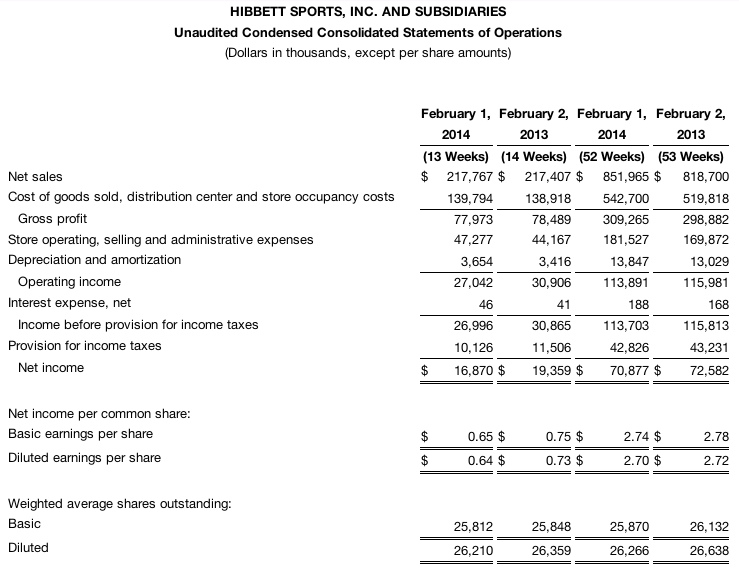

Hibbett Sports, Inc. reported sales for the 13-week period ended Feb. 1, 2014, increased 0.2 percent to $217.8 million compared with $217.4 million for the 14-week period ended Feb, 2, 2013. Comparable store sales increased 1.7 percent on a calendar basis (comparable 13-week period).

Gross profit was 35.8 percent of net sales for the 13-week period ended February 1, 2014, compared with 36.1 percent for the 14-week period ended February 2, 2013.

Store operating, selling and administrative expenses were 21.7 percent of net sales for the 13-week period ended February 1, 2014, compared with 20.3 percent of net sales for the 14-week period ended February 2, 2013.

Net income for the 13-week period ended February 1, 2014, was $16.9 million compared with $19.4 million for the 14-week period ended February 2, 2013. Earnings per diluted share were $0.64 for the 13-week period ended February 1, 2014, compared with $0.73 for the 14-week period ended February 2, 2013. The 14th week in Fiscal 2013 added approximately $0.07 in earnings per diluted share to the Fiscal 2013 quarterly and annual results.

Fiscal 2014 Results

Net sales for the 52-week period ended February 1, 2014, increased 4.1 percent to $852.0 million compared with $818.7 million for the 53-week period ended February 2, 2013. Comparable store sales increased 1.8 percent on a calendar basis (comparable 52-week to 52-week period).

Gross profit was 36.3 percent of net sales for the 52-week period ended February 1, 2014, compared with 36.5 percent for the 53-week period ended February 2, 2013.

Store operating, selling and administrative expenses were 21.3 percent of net sales for the 52-week period ended February 1, 2014, compared with 20.8 percent of net sales for the 53-week period ended February 2, 2013.

Net income for the 52-week period ended February 1, 2014, was $70.9 million compared with $72.6 million for the 53-week period ended February 2, 2013. Earnings per diluted share were $2.70 for the 52-week period ended February 1, 2014, compared with $2.72 for the 53-week period ended February 2, 2013.

Hibbett had previously said it expected earnings to come in the range of $2.68 to $2.77 a share.

Jeff Rosenthal, President and Chief Executive Officer, stated, “We were very pleased with sales during the holiday season, although we experienced a significant slowdown in January due to significant weather-related store closures and a less favorable sales impact this year from the college football championship game. Sales trends improved significantly in February as weather patterns normalized, and we transitioned to our spring assortment. Looking ahead, we feel confident in our product offering, inventory levels and execution as we progress through this important season. We also continue to be encouraged by new store unit growth and sales, and look forward to delivering value on our key initiatives in Fiscal 2015.”

For the year, Hibbett opened 72 new stores, expanded 14 high performing stores and closed 18 underperforming stores, bringing the store base to 927 in 31 states as of February 1, 2014.

Liquidity and Stock Repurchases

Hibbett ended the fourth quarter of Fiscal 2014 with $66.2 million of available cash and cash equivalents on the consolidated balance sheet, no bank debt outstanding and full availability under its $80.0 million unsecured credit facilities.

During the fourth quarter, the company repurchased 21,500 shares of common stock for a total expenditure of $1.3 million. Approximately $229.6 million of the total authorization remained for future stock repurchases as of February 1, 2014.

Fiscal 2015 Outlook

The company provided the following guidance for Fiscal 2015:

- Earnings per diluted share in the range of $2.78 to $2.98

- Increase in comparable store sales in the low-to-mid single digit range

- Approximately 75 to 80 new stores, 10 to 15 expansions and 15 to 20 closures

- Flat to slightly positive product gross margin rate compared to Fiscal 2014

- An estimated $0.11 per diluted share impact due to the transition to the new wholesaling and logistics facility in April/May, ongoing operational costs after opening, and increased depreciation

- Increase in SG&A expense as a percent of sales due to increased health care costs (estimated $0.02 per diluted share), as well as increases in marketing and IT costs