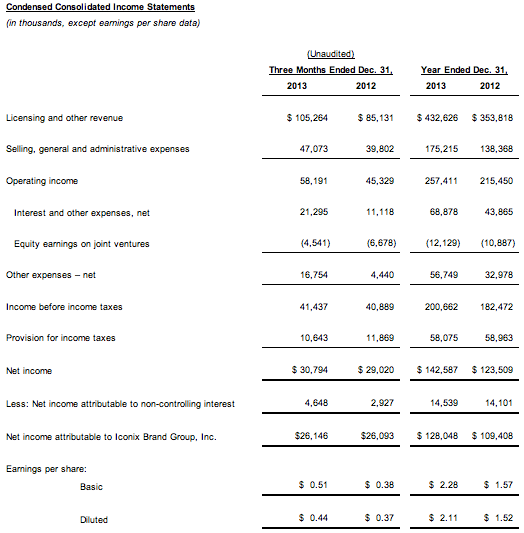

Iconix Brand Group, Inc. reported total revenue for the fourth quarter of 2013 was approximately $105.3 million, a 24 percent increase as compared to approximately $85.1 million in the fourth quarter of 2012. EBITDA attributable to Iconix for the fourth quarter was approximately $60.1 million, a 20 percent increase as compared to $50.0 million in the prior year quarter. Free cash flow attributable to Iconix for the fourth quarter was approximately $62.9 million, a 66 percent increase as compared to the prior year quarter of approximately $37.9 million.

On a non-GAAP basis, as defined in the tables below, net income attributable to Iconix was $30.2 million, a 5 percent increase as compared to the prior year quarter of approximately $28.9 million. Non-GAAP diluted EPS for the fourth quarter of 2013 increased 32 percent to $0.54 compared to $0.41 in the prior year quarter. GAAP net income attributable to Iconix for the fourth quarter of 2013 was approximately $26.1 million compared to $26.1 million in the prior year quarter and GAAP diluted EPS for the fourth quarter of 2013 increased 19 percent to $0.44 compared to $0.37 in the prior year quarter.

Full Year 2013 Results for Iconix Brand Group, Inc.:

Total revenue for the full year 2013 was approximately $432.6 million, a 22 percent increase as compared to approximately $353.8 million for the prior year. EBITDA attributable to Iconix for 2013 was approximately $262.9 million, a 21 percent increase as compared to approximately $217.0 million in the prior year. Free cash flow attributable to Iconix for 2013 was approximately $229.9 million, a 27 percent increase over the prior year of approximately $180.5 million. On a non-GAAP basis, as defined in the tables below, net income attributable to Iconix for 2013 was approximately $142.2 million, a 17 percent increase as compared to approximately $122.0 million in the prior year, and non-GAAP diluted earnings per share increased 41 percent to $2.39 versus $1.70 for the prior year. GAAP net income attributable to Iconix for 2013 was approximately $128.0 million, a 17 percent increase as compared to $109.4 million in the prior year and GAAP diluted EPS for 2013 increased 39 percent to $2.11 compared to $1.52 in the prior year. .

Neil Cole, chairman and CEO of Iconix Brand Group, Inc. commented, “Since converting to a licensing model in 2005, we have built a powerful global platform, delivering compounded annual growth of around 40 percent for both revenue and EPS. In 2013, we had another record year and continued to drive growth through the expansion of our worldwide footprint, our acquisition strategy of asset light businesses and global brands, and our ongoing commitment to share repurchases. Looking ahead, as we continue to focus on international markets and additional acquisitions, I believe we can build on our success and continue to deliver increased value to our shareholders.”

2014 Guidance for Iconix Brand Group, Inc.:

The company is maintaining its full year 2014 guidance as follows:

- Revenue of $440-$455 million

- Non-GAAP diluted EPS of $2.50-$2.60

- GAAP diluted EPS of $2.19-$2.29

- Free cash flow of $210-$217 million.

This guidance relates to the company's existing portfolio of brands and does not include any additional acquisitions. In addition, this guidance does not assume any additional share repurchases or dilution from the company's convertible notes above the current stock price.

Other company News:

The company announced today that its Board of Directors has authorized a program to repurchase up to $500 million of its common stock. See separate press release for additional details.

About Iconix Brand Group, Inc. Iconix Brand Group, Inc. owns, licenses and markets a growing portfolio of consumer brands including: Candie's (R), Bongo (R), Badgley Mischka (R), Joe Boxer (R), Rampage (R), Mudd (R), Mossimo (R), London Fog (R), Ocean Pacific (R), Danskin (R), Rocawear (R), Cannon (R), Royal Velvet (R), Fieldcrest (R), Charisma (R), Starter (R), Waverly (R), Zoo York (R), Ed Hardy (R), Sharper Image (R), Umbro (R), Lee Cooper (R), Ecko Unltd. (R), and Marc Ecko (R). In Addition, Iconix Owns Interests In The Artful Dodger (R), Material Girl (R), Peanuts (R), Truth Or Dare (R), Billionaire Boys Club (R), Ice Cream (R), Modern Amusement (R), and Buffalo (R) brands.