“Our mission is connecting family and friends, creating memorable moments, and playing life to the fullest,” Walter Glazer, CEO of Escalade, said on the sporting goods company’s first quarterly conference call. Sales in the first quarter ended March 21 climbed 22.3 percent year-over-year and 94.1 percent against the 2020 first quarter.

Escalade, based in Evansville, IN, and celebrating its 100th anniversary in 2022, offers more than 30 sports and recreational brands. Most saw a significant benefit during the pandemic as consumers embraced outdoor activities that supported social distancing and indoor games as they were tethered to their homes.

Glazer, shown right, started the presentation by providing a “high-level overview” of business with a summary of the company’s strategic priorities.

Glazer, shown right, started the presentation by providing a “high-level overview” of business with a summary of the company’s strategic priorities.

In outdoor categories, Escalade’s business includes basketball, where it is a leading supplier of residential hoops with its Goalrilla and Goalsetter brands; backyard playground equipment under the Woodplay brand, archery for youth to the enthusiast with Bear Archery, water sports with the Rave Sports brand, and outdoor games and licensed tailgating through Victory Tailgate.

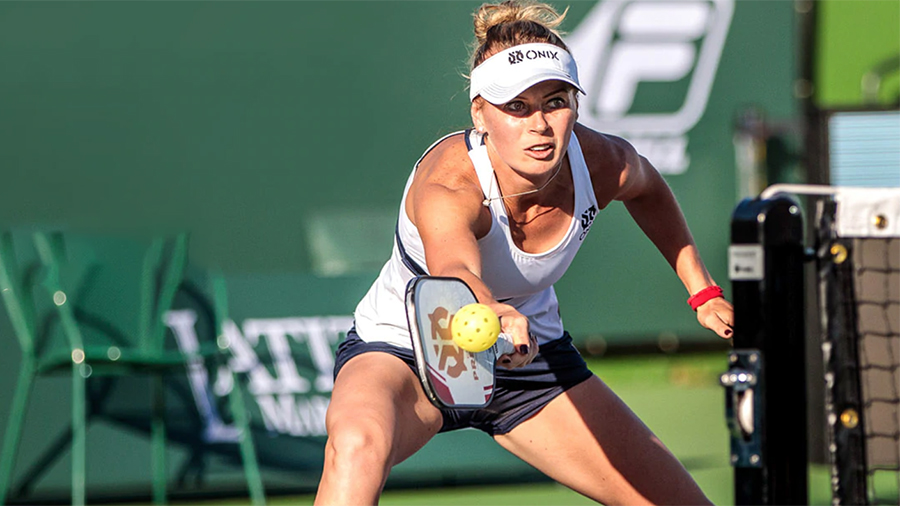

Glazer said Escalade was one of the early players in pickleball and supports the fast-expanding sport with its Onix, Dura and Pickleball Now brands.

Indoor categories include darts supported by the Accudart, Winmau and Unicorn brands and table tennis with Stiga. In game-room categories, Escalade’s line-up includes the just-acquired Brunswick Billiards and American Heritage and American Legend, with products including billiards, shuffleboard, foosball, air hockey, poker tables, and related furniture and accessories. In home fitness brands include The Step and Lifeline.

“Our first priority is reinvesting in our core businesses to protect and build upon our leading market positions and ensure that we provide great products at a fair price for our consumers,” said Glazer.

Commitment To Product Innovation

Product innovation, he said, “remains central to our long-term profitable growth,” and related investments are a priority.

Among the successes, Rave Sports’ Big Easy 4-Person Towable Tube received the Innovative Product of the Year award from the Water Sports Industry Association. Bear Archery received several reader choice awards for its compound bows from archery publications, while Trophy Ridge, another archery brand, earned honors and strong trade acceptance at the 2022 Archery Trade Association Show for its Digital React Bow Sight. Escalade’s basketball line-up incorporates dozens of patents to support differentiation in the marketplace.

Glazer said Escalade has invested in tooling and equipment to improve the quality of its products, increase capacity and enhance efficiency. A recent focus has been investing in digital tools and services to capitalize on data and improve customer engagement.

The company has also invested in existing and new facilities to support oversized growth during the pandemic and mitigate current supply chain challenges. Escalade employs a hybrid sourcing model with three manufacturing facilities in the U.S., one plant in Mexico and an Asian sourcing team.

“Currently, given higher freight costs and supply chain challenges, we’ve chosen to re-shore certain products, such as entry-level compound bows, umbrella bases and fitness weight sets. We are currently evaluating several additional opportunities,” said Glazer. “In the current environment, domestic production can be cost-effective while allowing for vastly improved inventory control and on-time delivery. During the last year, we’ve also added warehouse capacity to store additional buffer inventory in support of customer requirements.”

Glazer said Escalade “generates healthy free cash flow” and has returned nearly $45 million to shareholders since 2019 in regular cash dividends and share repurchases. Over the last decade, the company has acquired 12 businesses, including new and adjacent markets and bolt-on acquisitions in existing categories.

“We’ve bought both successful businesses that would benefit from Escalades resources, and we bought assets out of bankruptcy,” said Glazer. “The common theme is businesses that fit our mission and create shareholder value.”

Officers and directors own 20 percent of Escalade’s outstanding shares. Glazer said Escalade believes it is “critical that the interests of the company’s board and the management team are aligned with our shareholders.”

Escalade’s First-Quarter Sales Climb 22 Percent

In the first quarter ended March 21, sales expanded 22.3 percent to $72.4 million, up from $59.2 million a year ago and ahead 94.1 percent from $37.2 million in the first quarter of 2020. The sales gains were driven by organic growth across basketball, archery, pickleball, and indoor game categories, with contributions from the acquisition of Brunswick Billiards.

Excluding acquisition-related contributions, sales grew 12.2 percent in the quarter. Glazer noted that some sales from the second quarter were pulled forward into the first quarter as retail customers have been buying earlier in the tight inventory climate.

Escalade’s 10-Q filing showed that the company’s largest channel is mass merchants, with $27 million in sales in the quarter, up 46.9 percent year-over-year, followed by specialty dealers, $25.3 million, up 12.3 percent; e-commerce, $22.9 million, up 7.7 percent; and international, $4.1 million, up 150 percent.

According to its recent 10K filing, Amazon is Escalade’s largest customer, accounting for 21 percent of sales in 2021, followed by Dick’s Sporting Goods, at 11 percent.

Net earnings in the quarter improved 22.3 percent to $6.7 million, or 49 cents a share, from $5.4 million, or 39 cents, a year ago. Net earnings were $1.95 million, or 14 cents, in the 2020 quarter.

Operating income increased 26.6 percent year-over-year to $9.0 million, or 12.4 percent of sales.

Gross margin eroded 170 basis points to 27.8 percent year-over-year as continued challenges related to the supply chain, raw materials costs, inflation, and labor constraints offset a favorable sales mix. SG&A, as a percent of sales, was reduced to 14.5 percent compared with 16.7 percent from the same period in the prior year.

Escalade has expanded its sourcing and procurement initiatives in response to cost pressures and invested in new inventory ahead of further anticipated cost increases and supply chain disruptions. Escalade has also raised prices, where necessary, across its portfolio and continues to focus on expense management.

“We anticipate the global supply chain issues to continue for the foreseeable future with the current COVID situation in China and the West Coast longshoremen contract coming up for renewal this summer,” said Glazer. “We carefully monitor point-of-sale data with consumer behavior and sentiment given rising interest rates, inflation and geopolitical uncertainty.”

He added, “We serve a broad range of consumers and have performed well in various economic environments over the past century. We’re leaders in a diverse range of categories with a wide range of price points to address consumer needs.”

Brunswick Billiards Acquisition Integration Proceeding Well

In January, Escalade acquired Brunswick Billiards for $36.4 million. Glazer said Brunswick Billiards is the largest and oldest provider of billiard tables, game tables and game room furniture in the U.S.

“Founded in 1845, Brunswick is an iconic American brand,” said Glazer. “An interesting fact is that Abraham Lincoln owned a Brunswick billiard table. We view ourselves as the steward of this great brand. And just like all of our other great brands, we will invest, protect and build upon its name and reputation.”

He said Brunswick would retain its position at the high-end in the billiards space, while American Legend is positioned at entry-level and American Heritage reaches the medium range.

“The Brunswick integration is well underway as we combine our talented teams to create a world-class billiards business,” said Glazer. “We expect the Brunswick acquisition will be accretive to earnings beginning in the second half of 2022.”

Following the Brunswick acquisition completion, in addition to share repurchases and intentional purchases of buffer inventory intended to mitigate supply chain disruptions, Escalade’s net leverage is higher than historical levels but “manageable,” said Glazer.

At the end of the first quarter, the ratio of net debt to trailing 12 months EBTIDA was 2.56. Said Glazer, “For the remainder of 2022, debt reduction will be a focus and an excellent opportunity to increase shareholder value through de-leveraging.”

Targeting Low- To Mid-Teens Long-Term Growth

Asked about Escalade’s long-term targets in the Q&A session, Glazer said Escalade aims for top-line growth in the low- to mid-teens. Said Glazer, “A lot of our categories are mature, but we have some categories growing much faster, pickleball, for example. But we look at our mature businesses as being able to grow 2 to 3 percent in units. We’ve traditionally thought of 2-to-3 percent inflation or pricing, although that may be higher in the current environment. We also generate free cash flow, enhancing our growth with acquisitions.”

Escalade also looks to achieve a minimum of 10 percent operating margin.

Glazer also said inventory management remains a priority to reduce the cost of goods sold, but he also said investing in products in the constrained supply chain environment has helped it continue its outsized growth in the most recent quarter. Said Glazer, “Our sourcing teams, I think, have outperformed the industry in our ability to acquire inventory. For the most part, we’re well-stocked.”

Photos courtesy Escalade Sports/ONIX Pickleball