StockX has released its latest trend report, Big Facts: Brands Making Moves, identifying the fastest-growing brands across its sneakers, shoes, apparel, and accessories categories based on global sales data from the first six months of 2024 compared to the same period in 2023.

The company said analysis highlights key trends including the diversification of the sneaker market, gains in the streetwear space, and continued secondary market demand for non-sneaker footwear brands.

“This report underscores the evolution in the resale markets, and one of the largest brand rotations in recent history, which creates an exciting time for consumers,” said StockX CEO Scott Cutler. “We’re seeing the power of creativity, marketing, storytelling and innovation from smaller brands driving meaningful shifts in market share away from the largest brands who have struggled to keep pace. We’re seeing that dynamic play out in what’s trading on the platform.”

Report Highlights

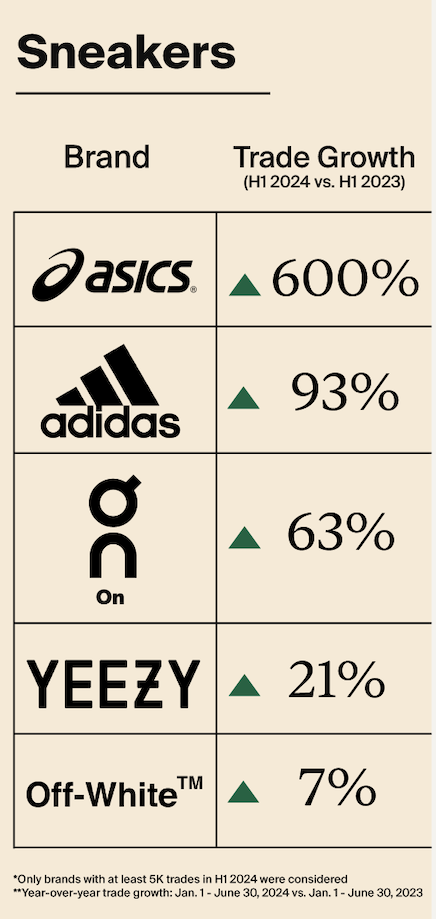

Asics Sees 600 Percent Growth, On Remains a Top 5 Growth Brand

The running aesthetic isn’t going anywhere, with Asics leading as the No. 1 fastest-growing sneaker brand on StockX this year, according to the latest report. The continued success of the Gel-1130 and Gel-Kayano 14 reportedly played a big role in Asics taking the top spot, but newer silhouettes like the Gel-NYC (introduced in 2023) and the GT-2160 (debuted in 2024) also gave the brand a boost, according to analysis from StockX.

The On brand also made the Top 5 ranking for the second year in a row, seeing 63 percent growth over 2023 thanks to continued demand for performance styles like the Cloud 5 and Cloud Monster, according to the report data.

While Saucony didn’t meet the trade minimums required to be included in the official ranking, it did lock in an impressive 93 percent sales growth year-over-year on StockX. The company said the running shoe brand has used the playbook perfected by other sneaker labels to build hype on the secondary market, recently rolling out collaborations with Bodega, Jae Tips, and Callen Schaub.

Adidas Leans on Retro Styles and Performance Basketball

Adidas Leans on Retro Styles and Performance Basketball

After not making the Top 5 fastest-growing brands ranking in 2023, Adidas nearly doubled sneaker sales on StockX in the first half of 2024. The company said credit goes to retro silhouettes like the Samba (+86 percent), Gazelle (+312 percent), and Spezial (+722 percent), which have reportedly seen double- and triple-digit growth over the last year.

Anthony Edwards’ new AE 1 also played a big role, with nearly 20,000 trades of the silhouette on StockX in the first six months of 2024.

Adidas also reportedly saw a 115 percent uptick in sales of James Harden’s performance line, led by the Harden Vol. 8.

Timberland and Crocs Find Success with Collabs

Timberland is more than 50 years old, but with increased marketing investment and big name partnerships — including a collection with Supreme as well a much-anticipated Louis Vuitton drop — the brand has seen sales surge 184 percent on StockX, according to the report. As the workwear trend remains as popular as ever, the company said in a media release that Timberland is positioning itself for continued success on the secondary market.

Crocs, which reportedly celebrates five straight years of growth on StockX in 2024, posted a 52 percent year-over-year sales surge for the first half. This was said to eclipse the growth Crocs achieved between 2023 and 2022 (+26 percent). StockX said the brand continues to strike gold with its collaboration strategy – recent collections with Japanese manga series Naruto, SpongeBob SquarePants, and Toy Story have performed well. Crocs has also seen consistent demand for the latest releases from its Salehe Bembury partnership.

High-Growth Apparel Brands Show Promise for Streetwear Space

Despite headlines claiming otherwise, StockX said its data shows that streetwear labels new and old continue to command attention on the secondary market.

Denim Tears moved from the No. 3 fastest-growing apparel brand in 2023 to No. 1 this year with more than 1,000 percent trade growth. While the brand’s recognizable cotton wreath collection is among its most popular, collections with Offset and Levi’s helped boost it to the top spot.

Other names that made the Top 5 rankings include Yeezy (+145 percent) and Revenge (+97 percent), a notoriously secretive brand that StockX said is known for its graphics-heavy, punk-inspired pieces.

Looking beyond the Top 5, StockX said there are plenty of other winners to celebrate. Fear of God pulled off 22 percent growth as Jerry Lorenzo is said to garner continued praise in both streetwear and high-fashion circles.

Trades of apparel from Stüssy — a pioneer in the space — were up 25 percent year-over-year in the first half, and new entrants like British brand Represent have also made gains (+96 percent YoY).

Y2K Trend Helps Push Prada to No. 1 Spot in Accessories

With growing Y2K obsession and heightened demand among the Gen Z audience, StockX said Prada locked in 560 percent growth in the accessories category. Styles like the Symbole Sunglasses and pieces from the brand’s iconic re-nylon collection — which features bucket hats and shoulder bags re-released in their original 2000s form — reportedly helped push the Milan-based fashion house into the No. 1 spot.

IRL Events Boost the Collectibles Market

StockX said that timely events can fuel heat on the secondary market, as proven by two of the fastest-growing brands in the collectibles category. Amidst one of the biggest world tours in music history, Taylor Swift’s vinyl records have seen hockey stick growth, helping to boost her collectibles catalog to 207 percent growth on StockX year-over-year, according to the report. Meanwhile, Pokémon collectibles saw a surge (+1,025 percent year-over-year) thanks to a first-of-its-kind exhibit at Amsterdam’s Van Gogh Museum.

Go here for more on the StockX 2024 First Half Report.

Image courtesy Asics/Graphic courtesy StockX