Tilly’s, Inc. reported fourth-quarter earnings that came in lower than guidance and forecast a significant decline in first-quarter earnings as it anniversaries last year’s federal stimulus payments and pent-up demand as the COVID-19 vaccine arrived.

Shares of Tilly’s in mid-day trading Friday were down about 24 percent.

On a call with analysts, Ed Thomas, president and CEO, said fiscal 2021 was the most profitable ever for Tilly’s. The fourth quarter showed a comp gain of 12.5 percent and EPS of 38 cents represented its best fourth-quarter earnings in history.

From a product perspective, all departments comped positively in the fourth quarter with accessories, men’s and boys especially strong seeing double-digit percentage increases.

“As we begin fiscal 2022, we have seen good, early reads from our spring assortment offerings in shorts, dresses, and more fashionable tops,” added Thomas. “Graphic tees with retro content from the 1990s and Y2K era are growing in popularity. We’ve launched a print-on-demand T-shirt initiative through a third-party service provider that is off to a nice start, and we expect this initiative to grow over the course of fiscal 2022 and beyond.”

He continued, “In footwear, global brands are driving growth for us, although adequate and timely supply remains a moving target with the ongoing supply chain challenges. Swim has also been hit disproportionately by the supply chain delays, but we still expect this category to be a meaningful contributor to the spring/summer season. The return of in-person school, festivals, and travel has driven a strong bags business. Long bottoms continue to do well with the combination of new fits, proportions, colors, and fabrics. We believe the newness that is available across several departments will continue to be important in driving sales.”

The positive momentum in the business for the past five quarters continued into the early part of the first quarter, although comparable sales have recently started to decline relative to last year. Thomas added that given the unique impacts of last year’s pent-up demand exiting 2020’s pandemic restrictions and federal stimulus payments, which created a significant acceleration in business for the latter half of the first quarter last year, the decline is expected to continue and “get more pronounced” as the quarter progresses.

Said Thomas, “While we continue to encounter risks and uncertainties relating to the COVID-19 pandemic, supply chain difficulties, labor challenges and increasing costs generally, we remain cautiously optimistic at this time about our business prospects for fiscal 2022 as a whole to our pre-pandemic performance due to the newness in merchandise trends that are available.”

In the fourth quarter ended January 29, net earnings rose 36.0 percent to $12.1 million, or 38 cents. In reporting third-quarter earnings on December 2, Tilly’s had guided earnings in the range of 42 cents to 50 cents. Wall Street’s consensus estimate was 41 cents a share.

Revenues reached $204.5 million, representing a gain of 14.9 percent. Sales fell short of Tilly’s guidance in the range of $210 million to $215 million. Wall Street’s consensus estimate was $203.61 million.

Total comparable store sales, including both physical stores and e-commerce, increased 12.5 percent in the quarter.

Sales from physical stores were $152.2 million, an increase of 24.2 percent. Same-store sales from physical stores grew 20.7 percent. Sales from stores represented 74.4 percent of sales compared to 68.9 percent of total net sales last year. Tilly’s ended the year 241 stores compared to 238 at the end of fiscal 2020, and expects to open 15 to 20 new stores in 2022.

E-commerce sales were $52.3 million, a decrease of 5.6 percent. E-commerce sales represented 25.6 percent of sales compared to 31.1 percent a year ago. The decline reflects a shift back to in-store selling with the year-ago period saw elevated online sales as stores were more constricted in operating hours.

Gross margin improved 170 basis points to 34.4 percent. Total buying, distribution and occupancy cost increased 190 basis points collectively due to sales leverage. Product margins decreased 20 basis points as an increase in sales return reserves and less favorable inventory shrink results than last year offset a lower markdown rate. SG&A expense deleveraged 110 basis points to 25.9 percent and overall increased $8.9 million year over year due to higher store payroll and related benefits to support significantly higher sales and increased marketing expenses primarily due to increased e-commerce marketing.

Operating income advanced 22.7 percent to $17.3 million and improved as a percent of sales to 8.5 percent from 7.9 percent a year ago.

In the year, sales were $775.7 million, an increase of 46.0 percent. Sales from physical stores jumped 70.4 percent, to $609.7 million. E-commerces sales were $165.9 million, a decrease of 4.3 percent. Net income was $64.2 million, or $2.06 per share, compared to a net loss of $1.1 million, or 4 cents, last year.

Entering this current week, inventories were up 7 percent to last year. Mike Henry, EVP and CFO, said, “We continue to contend with product delays through the Southern California ports and believe this condition will continue to be a challenge for several more months. Our merchant team has worked incredibly hard to manage and adjust our overall inventory levels through an extremely volatile and unpredictable period.

Looking ahead, Henry cautioned the current business environment remains subject to many unpredictable risks and uncertainties related to the pandemic, the inflationary environment, supply chain difficulties, geopolitical concerns, and how consumer behavior may change relative to any of these factors as well as last year’s historic anomalies of pent-up demand coming out of pandemic-related restrictions and federal stimulus payments.

“On top of that, we also have a later Easter this year,” added Henry. “As a result, it is extremely difficult to predict our business results with any certainty given that nothing has been so-called normal for two full years now.”

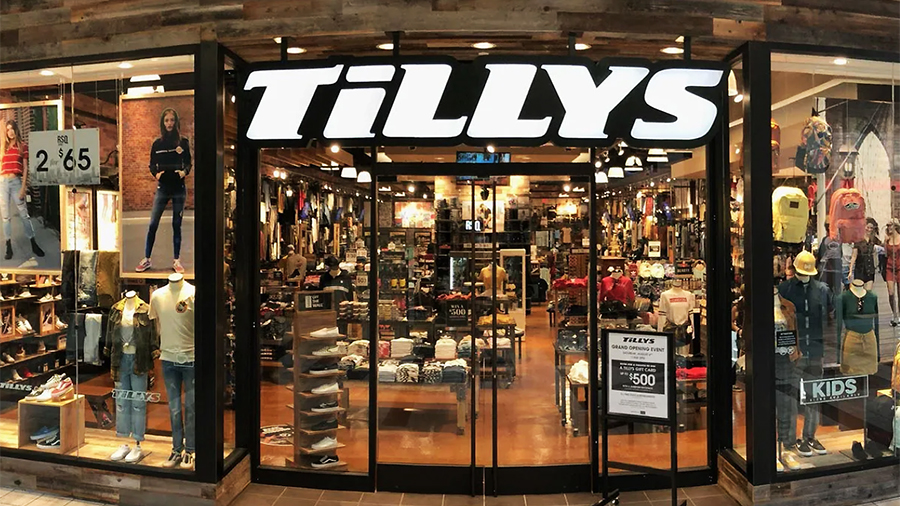

Photo courtesy Tilly’s