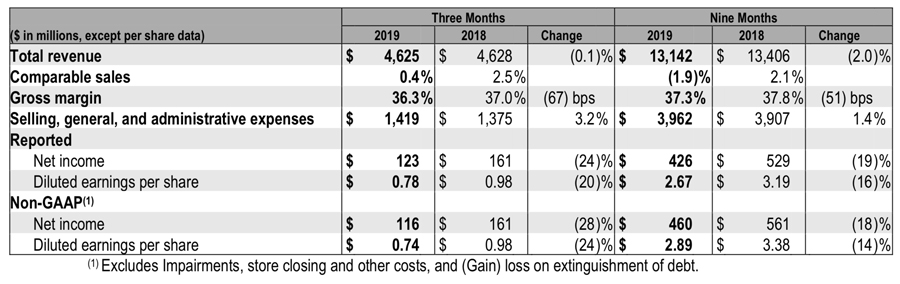

Kohl’s Inc. reduced its earnings outlook for the year after reporting third-quarter earnings slumped 28 percent and came in below Wall Street’s targets. Same-store sales inched up 0.4 percent in the period.

Highlights include:

- Sales were $4.36 billion versus $4.40 billion expected on average by analysts

- Comparable sales increase 0.4 percent versus Wall Street’s consensus target for 0.8 percent growth

- Diluted earnings per share of 78 cents a share

- Adjusted diluted earnings per share of 74 cents versus Wall Street’s consensus target of 86 cents

- Updates adjusted annual diluted earnings per share guidance to $4.75 to $4.95 compared with a prior range of $5.15 to $5.45. Analysts had been calling for $5.19 a share.

Michelle Gass, Kohl’s chief executive officer, said, “We are pleased to report that our business returned to growth during the third quarter, with a comparable sales increase of 0.4 percent. The quarter started off positive in August with another successful back-to-school season and ended strong in October. We enter the holiday period with momentum and are strategically increasing our investments to take advantage of the unique opportunity to fuel growth and customer acquisition. We believe that investing in the short-term will support our strategies to drive profitable growth over the long-term.”

Dividend

On November 13, 2019, Kohl’s Board of Directors declared a quarterly cash dividend on the company’s common stock of $0.67 per share. The dividend is payable December 24, 2019 to shareholders of record at the close of business on December 11, 2019.

Guidance

The company now expects adjusted annual earnings per diluted share to be $4.75 to $4.95, which excludes $0.22 per diluted share related to the extinguishment of debt and impairments, store closing and other costs recognized in the first nine months of 2019, compared to its prior guidance of $5.15 to $5.45.

Photo courtesy Kohl’s

Michelle Gass, Kohl’s chief executive officer, said, “We are pleased to report that our business returned to growth during the third quarter, with a comparable sales increase of 0.4 percent. The quarter started off positive in August with another successful back-to-school season and ended strong in October. We enter the holiday period with momentum and are strategically increasing our investments to take advantage of the unique opportunity to fuel growth and customer acquisition. We believe that investing in the short-term will support our strategies to drive profitable growth over the long-term.”

Dividend

On November 13, 2019, Kohl’s Board of Directors declared a quarterly cash dividend on the company’s common stock of $0.67 per share. The dividend is payable December 24, 2019 to shareholders of record at the close of business on December 11, 2019.

Guidance

The company now expects adjusted annual earnings per diluted share to be $4.75 to $4.95, which excludes $0.22 per diluted share related to the extinguishment of debt and impairments, store closing and other costs recognized in the first nine months of 2019, compared to its prior guidance of $5.15 to $5.45.

Photo courtesy Kohl’s