Gympass announced that Softbank, General Atlantic, Moore Strategic Ventures, Kaszek, and Valor Capital Group, are supporting the company with a new investment round of $220 million.

According to Gympass, it has seen its valuation “more than double to $2.2 billion,” reflecting the increased importance of wellbeing for companies. In May, Gympass said it saw “a record four million monthly visits across its network of over 50,000 global partners,” with many of its clients “seeing usage above pre-COVID-19 levels.”

The U.S. and the UK lead the way for the brand with “unprecedented growth in the demand for in-person fitness, with a similar trend reflected across Latin America and Europe. Gympass is currently experiencing double-digit subscriber growth month-over-month,” said Gympass.

Current clients include Santander, Accenture, Unilever, KPMG, and McDonald’s. Gympass also signed new deals with U.S. partners, including Barry’s, SoulCycle, F45, and Strava for fitness, and Calm, LifeSum, and Fabulous.

“We’ve already seen a surge in gym and studio visits as countries begin to open up, and we fully expect even greater momentum as people head back to the office,” said Cesar Carvalho, co-founder and CEO, Gympass. “We’ve created the most complete wellbeing platform, covering fitness, therapy, mindfulness, and nutrition. The additional funding will help us fuel further growth in the U.S., improve the product experience and continue to expand into new categories as we continue on our mission to make wellbeing universal.”

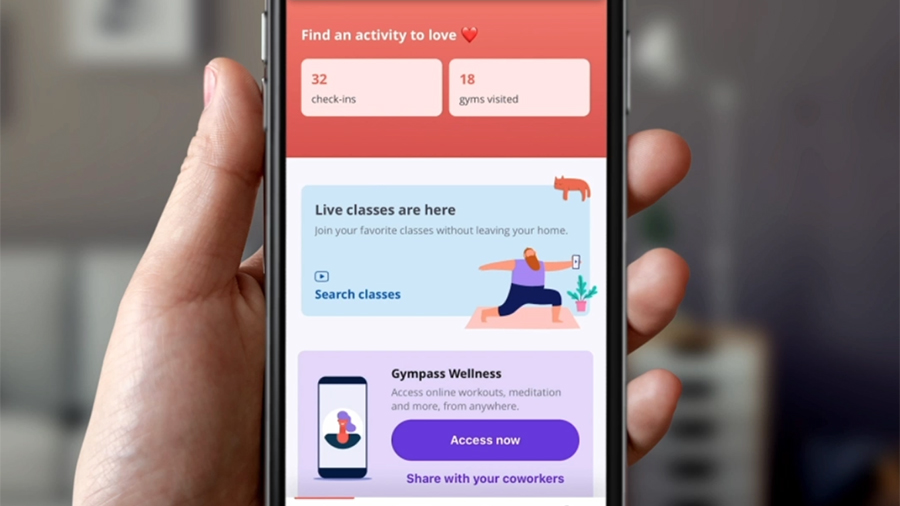

Photo courtesy Gympass