Macy’s, Inc. reported that total net sales for the fiscal second quarter decreased 3.8 percent year-over-year to $4.9 billion. Comparable store (comp store) sales were down 4.0 percent on an owned basis and down 3.3 percent on an owned-plus-licensed-plus-marketplace basis.

The department store retailer’s go-forward business comparable sales, including go-forward locations and digital across nameplates, was down 3.8 percent year-over-year in Q2 on an owned basis and down 3.0 percent on an owned-plus-licensed-plus-marketplace basis.

Nameplate Summary

Macy’s

Macy’s nameplate net sales were down 4.4 percent in the quarter, with comp store sales down 4.5 percent on an owned basis and down 3.6 percent on an owned-plus-licensed-plus-marketplace basis.

- Macy’s go-forward business comparable sales, inclusive of Macy’s go-forward locations and digital, were down 4.3 percent on an owned basis and down 3.3 percent on an owned-plus-licensed-plus-marketplace basis.

- Go-forward locations comparable sales declined 2.4 percent on an owned basis and were down 2.3 percent on an owned-plus-licensed basis.

- First 50 locations comparable sales, included within go-forward locations comparable sales, grew 0.8 percent on an owned basis and up 1.0 percent on an owned-plus-licensed basis.

- Non-First 50 go-forward locations comparable sales, included within go-forward locations comparable sales, decreased 3.8 percent on an owned basis and declined 3.7 percent on an owned-plus-licensed basis.

- Macy’s non-go-forward locations comparable sales down 6.5 percent on both an owned and owned-plus-licensed basis.

Bloomingdale’s

Bloomingdale’s net sales slipped 0.2 percent for the quarter. Comp store sales were down 1.1 percent on an owned basis and down 1.4 percent on an owned-plus-licensed-plus-marketplace basis.

Bluemercury

Bluemercury net sales grew 1.7 percent, with comparable sales up 2.0 percent on an owned basis.

Other Revenue of $159 million increased by $9 million year-over-year.

- Represented 3.2 percent of net sales, an increase of 30 basis points.

- Credit card revenues, net increased $5 million to $125 million. Net credit losses were in line with our expectations. As a reminder, in the second quarter of 2023, credit card revenues were negatively impacted by a change in net credit loss trends.

- Macy’s Media Network revenue, net rose $4 million to $34 million driven by higher advertiser and campaign counts.

Income Statement Summary

Gross margin rate of 40.5 percent of net sales in Q2 increased 240 basis points year-over-year.

- Merchandise margin increased 210 basis points driven by lower year over year discounting, favorable shortage due to the company’s asset protection work, and partially by the company’s shift to cost accounting.

- Delivery expense as a percent of net sales improved 30 basis points driven by lower shipped sales volumes and improved delivery expense control reflecting cost savings and process re-engineering initiatives.

Selling, general and administrative (SG&A) expense of $2.0 billion decreased $7 million.

- SG&A expense as a percent of total revenue was 38.7 percent, 120 basis points higher due to lower net sales.

- SG&A expense dollars benefited from the company’s cost controls while it protected customer-facing investments, particularly in First 50 locations.

Asset sale gains of $36 million increased $32 million due to an earlier-than-expected non-go-forward asset sale.

Diluted earnings per share and Adjusted diluted earnings per share were both tallied at 53 cents per share in Q2. This compares to diluted loss per share of 8 cents and Adjusted diluted earnings per share of 26 cents in the second quarter of 2023.

Merchandise Inventories Increase 6.0 percent

Inventories were said to be higher than expected due to second quarter sales results as well as the decision to invest into areas of strength for the second half of 2024. The conversion to cost accounting was estimated to account for approximately half of the increase from the prior year.

“During the second quarter, we delivered strong earnings performance in a challenging consumer environment,” said Tony Spring, chairman and CEO, Macy’s, Inc. “Our colleagues executed with discipline, supporting gross margin expansion and effective expense control throughout the organization. We are seeing signs of our strategy taking root, including two consecutive quarters of positive comparable sales in Macy’s First 50 locations. We are encouraged by the early traction of our Bold New Chapter and remain committed to returning Macy’s, Inc. to sustainable profitable growth.”

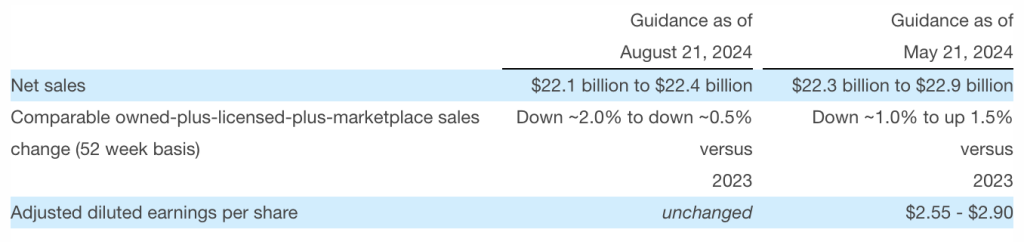

2024 Guidance

Macy’s Inc. said it updated its annual outlook to reflect a more discriminating consumer and heightened promotional environment relative to its prior expectations. The company believes the outlook range provided gives the flexibility to address the ongoing uncertainty in the discretionary consumer market.

The company is reaffirming its annual Adjusted diluted earnings per share outlook. The company continues to view 2024 as a transition and investment year, which includes investments in key customer-focused strategic initiatives. Supported by the company’s strong balance sheet, the company will continue to focus on enhancing gross margin and exercising expense control to protect profitability while navigating ongoing macro headwinds.

Revised Guidance Comparisons