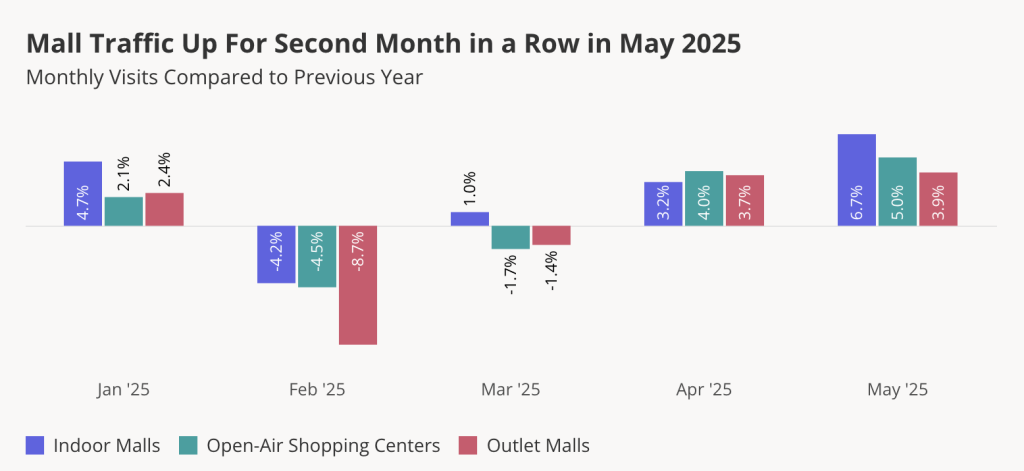

Placer.ai, the technology and market research company that tracks foot traffic in retail and restaurant spaces, reports that Indoor Malls saw a 6.7 percent year-over-year (y/y) increase in visits in May 2025. Open-air shopping centers increased 5.0 percent y/y, and Outlet Malls saw visits rise 3.9 percent yearly for the month.

“The weather’s heating up, so why not head to the air conditioning in the mall? That’s what many people have been thinking of late, as evidenced by the surge in foot traffic malls saw last month,” Placer.ai noted in its May 2025 Mall Index.

Mall visits reportedly increased across all formats in May 2025 as consumer confidence improved, according to Placer.ai’s analysis.

The rise in mall visits for a second consecutive month suggests that April’s positive year-over-year visit trends were more than a temporary pull-forward of consumer demand in response to tariff uncertainty. Instead, the latest data from Placer.ai indicates that the retail sector remains resilient despite the broader economic headwinds.

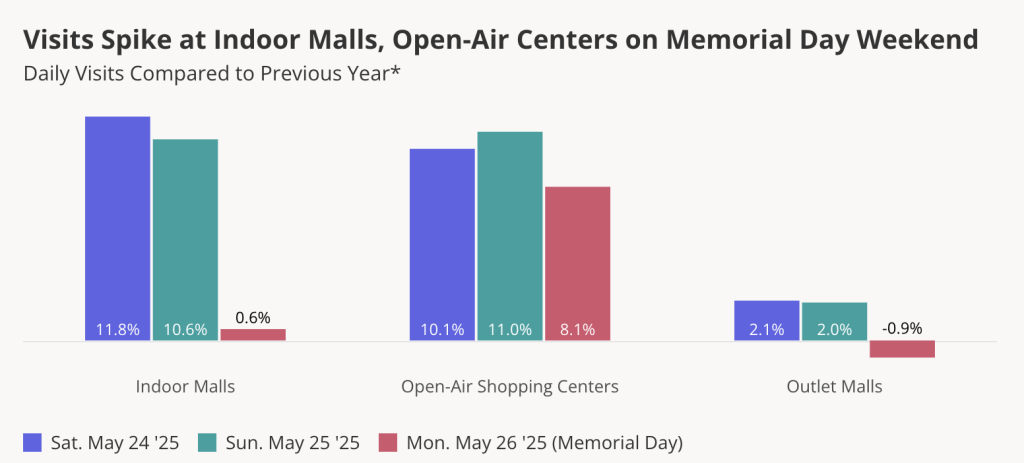

Memorial Day Success

The company said that some of May’s strength was likely driven by the sector’s strong showing over Memorial Day weekend.

“Indoor Malls and Open-Air shopping centers saw their year-over-year visits spike on the Saturday and Sunday before the holiday,” the company wrote in its May report. The wider brick-and-mortar retail industry saw relatively flat year-over-year visit numbers over the long weekend.

Placer.ai stated that this suggests shopping centers continue to operate as more than just retail destinations. The company said Malls’ entertainment offerings, specifically movie theaters, which posted impressive Memorial Day box office numbers, likely helped boost traffic despite the more muted Memorial Day performance of other discretionary categories.

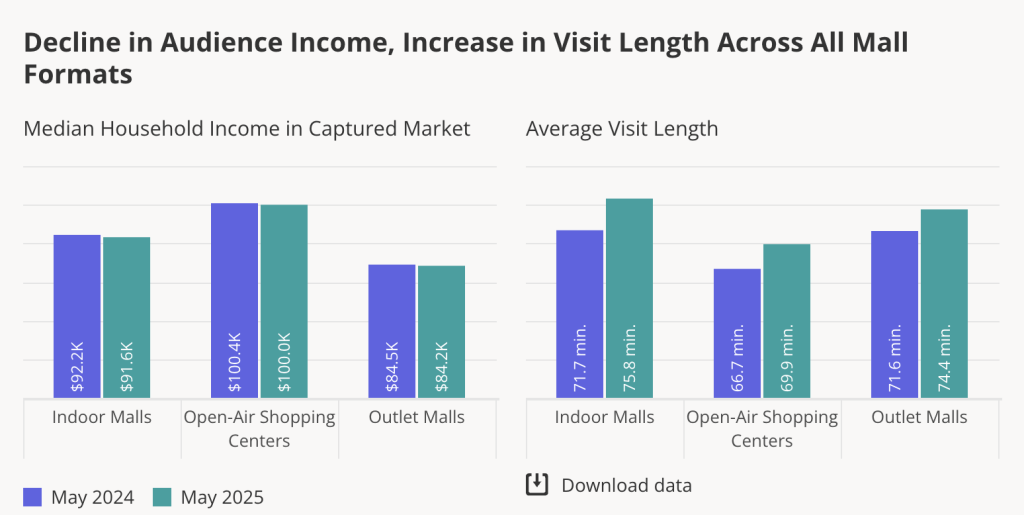

May 2025 Audience and Visitation Patterns

Placer.ai delved deeper into the demographic breakdown of mall visitors in May 2025, noting that it reveals a slight decline in median household income (HHI) for audiences across all mall formats, while visitation trends show an increase in average visit duration.

“This suggests that malls’ current resilience is not due to their effective appeal to higher-income shoppers during times of economic uncertainty, as the median HHI in their trade areas is on par with (and even slightly lower than) May 2024 levels,” Placer.ai noted. “Instead, the longer visit duration suggests that top-tier malls are succeeding by positioning themselves as social hubs and experiential destinations – using their diverse tenant base to keep visits up also during times of reduced retail activity.”

Malls are continuing to adapt to evolving consumer behaviors, with top-tier malls leaning into their role as multifaceted social and entertainment venues, positioning them well for continued growth and sustained relevance in a dynamic economic landscape, the research firm concluded in its report summary.

Image courtesy Georgetown Park Mall/Data and Infographics courtesy Placer.ai