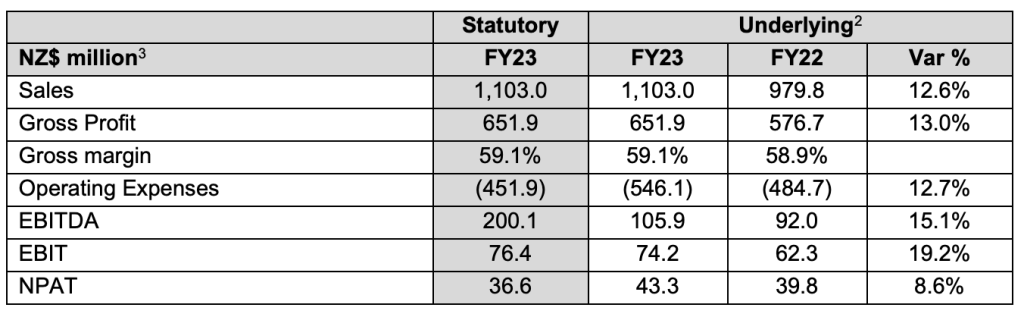

KMD Brands Limited, the parent company to the Rip Curl, Oboz and Kathmandu brands, reported it had achieved record sales of over NZ$1.1 billion dollars in the fiscal year ended July 31, its first year of uninterrupted trade post-pandemic.

Group wholesale sales growth was up 11 percent for the year and the company said it had strong sales growth across all key geographies, with Rip Curl and Oboz posting record sales. Kathmandu sales grew strongly over the first three quarters of the year, but the fourth quarter for Kathmandu was said to be more challenging with increased cost-of-living pressures softening consumer sentiment. Group CEO & Managing Director Michael Daly also said the Kathmandu business had to contend with the warmest winter on record in Australia, which cycled the best-ever winter trade season the prior year.

Group results were said to be supported by strong omni-channel sales growth from all brands.

“Customers returned to shopping in stores, with retail store sales increasing 17.5 percent. This had an impact on online sales, a trend noted across the industry as customers returned to pre-pandemic shopping behaviors,” Daly commented. “Online sales remain significantly above pre-pandemic levels.”

Gross margin remained resilient, increasing 20 basis points to 59.1 percent of sales. Improved channel mix, wholesale pricing and international freight costs reportedly offset currency headwinds. Operating expenses were maintained year-on-year at 49.5 percent of sales, despite softened sales performance in the fourth quarter.

Underlying EBITDA was NZ$105.9 million, up 15.1 percent year-over-year (YoY) despite the softening consumer sentiment in the fourth quarter.

Statutory net profit after tax (NPAT) was NZ$36.6 million and Underlying NPAT was up 8.6 percent YoY to NZ$43.3 million

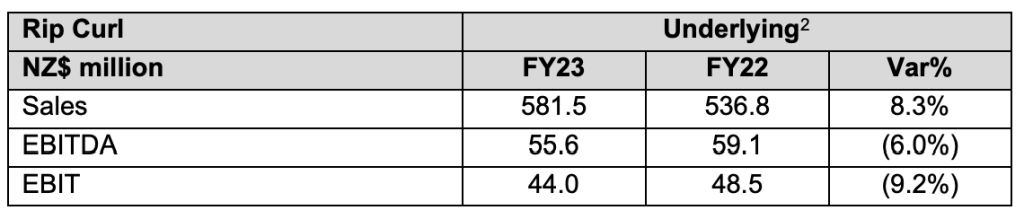

Rip Curl

Rip Curl saw total sales up 8.3 percent to NZ$581.5 million for the fiscal year. The company said the results were driven by strong direct-to-consumer results, particularly in Australasia following lockdowns last year, plus the return of international travel to Hawaii and Thailand. Consumers reportedly took advantage of the brand’s strong omnichannel offering – an attractive and premium brand experience in strategically placed stores. Online sales normalized at NZ$34.9 million, significantly above pre-pandemic levels, as customers returned to shopping in stores.

- Online sales represented 10.6 percent of direct-to-consumer sales.

- Wholesale sales showed resilience despite softening wetsuit demand from record highs.

- Gross margin increased +60 basis points, reflecting channel mix, improved wholesale pricing, and the easing of elevated international freight costs.

The recently launched Club Rip Curl customer loyalty platform has over 220,000 members to-date, driving more than NZ$30 million in member-based sales – a fantastic achievement given it launched just this year.

Oboz

Oboz sales reportedly recovered strong for the year, increasing 61.8 percent to a record of almost NZ$100 million. The company said the wholesale channel recovered following last year’s significant supply constraints. The brand also reportedly benefited from a commitment to diversified sales channels, delivering strong online sales growth, and increasing the mix of direct-to-consumer sales with high gross margins.

- Gross margin increased 270 basis points with improved channel mix, adjusted wholesale pricing, new product introductions, and the easing of elevated international freight costs.

- Oboz continued its investment to optimize the brand for growth and accelerate international expansion.

The company said the Oboz brand momentum remains strong, with ‘Fast Trail’ category expansion success and online performance continuing to indicate a significant growth opportunity.

Kathmandu

Kathmandu brand total sales increased 10.6 percent to NZ$422.2 million in the fiscal year, with strong growth in the first three quarters as customers returned to shopping in stores. Cost of living pressures softened consumer sentiment in the fourth quarter, which impacted the key winter trade season. Kathmandu faced the warmest winter on record in Australia and cycled its best-ever winter season performance last year.

- Australia sales grew 7.0 percent and New Zealand increased 13.1 percent for the year.

- Online sales normalized at NZ$58.8 million, comfortably above pre-pandemic levels. Online sales represented 14.0 percent of direct-to-consumer sales.

- Gross margin increased by +100 basis points with the deliberate strategy to continue to moderate the historic “high-low” pricing model.

- The sales result was said to be supported by a strong loyalty base and a strategic focus of the brand with a relaunch of the Kathmandu loyalty program in early FY24.

KMD said Kathmandu significantly reduced its inventory levels, and is now well positioned, with inventory NZ$37 million below July 2022 levels. The brand continues to cycle through its second phase of recovery, with travel presenting an opportunity for growth as it steadies and returns to pre-pandemic frequency, especially for customers traveling overseas.

The international soft launch of the brand delivered initial sales of NZ$2.6 million including first deliveries to select new wholesale customers in Europe and Canada. With the brand only just starting to diversify and leverage wholesale as a channel, the company said the new Kathmandu CEO will be “well placed to capitalize on this in the coming years, given her depth of global experience in this space.”

KMD hired Megan Welch as CEO of Kathmandu, effective August 7 (read SGB Media‘s coverage here). She joined Kathmandu from Crocs where she was SVP and general manager Asia Pacific in Singapore.

Balance Sheet

The Group had a net debt position of NZ$55.7 million with funding headroom of over A$200 million at year-end.

Net working capital as a percentage of sales improved to less than 20 percent, with a significant reduction in Kathmandu inventory. Rip Curl and Oboz continue to focus on reducing working capital, as the company transitions away from inventory builds in wetsuits and footwear.

Positive operating cash flow for fiscal 2023 reflects the first year of uninterrupted trade post-pandemic.

The Group’s strong balance sheet led the Board of Directors to declare a final dividend of NZ3.0 cents per share. The record date for this dividend is October 5, 2023, and the payment date is October 20, 2023.

“Our balance sheet is healthy with low net debt and improving inventory levels. We are well positioned as we begin FY24,” offered Daly.

Outlook

Group sales for August 2023 were down 6.4 percent versus the prior-year period. The trend in Kathmandu sales continued from the fiscal fourth quarter into August but was said to be consistent with pre-pandemic sales levels at this time of year. Rip Curl and Oboz have reportedly seen good momentum in direct-to-consumer sales.

“The long-term fundamentals of our diversified group of outdoor brands remain intact,” Daly said “Despite the challenging consumer sentiment, we expect tailwinds with the continued return to travel, positive impact from the launch of innovative products and the outdoor lifestyle trend post-pandemic. Our strategic growth pillars remain unchanged, and with new executive appointments in place we expect to accelerate our strategy execution.”

Photo courtesy Oboz