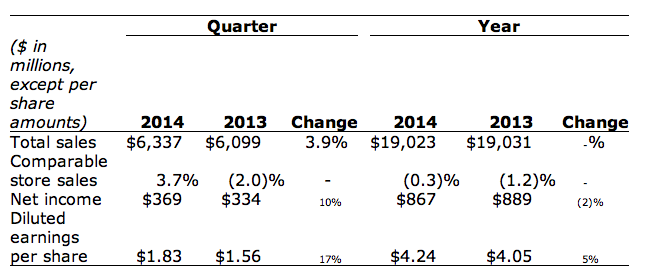

Kohl's Corporation reported fourth quarter earnings of $369 million, or $1.83 per diluted share, a 17 percent increase

Kevin Mansell, Kohl’s chairman, president and chief executive officer, said, “Our fourth quarter results showed significant improvement as many of our Greatness Agenda initiatives took hold. Our 3.7% increase in comparable sales was driven by both transactions per store – a key area of focus – and average transaction value. The sales strength was broad as all lines of business and all geographic regions reported higher sales. Our teams managed both expenses and inventories well, allowing us to exceed our previous earnings guidance.”

Dividend

On February 25, 2015 Kohl's Board of Directors declared a quarterly cash dividend on the Company's common stock of $0.45 per share, a 15% increase over its prior dividend. The dividend is payable March 25, 2015 to shareholders of record at the close of business on March 11, 2015.

Store Update

Kohl’s ended the fiscal year with 1,162 stores in 49 states. During 2014, the Company opened seven stores in new locations, relocated two existing stores, and closed three stores.

Initial 2015 Earnings Guidance

The Company expects earnings per diluted share of $4.40 to $4.60 for fiscal 2015. This guidance is based on the following assumptions:

- Total sales increase of 1.8% to 2.8%

- Comparable sales increase of 1.5% to 2.5%

- Gross margin as a percentage of sales to increase 0 to 20 basis points over 2014

- SG&A expense to increase 1.5% to 2.5% over 2014

- Depreciation expense to be $940 million

- Interest expense to be $335 million

- Effective tax rate of 37%

- $1 billion in share repurchases at an average price of $70 per share

- Capital expenditures of $800 million