Iconix Brand Group Inc. announced it has reached agreements with holders of approximately $110 million principal amount of the company’s 1.5 percent convertible notes due March 2018 to exchange their 2018 convertible notes for new senior subordinated convertible notes and cash payments representing accrued but unpaid interest on the 2018 convertible notes.

The 2018 convertible notes will be exchanged for the new convertible notes at an exchange ratio of $1,000 principal amount of new convertible notes for each $1,000 principal amount of 2018 convertible notes. On or prior to the settlement of the Exchange, the company may enter into agreements with one or more holders of 2018 convertible notes to increase the principal amount of 2018 convertible notes participating in the Exchange from $110 million to up to $125 million. The company expects to settle the Exchange on or about February 22, 2018.

The new convertible notes are expected to have an interest rate of 5.75 percent per annum, mature in August 2023 and be secured by the same assets that secure the obligations of the company’s wholly-owned direct subsidiary, IBG Borrower LLC, under its existing senior secured credit facility.

John Haugh, CEO of Iconix commented, “These exchange transactions are part of the company’s strategy to satisfy near-term debt obligations and represent a positive step in improving our balance sheet. We are also announcing a cost savings initiative to improve our profitability and free cash flow. With the reduction in near-term debt from this exchange satisfying a significant condition to the availability of our delayed draw term loan and the cost savings that have been identified, we are now in a good position to finalize the solution for the balance of our upcoming debt obligations.”

Haugh further commented, “From a business operations standpoint, we are reaffirming our 2017 revenue and non GAAP earnings per share guidance and we are pleased to highlight recent announcements of Starter with Amazon and Umbro with Target as evidence that we are making progress ensuring our brands are with the right long-term partners to maximize market presence and contribution to Iconix.”

The new convertible notes will be contractually subordinated in right of payment to the company’s obligations as a guarantor under the existing senior credit facility. Conversions of the new convertible notes will be subject to a make-whole payment by the company. The new convertible notes will be convertible at any time by the holders and under certain circumstances by the company. In addition, the company will have the right to repurchase the new convertible notes at par following the one-year anniversary of the issue date. The company will be permitted to settle any conversions of the new convertible notes, as well as pay accrued but unpaid interest on such new convertible notes and any make-whole payments, in cash, shares or a combination thereof.

Further detail regarding the terms and conditions of the Exchange and the new convertible notes are set forth in the company’s Current Report on Form 8‑K filed with the Securities and Exchange Commission on February 12, 2018. In addition, the company expects to file the indenture pursuant to which the new convertible notes are expected to be issued as an exhibit to a Current Report on Form 8‑K following its execution.

The Exchange will satisfy the condition to the availability of the second delayed draw term loan under the existing senior credit facility that the company achieve a reduction in the outstanding principal amount of the 2018 convertible notes of at least $100.0 million. In addition, the company believes that it should be able to satisfy the remaining conditions to disbursement of the second delayed draw term loan, allowing the company to access the additional funds under the second delayed draw term loan to retire the 2018 convertible notes that will remain outstanding following the Exchange at their maturity in March 2018. The remaining conditions consist of (i) the company being in financial covenant compliance under the existing senior credit facility, on a pro forma basis as of the time of the requested borrowing and on a projected basis for the succeeding 12 months based on projections reasonably acceptable to the lenders, and (ii) there not existing a default or event of default under the existing senior credit facility as of the time of the borrowing.

In connection with the Exchange, Guggenheim Securities, LLC is acting as the company’s sole financial advisor, and Dechert LLP is acting as the company’s legal advisor.

Cost Savings Plan:

Iconix announced today that it has initiated a cost savings plan to improve profitability and free cash flow to further position the company for long-term success. The company expects to achieve annual savings of approximately $12 million through proactive rightsizing of its expense structure, appropriately aligned to its expected go-forward revenue base.

2018 Outlook:

- The company is providing an initial outlook for 2018.

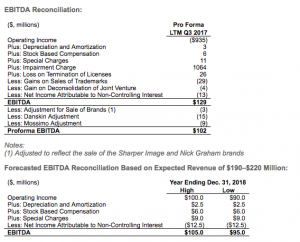

- The company expects 2018 revenue to be in a range of $190 million to $220 million, as compared to 2017 preliminary revenue of approximately $225 million. The year-over-year decline primarily reflects the transition of the DanskinNow and Mossimo brands, which together are estimated to decline approximately $25 million in 2018.

Additional Information:

In connection with the Exchange, the company disclosed the following information in its discussions with noteholders who agreed to be bound by confidentiality obligations with respect to such information:

- The company signed a new multi-year license agreement with Target for the Umbro brand, a world leader in soccer apparel. The exclusive Umbro collection will be available in all Target stores and on Target.com beginning in late February.

- The company expects to transition its Material Girl brand from a direct-to-retail license with Macy’s to a wholesale license following the expiration of the contract in January 2020. The company is currently negotiating a license with a new vendor that would run contiguous with Macy’s on a non-exclusive basis and then would be available to be renewed by the vendor for a three-year term. Guaranteed minimum royalties under the Material Girl license for 2018 are $5.0 million.

- The company received notice from JCPenney that it is currently not expecting to renew its Royal Velvet license when it expires in January 2019. Should the Royal Velvet license not be renewed by JCPenney, the company believes there are other opportunities to redeploy the Royal Velvet brand in the near future. Guaranteed minimum royalties under the Royal Velvet license for 2018 are $8.0 million.

- Proforma licensing revenue for the brands that are secured by the company’s Senior Secured Notes under the company’s securitization facility was $181 million in 2015, $166 million in 2016 and $121 million for the twelve months ended September 30, 2017. Proforma licensing revenue for the twelve months ended September 30, 2017 of $121 million is adjusted for the effect of the reduction in royalties expected from the DanskinNow and Mossimo transitions.

- Licensing revenue generated from the brands that are not securitized by the Senior Secured Notes under the company’s securitization facility was $86 million in 2015, $89 million in 2016 and $84 million for the twelve months ended September 30, 2017.

- Proforma cash flow available to service additional debt after paying interest and amortization on the Senior Secured Notes under the company’s securitization facility, adjusted to reflect the DanskinNow and Mossimo transitions, for the twelve months ended September 30, 2017 was approximately $31.5 million.

- The company expects 2018 EBITDA to be in a range of $95 million to $105 million. This compares to EBITDA of approximately $102 million for the twelve months ended September 31, 2017, after adjusting for the DanskinNow and Mossimo transitions.

Iconix’s lineup of brands include Candie’s, Bongo, Joe Boxer, Rampage, Mudd, Mossimo, London Fog, Ocean Pacific, Danskin, Rocawear, Cannon, Royal Velvet, Fieldcrest, Charisma, Starter, Waverly, Zoo York, Umbro, Lee Cooper, Ecko Unltd., Marc Ecko and Artful Dodger. In addition, Iconix owns interests in The Material Girl, Ed Hardy, Truth Or Dare, Modern Amusement and Buffalo.