The Helen of Troy, Ltd. Board of Directors had authorized the repurchase of $500 million of its outstanding common shares in keeping with its stated intention to return to shareholders capital not otherwise used for core business growth or acquisitions.

The company approved the authorization as part of the Board’s regular process of reviewing Helen of Troy’s capital allocation and existing authorization, effective August 20, 2024, for a period of three years and replaces the company’s existing repurchase authorization, of which approximately $245.3 million remained at the time the new authorization was approved.

Helen of Troy can purchase shares on a discretionary basis from time to time through open market purchases, issuer tender offers, privately negotiated transactions, and accelerated share repurchase programs, or other means, including through Rule 10b5-1 trading plans. The timing and amount of any transactions are subject to the discretion of Helen of Troy and may be based on market conditions and other opportunities that Helen of Troy may have for the use or investment of its capital.

The repurchase program does not require purchasing any minimum number of shares and may be implemented, modified, suspended, or discontinued in whole or in part at any time without further notice.

In total, the $500 million share repurchase authorization represents approximately 43 percent of the company’s outstanding common stock, based on the company’s closing price on August 20, 2024.

As of August 20, 2024, Helen of Troy had approximately 22.8 million shares outstanding.

Noel M. Geoffroy, chief executive officer at Helen of Troy, stated: “This share repurchase authorization underscores the confidence our management team and our Board have in our strategic initiatives, the strength of our brands, and the long-term growth opportunities we have ahead of us. Our business continues to generate significant cash flow and we remain committed to our planned growth investments, to reducing our net leverage ratio by the end of the fiscal year, and to the disciplined deployment of capital to deliver long-term, sustainable value creation for our shareholders.”

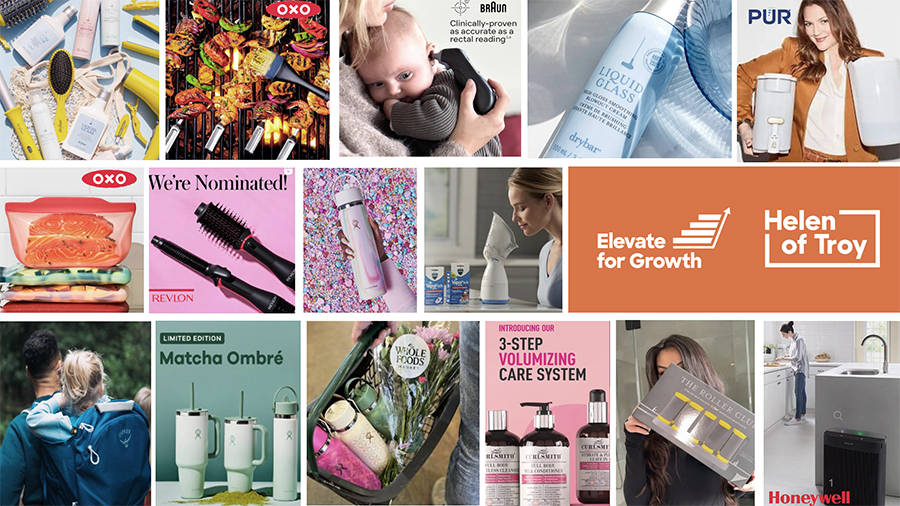

Image courtesy Helen of Troy