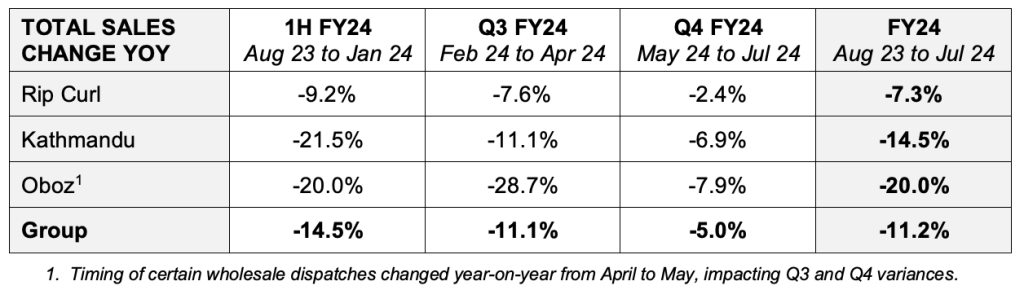

KMD Brands Limited, the New Zealand-based parent company of the Rip Curl, Oboz and Kathmandu brands, is forecasting total consolidated sales to decline 11.2 percent for its fiscal year ended July 31. Despite the double-digit decline, KMD Brands highlighted business improvements throughout the year after first-half sales fell 14.5 percent, Q3 sales declined 11.1 percent and the fourth quarter saw a significant moderation in the declines to slide 5.0 percent for the May through July period.

The company also confirmed it expects underlying EBITDA to be between $49 million and $51 million for FY24, in line with its June 2024 revised forecast of $50 million.

KMD Brands Preliminary Fiscal Year Results

Key Notes from the Company’s Preliminary Report

Rip Curl and Kathmandu sales continued improving against first-half sales trends during the third and fourth quarters of fiscal 2024.

Kathmandu sales trends, relative to FY23, continued to improve in a challenging consumer environment, with enhanced in-store execution and new products.

Australia (-4.5 percent) performed significantly better than New Zealand (-16.5 percent) through the key fourth-quarter winter selling period.

As previously reported by SGB Media, Kathmandu experienced a slower-than-expected start to the winter promotional period. When the company reported its revised forecast in June, the first three weeks of the sales season were down 11.5 percent year-over-year and fell below the improving second-half trend.

The company reported sales in Australia aligned with the H2 trend through the first three weeks of its winter sales period, but the New Zealand business it reported “remained challenging.” Australian sales for the brand reportedly improved weekly as the winter season progressed, resulting in a 6.9 percent decline for the fourth quarter.

Rip Curl’s direct-to-consumer (DTC) sales outperformed the wholesale channel. DTC sales for FY24 were down 2.8 percent below last year’s record sales result, compared to the wholesale channel, which was 13.0 percent below last year as wholesale customers continued to reduce their inventory holdings.

Oboz online sales continued to deliver strong year-on-year growth in fiscal 2024, at 31.7 percent above the prior year. Wholesale sales for the fiscal year were down 23.1 percent from the preceding year’s record sales.

Gross margin decreased 30 basis points to 58.8 percent of sales for the fiscal year, reportedly driven by increased promotional intensity through the fourth quarter. The company tightly controlled operating costs, benefiting from restructuring implemented in the prior year and lower variable costs associated with lower sales.

Group inventory at fiscal year-end was approximately $25 million below the end of fiscal 2023, resulting in Net Working Capital being roughly $21 million lower year-over-year.

Net debt at year-end was reported at $60 million, with “significant funding headroom of approximately $230 million.”

KMD Brands Limited will release its audited results for the 2024 fiscal year in late September. The preliminary report was authorized for release to NZX and ASX by the company’s Board of Directors.

Image courtesy Rip Curl

***

For SGB Media’s coverage of the company’s June revised forecast, see below.

EXEC: Rip Curl, Oboz Parent KMD Brands Sees Weaker-Than-Expected End to Fiscal Year