Pacific Sunwear of California joined a growing list of companies tempering their first quarter sales and earnings guidance because a backlog of containers at West Coast ports delayed deliveries of key spring products.

Pacific Sunwear of California joined a growing list of companies tempering their first quarter sales and earnings guidance because a backlog of containers at West Coast ports delayed deliveries of key spring products.

First quarter guidance the retailer issued March 25 anticipates later deliveries, coupled with severe cold weather in many parts of the country will reduce comparable store sales and non-GAAP earnings per diluted share in the fiscal first quarter by approximately 2-3 percent and 3-to-4 cents respectively.

“Delays in receiving approximately 30 percent of these spring goods across multiple brands and categories meant that we didn't fully get to our normal merchandising levels until approximately the second week of March,” said PSUN CEO Gary Schoenfeld. “We had a launch of new sneakers from one of the pretty exciting brands that we work with that was featured in all of our windows across the country, and we didn't have the product in the stores.

“So the biggest part of that is the sales impact of fresh spring product that we count on and that was sorely missing from our assortment,” he continued. “And then incrementally, there's been a margin impact in terms of how we then look at accelerating the turn of that inventory so that we still end up where we want to be as we go into Q2. And then there's also incremental air freight as a result of the port. “

PSUN comps declined the first five weeks of the fiscal first quarter, but have since rebounded.

“I believe we have a healthy spring summer season ahead, and none of this changes our internal expectations for 2015 as a whole,” Schoenfeld said.

PSUN issued the guidance in its latest earnings report, which showed sales reached $231.6 million in the fiscal fourth quarter ended Jan. 31, up 5 percent from the quarter ended Feb. 1, 2014 thanks to comparable store sales growth of 6 percent. PSUN ended the quarter with 605 stores, or 13 fewer than a year earlier and down from 800 in late 2011 when it negotiated with its top eight landlords to “right-size” its fleet. Men's and women's comped up 7 and 4 percent respectively.

A year-over-year increase in merchandise margins of 500 basis-points (bps) helped drive gross margin up an 600 bps to 26.0 percent during the quarter, but Schoenfeld said future gains will be much more modest.

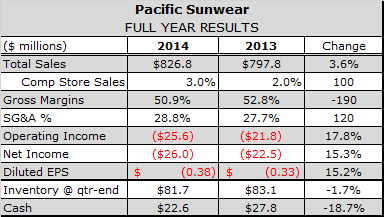

PSUN reported at net loss from continuing operations of $26.0 million, or 38 cents per diluted share, compared with a loss of $22.5 million, or 32 cents in the fourth quarter of fiscal 2013. Excluding non-cash losses related to derivative liabilities and other one-time charges, PSUN said it would have incurred a loss of $7.1 million, or 10 cents per diluted share, versus a loss of $11.8 million, or 17 cents per diluted share for the same period a year ago. The retailer in early January had forecast a non-GAAP loss in the range of 11 to 12 cents.