Hibbett Sports Inc. sharply raised its outlook for the year after reporting first-quarter earnings that blew past Wall Street’s consensus target. Comparable store sales increased 5.1 percent.

First Quarter Results

Net sales for the 13-week period ended May 4, 2019, increased 25.0 percent to $343.3 million, including $59.4 million for City Gear, compared with $274.7 million for the 13-week period ended May 5, 2018. Sales topped Wall Street’s consensus target of $327.0 million.

Comparable store sales increased 5.1 percent, well ahead of Wall Street’s consensus target of a 0.7 percent decline. Comparable store sales will not include sales from City Gear until the fourth quarter of Fiscal 2020. E-commerce sales represented 8.3 percent of total sales for the first quarter. Strength in footwear and sneaker-connected apparel & accessories continued to offset softer sales in licensed products and team sports.

Gross margin was 34.5 percent of net sales for the 13-week period ended May 4, 2019, compared with 35.2 percent for the 13-week period ended May 5, 2018. The 70 basis point decrease was mainly due to increased freight costs from strong e-commerce sales and a $1.0 million expense incurred to amortize an inventory step-up value related to the City Gear acquisition. Excluding non-recurring expenses, non-GAAP gross margin was 34.8 percent of net sales for the 13-week period ended May 4, 2019.

Store operating, selling and administrative expenses were 21.7 percent of net sales for the 13-week period ended May 4, 2019, compared with 22.5 percent of net sales for the 13-week period ended May 5, 2018. The decrease as a percent of net sales was mainly due to overall leverage gained through higher sales. SG&A expenses included $0.7 million in non-recurring costs related to the acquisition of City Gear, and $1.5 million in non-recurring impairment costs associated with the company’s strategic realignment and accelerated store closure plan. Excluding non-recurring costs, non-GAAP store operating, selling and administrative expenses were 21.1 percent of net sales for the 13-week period ended May 4, 2019.

Net income for the 13-week period ended May 4, 2019, was $27.4 million compared with net income of $21.5 million for the 13-week period ended May 5, 2018. Excluding non-recurring costs, non-GAAP net income for the 13-week period ended May 4, 2019, was $29.8 million. Earnings per diluted share was $1.48 for the 13-week period ended May 4, 2019, compared with earnings per diluted share of $1.12 for the 13-week period ended May 5, 2018.

Excluding non-recurring costs, non-GAAP earnings per diluted share was $1.61 for the 13-week period ended May 4, 2019. Wall Street’s consensus target has been $1.32.

Jeff Rosenthal, president and chief executive officer, stated, “Our first quarter results reflect improved performance in both the store and e-commerce channels. We believe our improved web traffic and mobile app, along with continued traction in Buy Online, Pickup in Store, are translating to traffic in our stores and online. We are moving forward with our plan to close our most unproductive stores. Our City Gear integration is progressing as planned and we are encouraged by the improved inventory position. Looking ahead, we are committed to the fundamentals of presenting a differentiated customer experience, building best in class teams and driving exceptional execution in all parts of the business.”

For the quarter, Hibbett opened three new stores, rebranded two Hibbett stores to City Gear stores, expanded one high-performing store, and closed 24 underperforming stores bringing the store base to 1,144 in 35 states as of May 4, 2019.

Strategic Realignment – Accelerated Store Closure Plan

As the retail environment continues to evolve, the company is focused on improving the productivity of the store base while continuing to grow its omni-channel business to serve customers where and when they want to shop. As previously reported, the company is proceeding with the closing of approximately 95 Hibbett stores in Fiscal 2020, which is expected to result in non-recurring impairment and store closure charges in the range of $0.15 to $0.20 per diluted share in Fiscal 2020.

Balance Sheet and Stock Repurchases

Hibbett ended the first quarter of Fiscal 2020 with $117.0 million of available cash and cash equivalents on the consolidated balance sheet. As of May 4, 2019, Hibbett had $26.0 million in debt outstanding and $74.0 million available under its credit facilities.

During the first quarter, the company repurchased 259,432 shares of common stock for a total expenditure of $5.4 million. Approximately $183.2 million remained authorized for future stock repurchases through January 29, 2022.

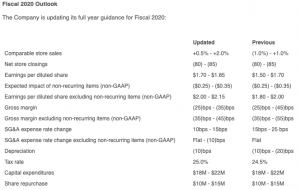

Fiscal 2020 Outlook

The company is updating its full year guidance for Fiscal 2020: