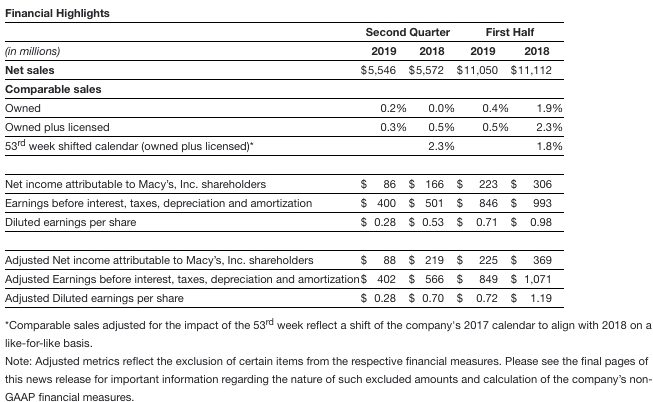

Macy’s Inc. on Wednesday lowered its diluted earnings per share guidance—excluding settlement charges, impairment and other costs—by 20 cents after posting EPS of 28 cents that missed analysts’ estimates by 17 cents. Comp sales growth was flat at 0.2 percent on an owned basis and 0.3 percent on an owned plus licensed basis.

The company’s shares were down in premarket trading Wednesday morning, leading a slow start for department stores on Wall Street.

“Macy’s, Inc. delivered another quarter of comparable sales growth. That said, we had a slow start to the quarter and finished below our expectations. Rising inventory levels became a challenge based on a combination of factors: a fashion miss in our key women’s sportswear private brands, slow sell-through of warm weather apparel and the accelerated decline in international tourism. We took markdowns to clear the excess Spring inventory and are entering the Fall season with the right inventory to meet anticipated customer demand,” said Jeff Gennette, Macy’s, Inc. chairman & chief executive officer. “While we had seasonal inventory challenges in Spring, there are many areas of the business that are performing well, notably our Destination Businesses. We continue to see healthier sales within our brick and mortar business, led by our Growth50 stores and Backstage expansion. Our digital business posted its fortieth consecutive quarter of double-digit growth, and mobile remained our fastest growing channel.”

“Our 2019 strategic initiatives are on track to contribute to sales growth in the back half of the year, and we have plans to drive productivity and improve gross margins,” Gennette added. “Our team has responded quickly to the external environment, course-corrected when needed and we remain confident. Our 130,000 colleagues compete every day to win our customers’ business.”

Asset Sale Gains

Asset sale gains for the second quarter of 2019 totaled $7 million pre-tax, or $5 million after-tax and $0.01 per diluted share attributable to Macy’s, Inc. shareholders. This compares to the second quarter of 2018 when asset sale gains totaled $46 million pre-tax, or $34 million after-tax and $0.11 per diluted share attributable to Macy’s, Inc. shareholders.

Asset sale gains for the first half of 2019 totaled $49 million pre-tax, or $36 million after-tax and $0.11 per diluted share attributable to Macy’s, Inc. shareholders. This compares to the first half of 2018 when asset sale gains totaled $70 million pre-tax, or $53 million after-tax and $0.17 per diluted share attributable to Macy’s, Inc. shareholders.

Updated Guidance

Updated Guidance

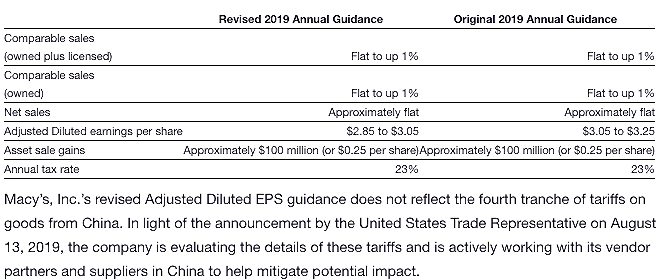

Macy’s, Inc. is reaffirming its previously provided annual sales guidance for 2019. Based primarily on its second quarter of 2019 performance, the company is lowering its guidance for Diluted EPS, excluding settlement charges, impairment and other costs, by 20 cents.

Photos/Charts Courtesy Macy’s