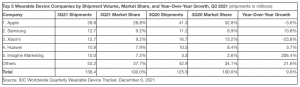

Global shipments for wearables grew 9.9 percent during the third quarter of 2021 (3Q21), reaching 138.4 million units, according to new data from the International Data Corporation (IDC) Worldwide Quarterly Wearable Device Tracker.

Hearables led the growth as the category grew 26.5 percent compared to 2020 and accounted for 64.7 percent of wearable device shipments.

Following hearables were wrist-worn wearables, most often associated with health and fitness tracking, which captured 34.7 percent of the market.

Global shipments for wearable devices grew 9.9 percent during Q3 2021, reaching 138.4 million units, according to IDC Worldwide Quarterly Wearable Device Tracker data.

Although the pandemic has driven interest in health and fitness tracking, wrist-worn wearables such as watches and wristbands faced challenges during the quarter as the devices were caught in supply constraints and shifting demand brought on by the pandemic. While the category has recently been led by Xiaomi’s low-cost bands, the company was hit hard by Apple and Huawei in 3Q21 as it tied for first place in the wrist-worn category.

“Demand has been slowly shifting away from wristbands toward watches as consumers increasingly want a more capable device and as the gap in pricing narrows,” said Jitesh Ubrani, research manager, IDC Mobility and Consumer Device Trackers. “The number of watches sold for under $100 is now equal to wristbands, which have dominated this price in the past. Growth among Indian and Chinese brands has led the low-end watch space while Apple, Huawei and Samsung maintain a hold at the high-end.”

“While the entire wrist-worn wearable market declined year-over-year, the market for watches grew 4.3 percent,” said Ramon T. Llamas, research directo, IDC’s Wearables. “And even as smartwatches (devices capable of running third-party applications) have been popular, it’s the other watches, including kids’ watches, exercise watches, hybrid watches, and others, that drove the market. That’s not to say that smartwatches are losing steam. On the contrary, Apple’s late release of the Watch Series 7 and WearOS relaunching itself is among its many hardware vendors will soon generate renewed interest.”

3Q21 Brand Highlights

Apple captured the top position in 3Q21 despite a 35.3 percent decline in Apple Watch shipments in the quarter. Hearables from AirPods and Beats have helped the company cement its leadership in the wearables market although these products have also faced challenges in recent quarters as competition in the hearables segment remains strong. Apple’s position is still enviable as it grabbed over 53 percent of the dollar value share in this market.

Samsung recent launch of the Galaxy Watch 4 Series has been well received and is a significant step forward for the watchmaker and Google, thanks to Tizen to Wear OS. Not only has Samsung focused on growing its wearables business by bundling its hearables, watches and bands with smartphones, but the company is also attempting to take wallet share from fashion spending with the launch of bespoke edition watches.

Xiaomi shipments fell 23.8 percent during the quarter as its reliance on wristbands and consumer preference for watches acted against it. The company has begun to transition from wristbands to watches and has expanded beyond China though these efforts are also heavily dependent on the success of its smartphone business in international markets. In hearables, ithas stayed true to its brand by offering low cost but high-value options.

Huawei managed to grow with the help of its hearables business as wristbands and watches combined declined 5 percent during the quarter. Hearables have been compatible across multiple brands, and this open nature has helped Huawei achieve growth in an environment where it faces political headwinds.

Imagine Marketing, the Indian company behind the brand BoAt, is it in the global Top 5 position. Marketing and low-cost products have helped drive volume. In recent quarters, the company has also launched watches, which now account for 10 percent of its shipments.

For more information, go here.