Iconix Brand Group Inc. reported revenues slumped 23.2 percent in the third quarter although operating earnings improved.

Highlights of the period include:

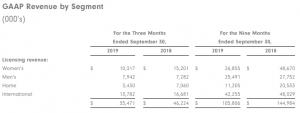

- Total revenue of $35.5 million compared with $46.2 million from the prior-year quarter.

- GAAP Operating Income- reports $8.1 million loss as compared to $12.1 million of income in the prior-year quarter.

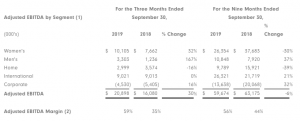

- Adjusted EBITDA increases 30 percent from the prior-year quarter, while Adjusted EBITDA margin improves to 59 percent from 35 percent in the prior-year quarter.

- Signed 155 license deals year to date, representing $126 million of aggregate guaranteed minimum royalties over the life of these contracts.

Bob Galvin, CEO commented, “Results for the third quarter of 2019 were consistent with managements’ expectations, as we continue to stabilize the business and our operational cost structure. Our focus on the business and costs continue to help improve our Adjusted EBITDA margin. We continue to develop our pipeline of future business, as we have signed 155 deals year to date for aggregate guaranteed minimum royalties of approximately $126 million. Additionally, we have entered into an agreement regarding our shareholder class action litigation and an agreement in principle regarding the SEC investigation, potentially putting both of these lingering legacy matters behind us.”

Third Quarter 2019 Financial Results

For the third quarter of 2019, total revenue was $35.5 million, a 23 percent decline, compared to $46.2 million in the third quarter of 2018. Such decline was expected, principally as a result of the transition of its Danskin and Mossimo direct to retail licenses in its Women’s segment, as previously announced. Revenue for the third quarter of 2019 was also impacted by the effect of the Sears bankruptcy on its Joe Boxer and Bongo brands in Women’s and the Cannon brand in Home. While we recently signed new agreements with the new Sears and Kmart for the Cannon and Joe Boxer brands, the overall revenue for the Cannon and Joe Boxer brands was down year over year. Men’s segment revenue increased 9 percent in the third quarter of 2019, compared to the prior year quarter primarily from the Buffalo and Starter brands. International segment declined 17 percent in the third quarter of 2019 primarily as a result of poor performance of Umbro in China and Umbro and Lee Cooper in Europe.

For the nine months ended September 30, 2019, total revenue was $105.8 million, a 27 percent decline, compared to $145 million in the nine months ended September 30, 2018.

SG&A Expenses:

Total SG&A expenses in the third quarter of 2019 were $26.3 million, a 13 percent decline compared to $30.2 million in the third quarter of 2018. Most of the decline for the quarter was a decrease in advertising and bad debt expense somewhat offset by the cost related to the potential SEC settlement and the impairment of the contract assets. Total SG&A expenses in the nine months ended September 30, 2019 were $60.8 million, a 34 percent decline compared to $92.4 million in the nine months ended September 30, 2018.

Operating Income and Adjusted EBITDA:

Operating loss for the third quarter of 2019 was $8.1 million, as compared to operating income of $12.1 million in the third quarter of 2018. Third-quarter results include a $17 million impairment charge related to its investment in Marcy Media. Adjusted EBITDA in the third quarter of 2019 was $20.9 million which represents an operating loss of $8.1 million excluding net charges of $29.0 million. Adjusted EBITDA in the third quarter of 2018 was $16.1 million which represents operating income of $12.1 million excluding net charges of $4.0 million. The change period over period in Adjusted EBITDA is primarily as a result of the cost reduction initiative, somewhat offset by the change in revenue as outlined above.

Operating income for the nine months ended September 30, 2019 was $28.9 million, as compared to an operating loss of $66.9 million in the nine months ended September 30, 2018. Adjusted EBITDA for the nine months ended September 30, 2019 was $59.7 which represents operating income of $28.9 million excluding net charges of $30.8 million. Adjusted EBITDA for the nine months ended September 30, 2018 was $63.2 million which represents operating loss of $66.9 million excluding net charges of $130.1 million. The change period over period in Adjusted EBITDA is primarily as a result of the change in revenue as outlined above, mostly offset by the cost reduction initiative.

Note: All items in the following tables are attributable to the Iconix Brand Group, Inc. and exclude the results related to non-controlling interest. Certain numbers may not add due to rounding.

Adjusted EBITDA margin in the third quarter of 2019 was 59 percent as compared to adjusted EBITDA margin in the third quarter of 2018 of 35 percent. The change period over period in adjusted EBITDA margin is primarily as a result of the Company’s decrease in expenses which outpaced the decrease in revenues.

Adjusted EBITDA margin in the nine months ended September 30, 2019 was 56 percent as compared to adjusted EBITDA margin in the nine months ended September 30, 2018 of 44 percent. The change period over period in adjusted EBITDA margin is primarily as a result of the Company’s decrease in expenses which outpaced the decrease in revenues.

Interest Expense and Other (Income) Loss, net:

Interest expense in the third quarter of 2019 was $ 14.4 million as compared to $ 14.9 million in the third quarter of 2018. In the third quarter of 2019, Other income (loss) was a $12.0 million loss as compared to a $25.8 million gain in the third quarter of 2018. This gain or loss results from the Company’s accounting for the 5.75 percent Convertible Notes, which requires recording the fair value of this debt at the end of each period with any change from the prior period accounted for as other income or loss in the respective period’s income statement.

Interest expense in the nine months ended September 30, 2019 was $ 43.4 million as compared to $ 44.3 million in the nine months ended September 30, 2018. For Other (Income) Loss, net for the nine months ended September 30, 2019, the Company recognized a $6.8 million gain as compared to an $84.0 million gain in the prior year period.

Provision for Income Taxes:

The effective income tax rate for the third quarter of 2019 is approximately 2 percent, which resulted in a $0.6 million income tax benefit, as compared to an effective income tax rate of 4.5 percent in the third quarter of 2018, which resulted in a $1.0 million income tax provision. The decrease in the effective tax rate is due to expenses recorded in the third quarter of 2019 for which no tax benefit was able to be recognized and to a trademark impairment recorded in the third quarter of 2018, for which the Company recognized a tax benefit.

The effective income tax rate for the nine months ended September 30, 2019 is approximately -15 percent, which resulted in a $1.3 million income tax provision, as compared to an effective income tax rate of 0.6 percent in the nine months ended September 30, 2018, which resulted in a $0.1 million income tax benefit. The increase in tax expense is due to expenses recorded in the nine months ended September 30, 2019 for which no tax benefit was able to be recognized and to trademark impairment recorded in the prior year nine months, for which the Company recognized a tax benefit.

GAAP Net Income and GAAP Diluted EPS:

GAAP net income attributable to Iconix for the third quarter of 2019 reflects a loss of $ 35.7 million, compared to income of $ 20.2 million for the third quarter of 2018. GAAP diluted EPS for the third quarter of 2019 reflects a loss of $ 3.07, compared to income of $ 0.26 for the third quarter of 2018.

GAAP net income attributable to Iconix for the nine months ended September 30, 2019 reflects a loss of $ 16.5 million, compared to a loss of $ 31.4 million for the nine months ended September 30, 2018. GAAP diluted EPS for the nine months ended September 30, 2019 reflects a loss of $ 1.62 compared to a loss of $ 7.35 for the nine months ended September 30, 2018.

Adjusted EBITDA:

Adjusted EBITDA for the third quarter of 2019 was $20.9 million, compared to $16.1 million for the third quarter of 2018. Adjusted EBITDA for the nine months ended September 30, 2019 was $59.7 million, compared to $63.2 million for the nine months ended September 30, 2018.

Balance Sheet and Liquidity:

The company currently projects compliance with its financial covenants under its senior secured term loan and the interest-only DSCR under the Securitization indenture for 2019.

Iconix Brand Group owns, licenses and markets the following brands: Candie’s, Bongo, Joe Boxer, Rampage, Mudd, Mossimo, London Fog, Ocean Pacific, Danskin, Rocawear, Cannon, Royal Velvet, Fieldcrest, Charisma, Starter, Waverly, Zoo York, Umbro, Lee Cooper, Ecko Unltd., Marc Ecko, Artful Dodger and Hydraulic. In addition, Iconix owns interests in the Material Girl, Ed Hardy, Truth Or Dare, Modern Amusement, Buffalo and Pony brands.