Hibbett Sporting Goods, Inc. tried to put the past  behind them on their quarterly conference call with analysts, describing the first 19 days of the new quarter as a series of dramatic shifts from second quarter trends. For Q3-to-date, calendar comps were said to be up 6%, with stores in enclosed malls outperforming strip center locations for the first time in four years. Sales in strip centers were up 4%, while enclosed malls were up 8%.

behind them on their quarterly conference call with analysts, describing the first 19 days of the new quarter as a series of dramatic shifts from second quarter trends. For Q3-to-date, calendar comps were said to be up 6%, with stores in enclosed malls outperforming strip center locations for the first time in four years. Sales in strip centers were up 4%, while enclosed malls were up 8%.

Mickey Newsome, chairman and CEO, said August is coming in ahead of expectations due to Texas and Florida pushing their school start date back and their tax-free holiday dates back approximately two weeks into August. In addition to this shift, Newsome also said he felt “consumers are waiting longer in general to make their purchases,” which will also be felt during the Holiday period. Finally, he believes the heat wave that baked the South for the last few weeks drove consumers into the malls and the AC therein.

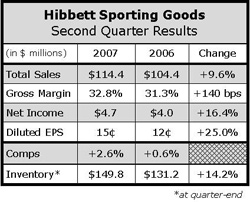

In the second quarter, though comparable store sales increased 2.6% on a fiscal basis, on a calendar basis comps were down 5.6%. Strip center sales increased 4%, while at the mall sales were up 1%. Suburban stores outperformed urban stores during the quarter. Moving sequentially through the quarter, sales for May were down 26%, partially due to the calendar shift, and June was down 3%, but July saw a rebound, jumping 14% for the month.

Categorically, apparel benefited from performance product from Under Armour and Nike in all genders, as VP of Merchandise Jeff Rosenthal sees “this trend continuing and becoming a bigger part of our business in the third and fourth quarters.” He sees opportunities for the retailer here, describing the Kids business as “under-penetrated.”

Rosenthal continued, “Urban apparel has been tough in May and June. However we're seeing some improvements in late July and in early August as our mix has become more fashionable. Licensed apparel has underperformed through the second quarter.”

The college business is expected to improve with the start of the football season, with that piece accounting for a larger part of the overall mix. However, pro apparel continued to be tough for the retailer, with management expecting difficulties remaining status quo for the rest of the fiscal year. NFL is expected to sell better with Saints and Titans and having better assortments from last year. As for the number 7 Falcons jerseys, management said Vick was one of the companys best sellers, but that it is a small part of the business and not having the product on shelves will not have a major effect on the business. Rosenthal said that “growth in the pro licensed business really has become more in the youth categories and women's. The adult business has been pretty tough from a jersey standpoint just from a fashion standpoint.”

Footwear was down single-digits on a calendar basis for the second quarter, but August has been up high-single-digits as customers delayed BTS buying. Key items for back-to-school were Nike Shox, Nike Impax and Air Force One. New Balance Zip and adidas Bounce products were also called out as strong performers. Classics were soft for the quarter, with Reebok called out as a weaker player. Looking to the year ahead, management said that it will launch Under Armour cross trainers during the first week of May 2008.

Equipment was described as “difficult” in the second quarter, but football and skateboards both saw “some improvement.” The accessory business was “very strong in socks, backpacks and vendor bags.”

Gross profit increased due to improved retail product margins, which was aided by better-than-planned shortage results and improved markdown rates with only slight deleveraging of both store occupancy and warehouse costs. Product margins in apparel and equipment were in the mid to high-40s, while footwear margins were in the low to mid-40s.

Selling and administrative costs increased over the prior year due to the deleveraging of store in corporate payroll, increased advertising cost due to the back to school calendar shift, and inventory taking expense related to the product margin expansion since the company did not take any inventories in the first quarter, due to the JDA system implementation. Operating margins improved 640 basis point to 6.8% from last year's 6.16%.

The company opened 17 new stores during the quarter, closing three, bringing the store base to 634 stores in 23 states. The company plans to open 28 to 30 stores and close 2 to 4 stores in the third quarter. For fiscal 2008, the company plans to open 90 to 95 stores and close 6 to 10 stores.

For the third quarter, the company expects to report earnings per diluted share of 20 cents to 25 cents with slightly positive comparable store sales on a calendar basis and mid-single-digit negative comparable store sales on a fiscal basis. For fiscal 2008, the company expects to report earnings of $1.07 to $1.20 per diluted share and a slightly positive comparable store sales increase on both a calendar and fiscal basis; down from earlier guidance of $1.30 to $1.35 per diluted share.