In its initial public offering prospectus, IFit Health & Fitness identified seven growth drivers to capitalize on the expanding connected fitness market.

“Our goal is to grow our recurring subscriber base globally through the sale of our digital services and interactive fitness products,” IFit wrote in the prospectus. “We will continue to drive member engagement and retention by providing immersive and interactive experiences through our integrated platform.

The company’s company’s seven growth drivers are:

- Scale Marketing To Accelerate Growth. IFit said its low customer acquisition cost allows it to invest more in brand marketing to acquire more customers. The company wrote in its prospectus, “As we significantly scale our marketing efforts in the United States and internationally, we believe we can drive sustainable growth across our subscriber base and product portfolio.”

- Accelerate Global Growth To Leverage International Presence. IFit noted that with minimal marketing spend in fiscal 2021, its international direct-to-consumer business experienced high double-digit growth in the UK, France and Australia. Growth is also expected to come from an increased presence at strategic retail partners, including Decathlon and Rebel Sports. Overall, 16 percent of its fiscal 2021 revenue came from global markets that it believes give it a first-mover advantage. IFit said, “We believe we have a significant runway to expand market share and grow IFit memberships as we meet increasing global demand through our multi-channel distribution strategy.”

- Continuously Improve Members Experience. Continued development of new content and software it expects will drive high subscriber engagement, retention and satisfaction.

- Continue To Launch New And Disruptive Products. The company has created an extensive multi-year innovation pipeline and an R&D team of more than 600 professionals and engineering teams across three continents to enable the brand to continuously launch new products across software, content and hardware.

- Leverage Installed Consumer Base To Increase Hardware Sales And Subscription Revenue. From fiscal 2017 through fiscal 2021, IFit has sold over 48.3 million fitness products worldwide and plans to tap consumers to accelerate hardware sales and conversion to IFit Subscriptions. IFit said its data shows that 16 percent of subscribers using the IFit platform for more than three years have purchased multiple pieces of interactive hardware from the company. IFit also intends to leverage Sweat, its recently acquired fitness app, to cross-sell IFit products and memberships to app subscribers.

- Grow Commercial Sales And Expand Strategic Partnerships. Through its commercial brand, Freemotion, IFit believes it has significant growth opportunities to leverage more of its interactive hardware and membership offerings into all verticals within the commercial channel. IFit has relationships with Planet Fitness, Orangetheory Fitness and other training facilities for pro and collegiate teams. Orangetheory Fitness uses IFit technologies in its facilities. Through an exclusive partnership, IFit content is provided to Planet Fitness’ more than 15 million members through the gym chain’s app.

- Expand IFit Platform Into Adjacent Categories. Naturally adjacent categories to fitness, including mindfulness, nutrition and recovery, are seeing expansion opportunities. Recently IFit launched IFit Mind sessions guided by mental health experts. The recently acquired “29029,” the creator of endurance hiking events, is expected to accelerate its expansion into wellness tourism and corporate wellness. IFit wrote in its prospectus, “As we expand into adjacent categories, which we believe are currently underserved, we believe we will enhance stickiness of current members and create more on-ramps into the IFit ecosystem.”

The filing noted that IFit, based in Logan, UT, was founded in 1977 when Scott Watterson, chairman and CEO, and Gary Stevenson, IFit’s former president who remains a director, founded Weslo. In 1987, the company acquired ProForm Fitness. After being sold to Bain Capital Inc. in 1994, the company was renamed Icon Health & Fitness. The name was changed to IFit in August 2021.

Driven by the adoption of the IFit platform, the company said it has become the leading provider of large fitness equipment in the U.S.

In fiscal 2021, the company sold approximately 10.1 million interactive fitness products with a gross merchandise value of $2.8 billion. Brands include IFit, NordicTrack, ProForm, Freemotion, Weider, and Sweat. Equipment includes treadmills, bikes, ellipticals, rowers, climbers, strength equipment, fitness mirrors, yoga equipment, and accessories.

According to the prospectus, the IFit platform has a growing user base of over 6.1 million members and 1.5 million fitness subscribers, with users in over 120 countries.

The IFit system provides an interactive experience on its connected equipment brands for members to access a library of IFit live and on-demand content for $15/month for individuals or $39/month for families of up to five.

IFit wrote in its prospectus, “We believe the combination of our proprietary software and experiential content connected with our interactive hardware creates a compelling value proposition for our rapidly growing member base and generates attractive recurring subscription revenue.”

Its recent growth reflects the rapid growth in its member base and consistent increase in member engagement on its platform, as seen through:

- Total fitness subscribers have increased from approximately 103,000 to 1.1 million between May 31, 2017 and May 31, 2021, representing a CAGR of 81.3 percent;

- Total number of workouts on the IFit platform grew from 12.1 million during fiscal 2019 to 34.1 million during fiscal 2020, representing a 181 percent growth. I

- n fiscal 2021, its members participated in 112 million workouts, reflecting a growth of 229 percent year-over-year.

- IFit generated total revenue of $700.0 million and $851.7 million during fiscal 2019 and fiscal 2020, respectively, representing an increase of 21.7 percent, and $1.75 billion in fiscal 2021, representing an increase of 104.9 percent;

- IFit generated a net income of $56.6 million during fiscal 2019 and incurred a net loss of $98.5 million and $516.7 million during fiscal 2020 and 2021, respectively.

- IFit generated billings of $92.7 million and $183.7 million during fiscal 2019 and fiscal 2020, respectively, representing an increase of 98.2 percent, and $382.3 million in fiscal 2021, representing an increase of 108.1 percent.

Competitive Advantages

Competitive differentiators cited in its prospectus include IFit’s in-house developed software, content and hardware that can integrate and bring content to a wide range of connected devices. IFit wrote, “This comprehensive technology stack allows our devices to seamlessly connect to our network of products and members. This network effect of interactive fitness devices drives high engagement, retention and social interaction. We believe our member-centric platform is difficult to replicate and highly scalable into adjacent categories and verticals.”

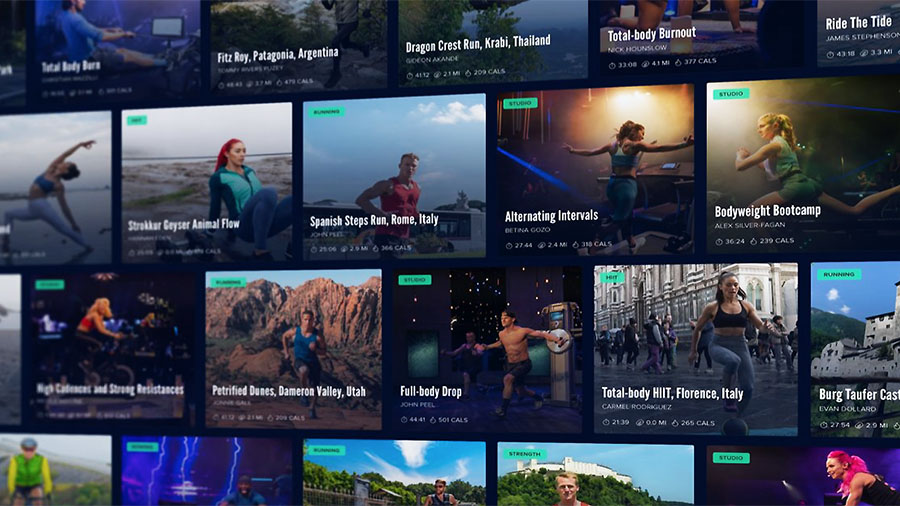

A second competitive advantage is its experiential content that includes live and on-demand studio classes and digital outdoor experiences. IFit said its production teams film content in more than 50 countries across seven continents, led by more than 180 trainers, including Olympians, top female fitness icons, and other elite athletes. The company wrote in the prospectus, “IFit members can trek to Mt. Everest base camp or walk with elephants on safari in South Africa on their treadmills and ellipticals. They can join live studio cycle classes or ride the Swiss Alps on their bikes. IFit members can row the River Thames on their rowers or join a studio boot camp class from their fitness mirrors.”

IFit’s growing library includes more than 17,000 interactive workouts in more than 60 categories, including running, cycling, HIIT, strength, boot camp class, yoga, and new categories including mindfulness, nutrition and active recovery. Its proprietary LiveAdjust streaming technology allows trainers to control members’ equipment variables, including speed, incline, resistance and digital weight, which adds more authenticity to the interactive workout.

Finally, IFit pointed to its innovation as a differentiator, noting that it has compiled a portfolio of more than 400 issued and pending patents ranging from interactive streaming to adaptive fitness technology. The company said, “These patents provide a competitive moat to our business.”

The prospectus showed that in fiscal 2021, IFit generated 44 percent of its interactive hardware revenue through its direct-to-consumer channel via its websites. Another 54 percent of interactive hardware revenue is from retail partners, including Amazon, Best Buy, Dick’sDick’s Sporting Goods, Costco, Canadian Tire, Rebel Sports, and Decathlon. Two percent of its interactive hardware revenue was generated through the commercial channel, including Orangetheory and 24 Hour Fitness.

The size of the offering and expected proceeds have not been determined. Proceeds from the offering will be used for general corporate purposes and to make a $35.0 million bonus payment to Watterson.

IFit said it intends to list its common stock on the Nasdaq Global Select Market under the ticker symbol “IFIT.” Morgan Stanley, BofA Securities, Barclays, Citi, Credit Suisse, Jefferies, and Baird are the joint bookrunners on the deal.

Photo courtesy IFit