J. C. Penney Company, Inc. reported comparable store sales grew 4.4 percent for both the fourth quarter and full fiscal year. The combination of this sales improvement, stronger gross margins and decreasing SG&A expense resulted in a $1.1 billion increase in EBITDA for the year.

Myron E. (Mike) Ullman, III, chief executive officer, said, “2014 was a successful year for JCPenney. Thanks to the hard work and outstanding execution by our teams, we significantly grew sales and gross margin and delivered on our goal to generate positive free cash flow, representing a $2.8 billion improvement over last year. I am extremely proud of all that has been accomplished to restore this great company. We are back in the eyes of our customers, back running the business effectively and back on solid financial footing. We fully intend to build on this momentum and continue to significantly improve our business in 2015.”

Marvin Ellison, president and CEO-designee, said, “I have been very impressed by what I have seen in my first few months at JCPenney. The passion and knowledge of our associates and their dedication to customer service is helping us take back share from our competitors, as we continue to find new ways to put the customer first. I believe 2015 will be an important year for JCPenney, and the team is focused on profitably executing our business.”

Fourth Quarter Results

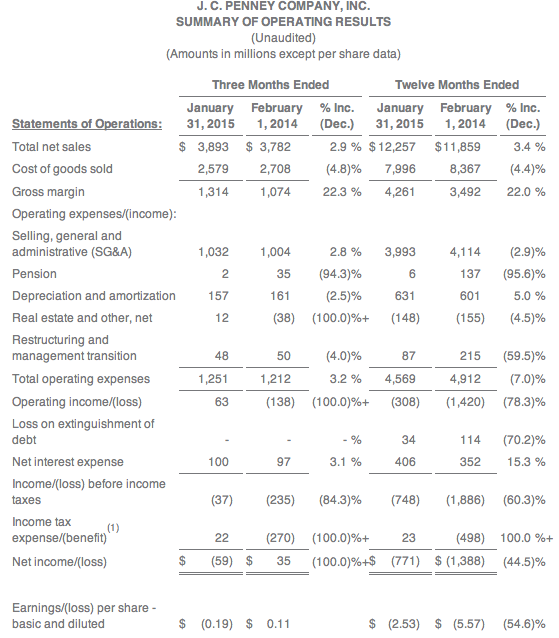

For the fourth quarter, which included a successful holiday season, JCPenney reported net sales of $3.89 billion compared to $3.78 billion in the fourth quarter of 2013. Comparable store sales rose 4.4 percent for the quarter. Online sales through jcpenney.com were $428 million for the quarter, up 12.5 percent versus the same period last year.

Men's apparel, Home and Fine Jewelry were the company's top performing merchandise divisions during the quarter. Sephora inside JCPenney, now in 492 locations, also continued its strong performance. Geographically, all regions delivered sales gains over the same period last year with the best performance in the central and western regions of the country.

For the fourth quarter, gross margin improved 540 basis points to 33.8 percent of sales, compared to 28.4 percent in the same quarter last year. Gross margin was positively impacted by significant improvement in the company's merchandise mix and margin on clearance sales over the prior year quarter.

SG&A expenses for the quarter were up $28 million to $1.032 billion, or 26.5 percent of sales.

Operating income for the quarter was $63 million, which represents a $201 million increase over last year. EBITDA was $220 million, a $197 million improvement from the same period last year.

Adjusted net income for the fourth quarter improved $206 million to breakeven. Net income for the quarter was a loss of $59 million, compared to a gain of $35 million in last year's fourth quarter, which benefitted from a one-time $270 million non-cash tax credit. These income tax changes resulted in a negative year over year impact of $292 million on the company's reported net income.

A reconciliation of GAAP to non-GAAP financial measures is included in the schedules accompanying the consolidated financial statements in this release.

Full Year Results

For the full year 2014, comparable store sales increased 4.4 percent. Total sales increased 3.4 percent for the year. Internet sales through jcpenney.com grew $145 million to $1.22 billion for the year, increasing 13.4 percent over last year.

For the year, gross margin increased 540 basis points to 34.8 percent from 29.4 percent in the prior year. SG&A decreased $121 million or 210 basis points compared to the prior year.

EBITDA was $323 million, a more than $1.1 billion improvement from last year.

Free cash flow was $57 million, a positive increase of over $2.8 billion.

The company ended the year with liquidity of approximately $2.1 billion.

In 2014, the company opened its first ever store in Brooklyn, N.Y., giving JCPenney a location in all five boroughs of New York City. The company opened 46 Sephora inside JCPenney boutiques, bringing the total to 492 locations, and announced plans to open 25 additional locations in 2015. In addition, JCPenney, which carries an exclusive assortment of Disney merchandise, is capitalizing on the success of its Disney-branded Shops inside JCPenney by opening an additional 100 locations by back-to-school 2015, bringing the total to nearly 700 locations.

Outlook

Building on the success of 2014, the company's 2015 full year guidance is as follows:

- Comparable store sales: expected to increase 3 percent to 5 percent;

- Gross margin: expected to improve 50 to 100 basis points versus 2014;

- SG&A: expected to decrease $50 to $100 million versus 2014;

- Primary pension plan expense: approximately $19 million;

- Depreciation and amortization: approximately $615 million;

- Interest expense: approximately $415 million; and

- Free cash flow: expected to be flat.