Macy’s reported quarterly earnings that topped analysts’ expectations as robust digital sales boosted results.

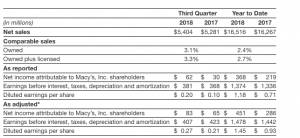

- Comparable sales growth of 3.1 percent on an owned basis; 3.3 percent on an owned plus licensed basis

- Higher sales and earnings driven by strong digital, continued improvement from brick & mortar and execution of the North Star Strategy

- Company updates annual guidance, including 15 cent increase in earnings per share

- Strategic initiatives put company on track to deliver strong holiday season and fourth quarter

Earnings of 27 cents on an adjusted basis exceeded Wall Street’s consensus estimate of 14 cents. Revenues of $5.40 billion were basically line line of expectations of $5.41 billion.

“We are pleased with Macy’s, Inc. performance in the third quarter, marking our fourth consecutive quarter of comparable sales growth. Macy’s, Bloomingdale’s and Bluemercury all performed well. Our strategic initiatives are gaining momentum and delivering results. Another double-digit quarter from our digital business and a strong stores performance combined to help us exceed expectations. We continue to see an improved trend in brick and mortar across the fleet with particularly strong results from our Growth50 stores,” said Jeff Gennette, Macy’s, Inc. chairman and chief executive officer. “The holiday season is when Macy’s truly shines. We have the right merchandise, the right marketing and the right customer experiences in place to deliver a strong fourth quarter.”

Asset Sale Gains

Asset sale gains for the third quarter of 2018 totaled $42 million pre-tax, or $31 million after-tax and $0.10 per diluted share attributable to Macy’s, Inc. This compares to the third quarter of 2017 when asset sale gains totaled $65 million pre-tax, or $40 million after-tax and $0.13 per diluted share attributable to Macy’s, Inc.

Asset sale gains for the 39 weeks ended November 3, 2018 totaled $111 million pre-tax, or $84 million after-tax and $0.27 per diluted share attributable to Macy’s, Inc. This compares to the 39 weeks ended October 28, 2017 when asset sale gains totaled $176 million pre-tax, or $109 million after-tax and $0.36 per diluted share attributable to Macy’s, Inc.

Looking Ahead – Revising Annual Sales and Earnings Guidance

Macy’s, Inc. is updating its guidance for fiscal 2018.

Image courtesy Macy’s