; and Fabricated Metal Products) reported increased production.

“As they closed the third quarter, panelists’ companies maintained output levels compared to August. New order rates remain weak, and backlog levels continue to decline (though at slightly slower rates). Companies continue to avoid investing in inventory due to economic uncertainty that may be alleviated Federal Reserve actions at the end of September,” offered Fiore.

The five industries reporting growth in production during the month of September are: Textile Mills; Computer & Electronic Products; Miscellaneous Manufacturing; Food, Beverage & Tobacco Products; and Fabricated Metal Products. The nine industries reporting a decrease in production in September, in order, are: Printing & Related Support Activities; Nonmetallic Mineral Products; Plastics & Rubber Products; Wood Products; Transportation Equipment; Electrical Equipment, Appliances & Components; Primary Metals; Machinery; and Chemical Products.

Employment

ISM’s Employment Index registered 43.9 percent in September, 2.1 percentage points lower than the August reading of 46 percent. The July, August and September readings are among the five lowest recorded since the index registered 43.7 percent in July 2020, early in the economic recovery. (The others are 45.9 percent in February 2024 and 45 percent in July 2023.) An Employment Index above 50.3 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.

“The index contracted for the fourth consecutive month after an expansion in May, which broke a seven-month streak of contraction. Of the six big manufacturing sectors, two (Food, Beverage & Tobacco Products; and Machinery) expanded employment in September. Respondents’ companies are continuing to reduce head counts through layoffs, attrition and hiring freezes. This sentiment was supported in September by the approximately 1-to-1.5 ratio of hiring versus staff reduction comments,” explained Fiore.

Of 18 manufacturing industries, the two industries reporting employment growth in September are: Food, Beverage & Tobacco Products; and Machinery. The 11 industries reporting a decrease in employment in September, in the following order, are: Apparel, Leather & Allied Products; Printing & Related Support Activities; Primary Metals; Plastics & Rubber Products; Transportation Equipment; Textile Mills; Electrical Equipment, Appliances & Components; Computer & Electronic Products; Fabricated Metal Products; Chemical Products; and Miscellaneous Manufacturing.

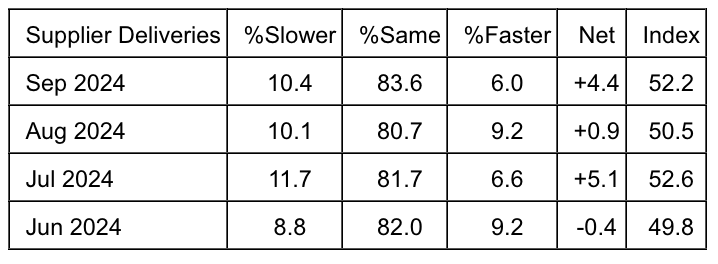

Supplier Deliveries

Delivery performance of suppliers to manufacturing organizations was slower in September, with the Supplier Deliveries Index registering 52.2 percent, a 1.7-percentage point increase compared to the reading of 50.5 percent reported in August. This is the third month of slower deliveries after four consecutive months of faster deliveries. A reading below 50 percent indicates faster deliveries, while a reading above 50 percent indicates slower deliveries.

After a reading of 52.4 percent in September 2022, the index went into contraction territory the following month and remained there for 20 out of 21 months until February.

Of the six big industries, two (Food, Beverage & Tobacco Products; and Fabricated Metal Products) reported slower supplier deliveries in September. “Supplier deliveries are slowing as panelists’ companies continue to rely on their suppliers to manage their purchased material inventories, which is putting strain on the supply chain,” added Fiore.

The eight manufacturing industries reporting slower supplier deliveries in September — listed in order — are: Textile Mills; Petroleum & Coal Products; Miscellaneous Manufacturing; Food, Beverage & Tobacco Products; Furniture & Related Products; Electrical Equipment, Appliances & Components; Plastics & Rubber Products; and Fabricated Metal Products. The two industries reporting faster supplier deliveries in September are: Machinery; and Transportation Equipment. Eight industries reported no change in supplier deliveries in September as compared to August.

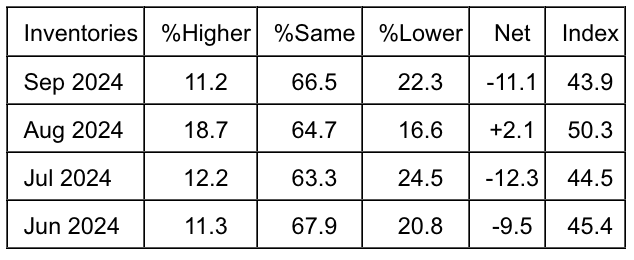

Inventories

The Inventories Index registered 43.9 percent in September, down a substantial 6.4 percentage points compared to the reading of 50.3 percent reported in August.

“Manufacturing inventories returned to their unusually low levels prior to August, as the timing mismatch with production the previous month was resolved in September. Of the six big industries, none reported increased manufacturing inventories in September,” said Fiore. An Inventories Index greater than 44.4 percent, over time, is generally consistent with expansion in the Bureau of Economic Analysis (BEA) figures on overall manufacturing inventories (in chained 2000 dollars).

Of 18 manufacturing industries, the only industry to report higher inventories in September is Petroleum & Coal Products. The 12 industries reporting lower inventories in September — in the following order — are: Printing & Related Support Activities; Wood Products; Textile Mills; Computer & Electronic Products; Paper Products; Electrical Equipment, Appliances & Components; Primary Metals; Chemical Products; Machinery; Food, Beverage & Tobacco Products; Miscellaneous Manufacturing; and Fabricated Metal Products.

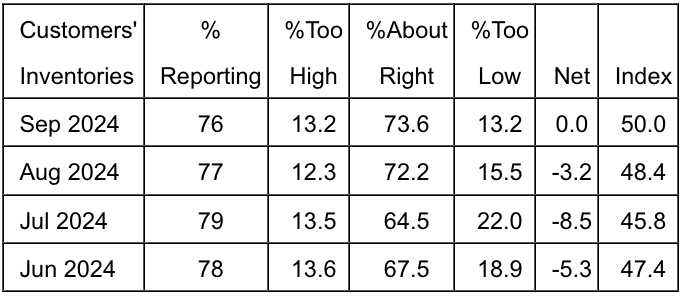

Customers’ Inventories

ISM’s Customers’ Inventories Index registered a reading of 50 percent in September, up 1.6 percentage points compared to the 48.4 percent reported in August.

“Customers’ inventory levels in September were ‘about right.’ Panelists are reporting that the amounts of their products in their customers’ inventories suggest a demand level that is neutral to negative for future new orders and production,” Fiore suggested.

The four industries reporting customers’ inventories as too high in September are: Nonmetallic Mineral Products; Primary Metals; Transportation Equipment; and Miscellaneous Manufacturing. The six industries reporting customers’ inventories as too low in September, in order, are: Paper Products; Food, Beverage & Tobacco Products; Machinery; Computer & Electronic Products; Fabricated Metal Products; and Chemical Products. Eight industries reported no change in customers’ inventories in September as compared to August.

Prices

The ISM Prices Index registered 48.3 percent, a notable 5.7 percentage points lower compared to the August reading of 54 percent, indicating raw materials prices decreased in September after eight straight months of increases, preceded by eight consecutive months of decreases. A Prices Index above 52.8 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) Producer Price Index for Intermediate Materials.

Of the six largest manufacturing industries, two — Food, Beverage & Tobacco Products; and Machinery — reported price increases in September.

“The Prices Index indicated decreasing prices in September, compared to the previous month. Commodity prices were less volatile, with (1) petroleum-derived products showing weakness, (2) aluminum indicating slowing growth, (3) corrugate and ocean freight continuing growth and (4) steel and steel products prices easing. Thirteen percent of companies reported higher prices in September, compared to 21 percent in August,” Fiore detailed.

In September, the seven industries that reported paying increased prices for raw materials, in order, are: Printing & Related Support Activities; Textile Mills; Plastics & Rubber Products; Miscellaneous Manufacturing; Electrical Equipment, Appliances & Components; Food, Beverage & Tobacco Products; and Machinery. The six industries reporting paying decreased prices for raw materials in September, in order, are: Petroleum & Coal Products; Wood Products; Nonmetallic Mineral Products; Primary Metals; Computer & Electronic Products; and Transportation Equipment.

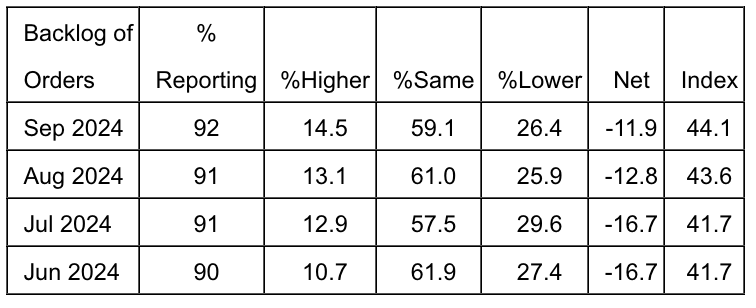

Backlog of Orders

ISM’s Backlog of Orders Index registered 44.1 percent, a gain of 0.5 percentage point compared to the August reading of 43.6 percent, indicating order backlogs contracted for the 24th consecutive month after a 27-month period of expansion.

Of the six largest manufacturing industries, only Computer & Electronic Products reported expanded order backlogs in September.

“The index remained in contraction in September, as contracting new orders and stable production levels versus August were insufficient to allow backlogs to significantly grow,” offered Fiore.

Of the 18 manufacturing industries, two reported growth in order backlogs in September: Textile Mills; and Computer & Electronic Products. The 13 industries reporting lower backlogs in September — in the following order — are: Wood Products; Printing & Related Support Activities; Plastics & Rubber Products; Electrical Equipment, Appliances & Components; Primary Metals; Machinery; Furniture & Related Products; Paper Products; Fabricated Metal Products; Transportation Equipment; Miscellaneous Manufacturing; Chemical Products; and Food, Beverage & Tobacco Products.

What Did Respondents Say?

“Our sales continue to be flat. Our customers are telling us that although our products perform very well, they are forced to seek lower-cost components to maintain their sales.” [Textile Mills]

“North America demand has started to weaken. Asian demand is slightly higher but shows signs of weakness in future months. Comments tied to automotive builds.” [Chemical Products]

“Global demand continues to remain soft. Fourth-quarter forecasts have been further reduced, with several new programs shifted from 2024 to 2025. Manpower, working capital and supplies are being flexed down in response. The previously anticipated shift from internal combustion engine to electric vehicle (EV) technology has been pushed out due to market response. Long-range plans are being adjusted to incorporate traditional products for longer, while new EV product offerings are being planned for slower rollouts.” [Transportation Equipment]

“The second half of 2024 is trending upward enough to more than compensate for the year-over-year losses we experienced in the first half. We are anticipating a record sales volume for 2024.” [Food, Beverage & Tobacco Products]

“The strategy of customer push-outs last year enabled those customers to adapt to the market. Now, while most companies are seeing a slowdown, we are seeing solid growth. The general slowdown in the economy is allowing for prices to continue to stabilize.” [Computer & Electronic Products]

“A continuing low order rate is resulting in ongoing manufacturing adjustments to balance output with demand.” [Machinery]

“The fourth quarter is slower than anticipated. We won’t realize the effect of interest rate adjustments with new project starts until the first quarter of 2025.” [Fabricated Metal Products]

“Business is flat. Waiting for interest rates to drop and the election outcome in November before we confirm our 2025 plans. Currently planning on a flat 2025.” [Furniture & Related Products]

“Sales have slowed this quarter compared to the same time period last year. Adjusting production accordingly.” [Miscellaneous Manufacturing]

“Still hiring to fill vacant positions in production/management. Not adding new jobs. Automotive original equipment manufacturers (OEMs) are starting to slow or cancel orders. The pace is slowing.” [Primary Metals]

Image courtesy Mohawk Industries, data and charts courtesy Institute for Supply Management