Li Ning reported earnings in 2018 rose 39 percent on an 18 percent revenue gain.

Financial Highlights

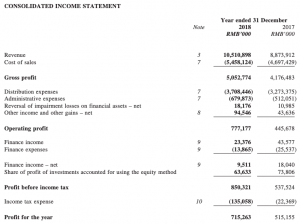

- Reported net profit attributable to equity holders increased by 39 percent to RMB715 million, net profit margin

raised from 5.8 percent to 6.8 percent: - Revenue increased by 18 percent to RMB10,511 million

- Gross profit margin expanded 1 percentage point

- Enhanced operating leverage notwithstanding investment in new initiatives and an increase of

organization costs - Operating cash flow increased by 44 percent to RMB1,672 million.

- Significant improvement in working capital continued:

- Gross average working capital improved (reduced) by 12 percent while revenue increased by 18 percent

- Cash conversion cycle further improved (shortened) by 9 days (2017: 49 days/2018: 40 days)

- The board has recommended payment of a final dividend of RMB8.78 cents per ordinary share of the

company issued or to be issued upon conversion of convertible securities for the year ended 31 December

2018 (2017: Nil).

Operational Highlights

- The retail sell-through for the overall platform increased by mid-teens, including online and offline channels.

- Channel inventory turnover further improved.

- Overall same-store-sales growth accelerates to low-teens.

- Offline channel new product sell-through increased by mid-teens with new product mix increased by 2

percentage points: - Direct retail new product gross margin improved over 1 percentage point.

The full report is here.