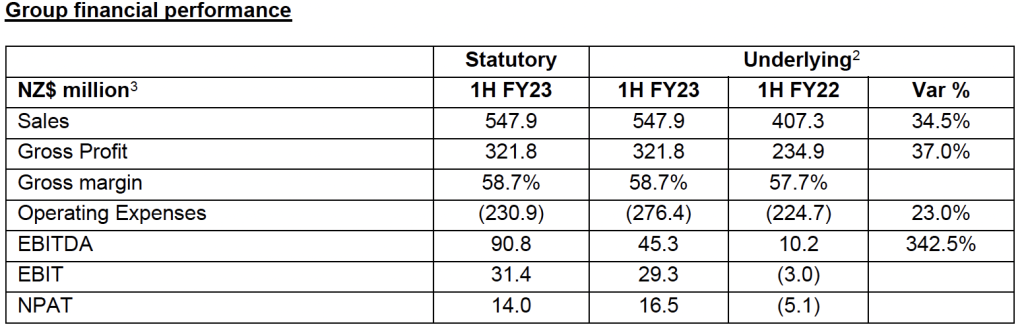

KMD Brands Limited, the parent company for Rip Curl, Oboz and Kathmandu brands, reported that fiscal 2023 first-half revenue jumped 34.5 percent to A$547.9 million, compared to A$407.3 million in the prior-year comparable period. The first half saw continued sales growth for Rip Curl, strong Australian recovery for Kathmandu, and record first-half sales for the Oboz business.

The company said in a report that 2023 first-half Group results were boosted by record first-half sales, cycling the Australasian Covid lockdowns last year, and supported by the return of international travel and tourism. Although the Group continued to experience elevated international freight costs and raw material cost pressures, gross margin increased by 100 bps to 58.7 percent to 58.7 percent of sales in the 2023 first half.

Operating expenses 23.0 percent to A$276.4 million and Underlying EBITDA was A$45.3 million for the six-month period, a 342.5 percent increase from A$10.2 million in the prior-year comp period. Operating expenses reflect continued investment to support brand expansion while leveraging sales growth. First-half operating expenses were 50.4 percent of sales, with a “strong sales recovery post-COVID lockdowns last year.”

Statutory net income was A$14.0 million and Underlying NPAT was A$16.5 million versus a loss of A$5.1 million in the 2022 H1 period.

“We are delighted with the results our team has delivered in 1H FY23, building on the strong momentum of the previous six months,” said Group CEO and Managing Director Michael Daly. “We achieved record sales results for the Group, highlighting the strength of our global brands.”

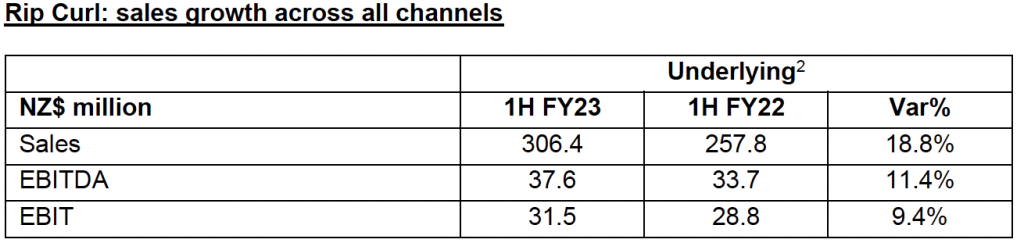

Rip Curl’s sales results were said to be strengthened by growth across all channels, with total sales up 18.8 percent to A$306.4 million in the first half. Direct-to-consumer sales growth was particularly strong in Australasia after COVID lockdowns last year, with Hawaii also performing strongly off the back of a return of international travel.

“For the first time since Rip Curl was acquired, the Group has experienced a full 12 months of trade without significant interruption from the COVID pandemic, which resulted in group sales of over A$1 billion,” Daly added.

Wholesale sales are said to be showing resilience, with 2.2 percent growth at constant exchange rates, despite softening wetsuit demand from record highs, and strategic destocking from retailers. Whilst online traffic reduced year on year, online sales remain significantly above pre-COVID levels. The direct-to-consumer (DTC) channel, including owned retail stores and online, generated same-store sales growth of 13.9 percent.

EBITDA was up 11.4 percent to A$37.6 million, moderated by the impact of channel mix and freight costs on gross margin, and increased distribution costs.

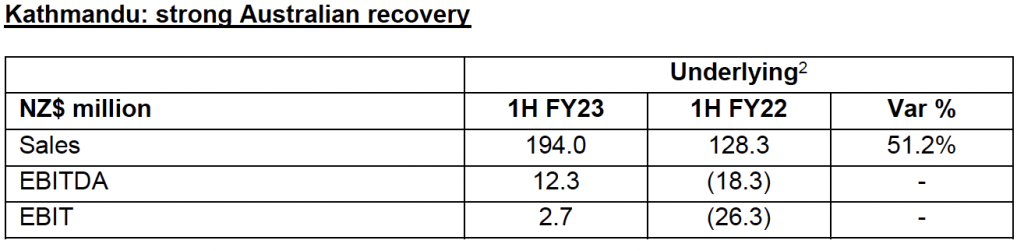

Kathmandu’s performance in the first half of FY23 was attributed to a strong recovery in the Australian market following COVID lockdowns last year. Total sales were up 51.2 percent to A$194.0 million, driven by a strong rebound in Australia (+59 percent) after lockdowns, the return of domestic and international tourism in New Zealand (+22 percent), and international sales of A$1.4 million, which includes first deliveries to select new

wholesale customers in Europe and Canada.

Online sales normalized at approximately A$26 million following lockdowns last year, which represents 13.6 percent of DTC sales, and continues to be significantly above pre-COVID levels.

Gross margin increased +580 bps, driven by currency benefit, and the deliberate strategy to carefully moderate the historic “high-low” pricing model.

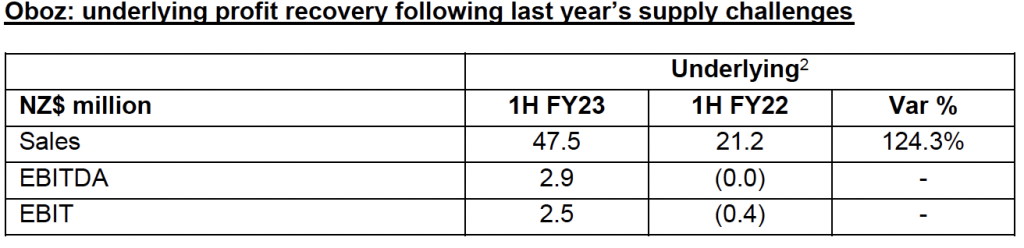

Oboz wholesale and online sales performed strongly in the first half, demonstrating a successful recovery following last year’s significant supply challenges, as well as strong growth in the new online sales channel which increased the mix of DTC sales. Overall sales jumped 124.3 percent to A$47.5 million in the first half.

Gross margin decreased 50 bps due to elevated international freight costs over the last twelve months, noting that freight costs are now trending towards historical levels. Operating expenses reflect investment in brand and product teams, which is expected to be leveraged as sales growth continues.

The Group had a net debt position of A$84.9 million at the end of the half, with significant funding headroom of over A$200 million.

The higher inventory balance reflects investments in Oboz inventory to meet second-half 2023 forward orders, as well as investments in wetsuit raw materials for perennial styles to mitigate international supply challenges. The company expects inventory to be A$270 to A$280 million by the end of FY23, depending on currency translation and timing of goods in transit. Inventory obsolescence provisions represent 1.4 percent of gross inventory on hand, 50 bps below July 2022.

Operating cash flows were affected by the temporary inventory build. It is expected that an unwind of inventory will underpin the traditionally strong operating cash flow generation in the second half.

The company’s strong balance sheet and positive growth outlook led Directors to declare an interim dividend of 3.0 cents per share (fully franked for Australian shareholders). The record date for this dividend is June 15, 2023, and the payment date is June 30, 2023.

Dedicated To Leading In ESG

Commenting on the Group’s sustainability initiatives, Mr. Daly said: “We are pleased to have made significant progress on ESG initiatives during the half as we continue to work towards becoming a leader in ESG across all of our businesses.”

“We were also very proud to recently announce that KMD Brands and all three of its brands are now Certified B Corporations, becoming one of the first multinational companies in Australia and New Zealand to have all its brands individually certified. This is a testament to our commitment to setting ourselves high standards of social and environmental impact, accountability, and transparency,” Daly shared.

“In addition to the recent B Corp announcement for all of our brands, the Group was also recognized with the Deloitte New Zealand Top 200 Sustainable Business Leadership award. We have also submitted science-based targets to SBTi, with 2030 emission reduction goals aligned to the Paris Climate agreement.”

Positive Fiscal 2023 H2 Outlook

Positive first-half sales momentum has reportedly continued through February, with continued strong diversified sales growth across brands, channels, and key international regions. Total group sales were up 31.9 percent in February 2023 compared to February 2022, noting that February is not a significant trading month.

Fiscal 2023 full-year operating expenses are expected to be approximately 48 percent of sales, with ongoing initiatives to further reduce annualized operating costs by up to 2 percent of sales for fiscal 2024.

Commenting on the outlook for the Group, Daly said: “Positive direct-to-consumer sales trends have continued into the second half, and we are well positioned to continue to benefit from the return of international travel and tourism. Products across all three of our brands appeal to a diverse range of consumer interests, ages, and demographics.

“While the consumer outlook remains uncertain, with high global inflation and rising interest rates expected to impact consumer demand, we remain cautiously optimistic. The Group is well-capitalized and will continue to invest in the long-term global expansion of all our brands.

“With a healthy balance sheet and expectations for strong cash flow generation in the second half, we are in an excellent position to execute our growth strategy through expanding our global footprint, investing in digital platforms, leveraging operational excellence, and leading the industry through sustainability and innovation.”

Photo courtesy Rip Curl