Globe International, Ltd. posted a double-digit decline in revenues and a sharp downturn in profit in the fiscal year ended June 30 as the action sports/street lifestyle company struggled with declines in its hardgoods business and the clearance of related inventories, particularly in the U.S.

The company said it saw a performance improvement in the second half of the year. Compared to the first half of the financial year, profitability was higher despite lower sales, as the clearance of excess hardgoods inventories began to wind down and other positive business changes began to take effect.

“The downturn in the hardgoods market from the second quarter of FY22 had a significant impact on FY23 financial performance, compared to the prior two years when hardgoods generated massive sales and profit growth,” company CEO Matt Hill explained. “In addition, multiple factors put downward pressure on gross profit margins; this included exceptional clearance sales due to excess hardgoods inventories that built up as a result of logistics delays and the market downturn, which resulted in an industry-wide inventory glut, as well as the strength of the USD, and heightened freight costs.”

Hill said the company moved quickly to address the issues while its apparel brands remained stable. “Consequently, profitability improved in the second half of the financial year, and we ended the financial year in a much stronger financial position,” he said.

Total full-year net sales declined 14.6 percent (-17 percent constant-currency) year-over-year to $234.3 million in the fiscal year, which the company said was due to reduced hardgoods sales. Sales were lower in the second half, but margins and profits were higher thanks to expense controls.

Australasia region revenues declined 6.9 percent year-over-year (YoY) to A$112.4 million in fiscal 2023,

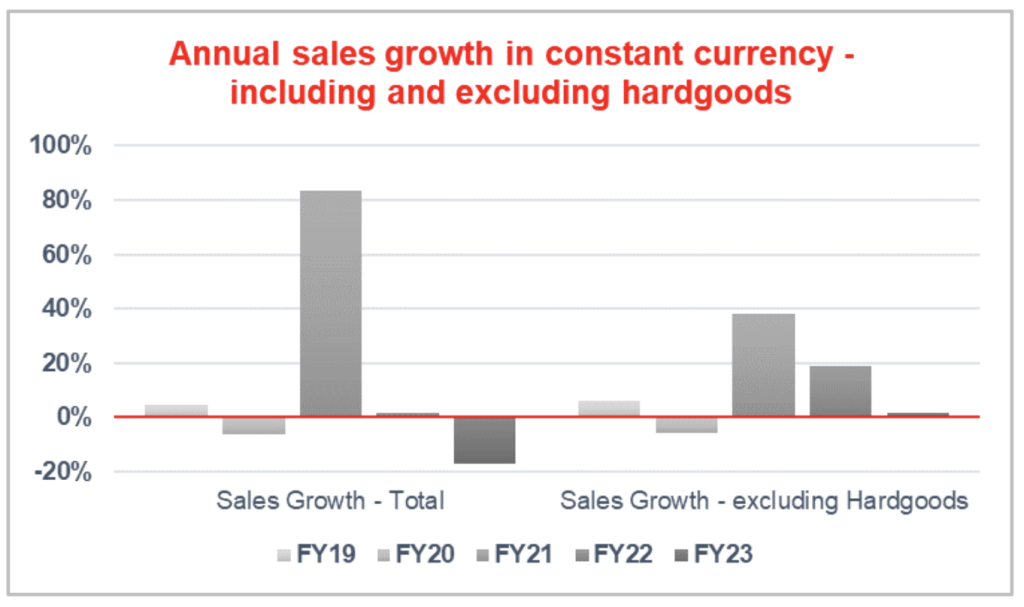

The company emphasized that the strength and stability of the Group’s apparel and footwear brands, including global brands FXD, Salty Crew and the newly acquired It’s Now Cool, continued to grow post-pandemic despite the challenging global economic environment. Globe illustrated the impact of the hardgoods issue in a graphic included in their annual report.

“Normally, we don’t adjust our results to exclude specific activities or costs because the results delivered are what drives the value for shareholders,” Hill explained in a letter to shareholders. “But given the significant impact of these items, which are unique to FY23, we felt it was important to highlight the underlying sales and profitability as a reference point for future periods. It can be seen that underlying margins are healthier in the go-forward business and that revenues and margins are higher than they were pre-pandemic. In short, the hardgoods boom drove exceptional profits and shareholder returns in FY21 and FY22, but the downturn negatively impacted profitability in FY23. If we strip away the impact caused by the hardgoods cycle, there is an underlying apparel business that has grown over the last four years. Now, as we emerge on the other side of the pandemic-related boom, we have a larger, more stable company than we did pre-pandemic, with global apparel brands of much larger scale, operating in diverse distribution channels around the world.”

The company also highlighted the margin and EBIT impact of exceptional clearance sales and related expenses, pointing out that gross margins lost 310 basis points due to these sales and EBIT margin fell 370 basis points due to the clearance sales.

EBIT for the fiscal year was $4.6 million, with H2 EBIT of $3.7 million and $0.9 million in H1. Underlying EBIT for the year was $12.5 million. As a result of changes made throughout the 2022 calendar year to address the collective issues that negatively impacted profitability, the company said gross profit margins were higher, and costs were lower in the second half of the year, resulting in an overall increase in profitability.

The fiscal year EBIT generated a return of 2.0 percent on net sales, compared to 10.0 percent in the prior year. The decline in profitability was said to be caused by the reduction in hardgoods sales, the strength of the U.S. dollar, excessive clearance activity, restructuring costs, and inflationary pressures on costs across the business.

On a regional basis, the Australian division continued to be the most stable and profitable of the three regions. Australian region revenues were down 6.9 percent YoY to A$112.4 million. EBIT for the region was down 39.5 percent YoY to A$16.7 million.

North America region revenues fell 17.4 percent YoY for the fiscal year to A$94.1 million. Region EBIT was $154,000, a 98.2 percent decline from the prior year. The U.S. was reportedly the most heavily impacted by the clearance of excess hardgoods inventories, which are non-recurring.

The European business fell 30.2 percent for the year to A$27.9 million and generated an EBIT loss of A$5.8 million for the financial year, compared to revenue of A$39.9 million and EBIT of A$1.7 million in the prior year. A combination of macro factors and internal management issues caused the loss. Extensive restructuring has occurred over the second half of the year, including replacing the management team, and performance is expected to improve in FY24 and beyond.

Cash generated from operations was $12.1 million for the year, helping to reduce the company’s reliance on banks for working capital funding by 77 percent, with just A$3.2 million in facilities utilized at year-end.

“With improving margins, right-sized inventories and a stabilization in sales from our strong apparel brands and with a low base of hardgoods sales, we are in a good position as we head into FY24 to see profitability improve,” the company said in its report.

In wrapping up the report, Hill said, “The last twelve months have been challenging, but I am proud of how fast our team has moved to rectify the situation. We have restructured where needed, cleared inventory as required, and made adjustments to both pricing and the cost base. Consequently, we enter FY24 with these restructuring efforts largely completed, and now look to improve profitability in FY24 with a stable base of revenue and strong margins from our apparel and footwear brands, and a right-sized hardgoods business.”

Hill said the company continues its evolution as a branded apparel, footwear and hardgoods company and has an excellent platform of key apparel and footwear brands in FXD, Salty Crew and It’s Now Cool to drive reliable future growth globally while maintaining its core heritage in hardgoods with the Impala and Globe brands.

“Of course, our business relies on consumer discretionary spending, so to the extent that inflation and interest rates impact the availability of discretionary spending over the next 12 months, the sales outlook is uncertain. Current retail feedback certainly suggests that the market is tough,” Hill remarked. “However, while it’s very early in the year, the positive trends we saw in the latter part of FY23 seem to have continued into the start of FY24, with sales in July stabilizing and profits higher than at the same time last year.”

Looking ahead, Hill said it was too early in the year to give any reliable sales outlooks, but as things stand today, he said the company expects profitability to improve based on a lower cost base and higher gross profit margins, compared to FY23, and for revenues to stabilize.

Photo, data and graphics courtesy Globe International, Ltd.