Peloton’s fiscal second-quarter earnings and sales trounced analysts’ estimates, but officials warned that near-term investments in its supply chain to speed deliveries would weigh on margins.

The company’s performance led it to raise its full-year outlook, estimating revenue would top $4 billion, up from prior estimates for more than $3.9 billion. Analysts had been calling for $3.95 billion, but its earnings outlook was left unchanged.

In the quarter ended December 31, sales vaulted 128 percent to $1.06 billion, marking its first billion-dollar quarter, as the momentum keeps climbing for the at-home fitness equipment maker, Wall Street’s consensus estimate had been $1.03 billion.

Earnings grew to $63.6 million, or 18 cents per share, from a loss of $55.4 million, or 20 cents per share, a year ago. Analysts had been calling for Peloton to earn 9 cents a share on average.

“Global demand for our products was strong throughout the quarter, and we added a record number of new Connected Fitness subscriptions,” said John Foley, co-founder and CEO, on a conference call with analysts.

He noted that Peloton launched its new Peloton Tread in the U.K., produced over 2,100 new classes for its on-demand content platform and added more software features to elevate its Global Connected Fitness offering. He said, “And our members are responding as we again posted substantial year on year engagement growth in the quarter.”

Among the indicators of strong demand:

- About 333,000 net Connected Fitness subscriptions were added in the quarter, bringing its end of quarter Connected Fitness membership base to 1.67 million, up 134 percent year on year. The company expects to have 2.28 million or more connected fitness subscriptions by the end of the fiscal year, up from a previous outlook for 2.17 million users;

- Q2 Connected Fitness subscription workouts grew 303 percent to over 98.1 million, averaging 21.1 monthly workouts per subscription, versus 12.6 in the year-ago period;

- Total platform workouts—both Connected Fitness and Digital—grew to over 113 million in the quarter from 26 million in the year-ago quarter; and

- The average net monthly connected fitness churn was 0.76 percent during the latest quarter, which marked a slight uptick from 0.65 percent during the prior period. But the churn rate during the current quarter is projected to be below 0.75 percent, and its churn rate for fiscal 2021 will be below 0.80 percent, better than a prior outlook of under 0.90 percent.

However, much of the call’s discussion explored Peloton’s challenges ramping up its manufacturing capabilities to catch up to strong demand.

Steps to expand its manufacturing capabilities include the acquisition 15 months ago of Tonic, one of its Taiwanese based third-party manufacturing partners. The purchase has enabled Pelton to scale its Bike and Bike+ production significantly. A new Tonic plant in Shinji is also up and running.

In December, Peloton announced its planned acquisition of Precor, the global manufacturer of commercial fitness equipment.

“Our acquisition of Precor will allow us to produce Peloton products here in the U.S. and fast track our ability to build a large domestic manufacturing footprint over time,” said Foley. “Importantly, Precor has deep manufacturing in R&D expertise, which will help us bring new hardware products to market more quickly and better position us to serve our North American member base over time.”

He further noted that Precor’s product portfolio and sales team would also accelerate its commercial business, “where we see a significant opportunity to grow Precor’s franchise while introducing the Peloton platform to an even greater number of fitness enthusiasts and channels such as hospitality, multi-unit residential buildings, corporate campuses, and colleges, and universities.”

He reiterated that Peloton expects to produce Peloton equipment in the U.S. by the end of this calendar year at Precor’s North Carolina facility and expects to close the Precor acquisition early this calendar year.

Foley said that although the company is beginning to see the benefits of extensive supply chain investments, delivery wait times remain elevated.

Foley said that as with its first quarter, continued strong demand for Peloton machines, West Coast port delays, and COVID-19-related delivery challenges are challenging Peloton from returning to our regular order-to-delivery wait times, which led to rescheduling many deliveries.

Demand for its popular line of fitness products, including its $1,895 stationary bike, have resulted in delivery wait times as long as 8-to-10 weeks — more than double the delivery turnaround time before the pandemic. Customers have complained online that Peloton has not told them how long the delays would last. Competitors such as SoulCycle, are advertising shorter delivery windows.

Beyond continued investments in manufacturing, Foley said Peloton is investing over $100 million in expedited shipping to reduce the wait times. The expense will include air shipments, expedited ocean freight and incremental cost to get containers to other less congested ports. He said of the investment, “Today, we are putting our money where our mouth is.”

Peloton has also more than doubled its Member Support, or customer-service team’s size, to support its expanding member base over the past year.

“We will continue making significant investments to get our products to the U.S. with more certainty and with greater speed,” said Foley. “We have also significantly lowered marketing spend during our typical peak selling periods. We are determined to do what it takes to reduce our delivery times and get certainty for customers on the delivery dates we offer.”

Peloton also announced it planned to delay the launch of its new Tread in the U.S. The Tread went on sale in the U.K. on December 26 and exceeded expectations. Plans had called for a limited market launch in the U.S. on February 9 in conjunction with a Canada launch. Nationwide delivery in the U.S. was scheduled for April.

However, Foley said Peloton has decided to focus its resources on introducing the Tread to the U.K. and Canada markets to “fulfill expected demand with high levels of customer service.” A limited number of new Peloton Treads will be sold in the U.S. starting on February 9 to customers who have expressed early interest in the product. This limited sale will be restricted to select zip codes. A full U.S. rollout, excluding Alaska and Hawaii, will arrive on May 27.

Foley said, “For many of those eagerly awaiting our U.S. launch, this is no doubt disappointing, but these additional weeks will enable us to build a deeper inventory footprint helping us deliver a better member experience once deliveries commence.”

The increase in revenue guide for the fiscal year’s balance is driven by the continued robust global demand for Bike, Bikes+ and strong U.S. demand for Tread+. The new Tread is expected to be a more meaningful contributor to Peloton’s growth in FY22.

Due to increased shipping costs for the balance of the year, the FY21 gross margin is expected to be approximately 39 percent, down from the previous guidance of 41 percent, including investments for air shipments, expedited ocean shipping and shipping price increases. Connected Fitness product gross margins are expected to be roughly 34 percent. Other drivers to the reduced margin outlook include its recent Bike price and continued mix shift to Tread products.

For its current fiscal third quarter, Peloton forecasts sales to reach $1.10 billion. Analysts had been calling for $1.09 billion. Year-ago sales were $524.6 million.

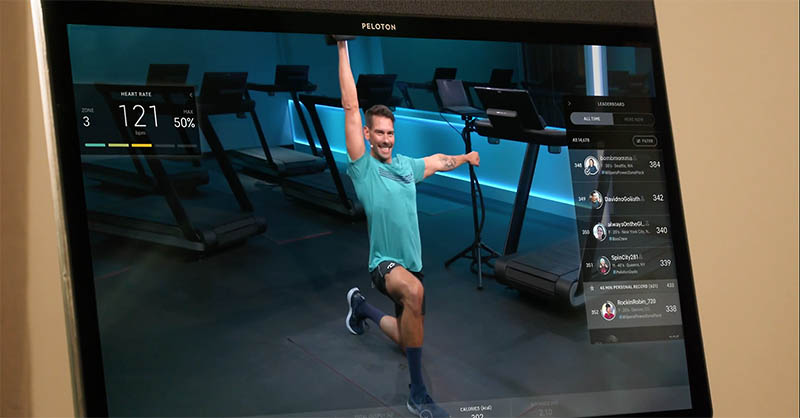

Photo courtesy Peloton Tread