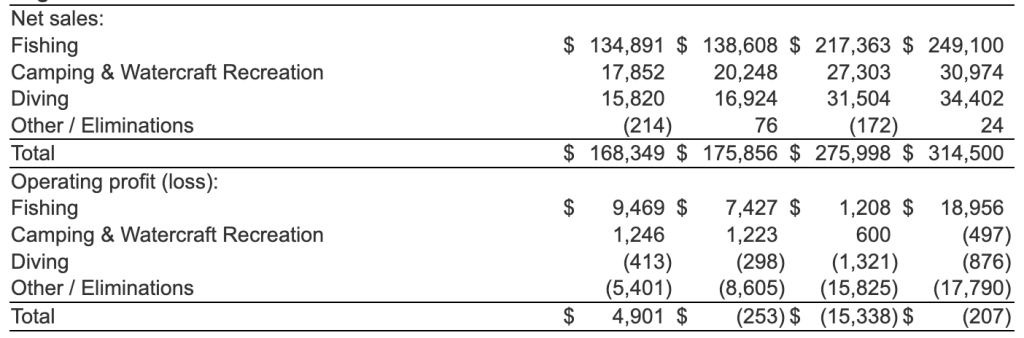

Johnson Outdoors Inc. is reporting that total company net sales in the second quarter ended March 28 declined 4 percent to $168.3 million, compared to $175.9 million in the prior-year second fiscal quarter.

- Fishing revenue, which includes Cannon, Minn Kota and Humminbird, decreased 3 percent year-over-year, reportedly due to continued market and macroeconomic dynamics affecting consumers.

- Camping & Watercraft Recreation sales, which includes Jetboil and Old Town were down 12 percent, with growth in Jetboil partially offsetting the declines in Watercraft and the exit of the Eureka! business.

- Diving sales, which represents Scubapro, decreased 7 percent, said to be primarily due to softening market demand and economic uncertainty across all geographic regions.

“Our second quarter results reflect continued market challenges and a cautious retail and trade environment. However, we saw positive results from new products in Humminbird and Jetboil, underscoring the critical importance of our ongoing investment in innovation,” said Helen Johnson-Leipold, chairman and CEO, Johnson Outdoors Inc. “Looking ahead, tariffs will impact our business, despite the fact that we are an American company with U.S.-based manufacturing and operations. We are working on multiple paths to mitigate as much of the tariff impact as possible. Our sustained focus on our strategic priorities, as well as leveraging our strong debt-free balance sheet and cash position, will help us as we navigate the uncertain economic environment ahead.”

Income Statement Summary

Gross margin was said to be “relatively flat” at 35.0 percent, compared to 34.9 percent in the prior-year quarter.

Operating expenses of $54.0 million decreased $7.7 million year-over-year, said to be due primarily to lower sales volumes between quarters as well as lower promotions expense and decreased expense on the company’s deferred compensation plan.

Total company operating profit was $4.9 million for the second fiscal quarter versus an operating loss of $0.25 million in the prior-year second quarter.

Profit before income taxes was $4.2 million in the current-year quarter, compared to $3.0 million in the prior-year second quarter. The improvement in operating profit was said to be partially offset by an increase in Other Expense of approximately $3.4 million due primarily to a decline in earnings on the company’s deferred compensation plan.

Net income for the fiscal 2025 second quarter was $2.3 million, or 22 cents per diluted share, versus $2.2 million, or 21 cents per diluted share in the fiscal 2024 second quarter.

The effective tax rate was 44.6 percent compared to 28.4 percent in the prior year second quarter.

Balance Sheet and Cash Management Summary

The company reported cash and short-term investments of $94.0 million as of March 28, 2025.

Depreciation and amortization were $10.0 million in the six months ending March 28, 2025 (H1), compared to $9.9 million in the prior-year H1 period.

Capital spending totaled $7.4 million in the current six-month period compared with $10.2 million in the prior-year H1 period.

In February 2025, the company’s Board of Directors approved a quarterly cash dividend to shareholders of record as of April 10, 2025, which was payable April 24, 2025.

“We continued to drive our inventory levels lower, and our cash balance remains healthy,” said company VP and CFO David W. Johnson. “Although we’ve been focused on strategically managing costs while also making investments to strengthen the business, the evolving macroeconomic situation brings additional challenges.

“We’re working through short- and long-term strategies to mitigate the tariff-related impact of potential increases in the costs of our raw materials and purchased components.”

Image courtesy Old Town / Johnson Outdoors, Inc.