Gildan Activewear, the parent of Gold Toe, reported a loss $41.2 million, or 34 cents per

share, in the fourth quarter. The loss was attributed to strategic pricing actions in its Printwear segment, which the company announced on

Dec. 3, in order to reinforce its leadership position in the

industry.

The company provided sales and EPS guidance for its first calendar quarter of 2015, and announced a 2-for-1 stock split. The company further announced that it had reached an agreement with country singer, Blake Shelton, to promote the Gildan brand. Concurrent with this earnings release, the company issued a separate press release announcing a definitive agreement to acquire substantially all of the assets of Comfort Colors, a leading brand in the growing fashion basics segment of the Printwear market, for approximately $100 million.

Consolidated Results for the Three Months Ended January 4, 2015 (Fourth Calendar Quarter of 2014)

Gildan today reported a net loss of U.S. $41.2 million or U.S. $0.34 per share on a diluted basis for the three months ended January 4, 2015, compared with net earnings of U.S. $41.7 million or U.S. $0.34 per share for the three months ended December 29, 2013. Before reflecting restructuring and acquisition-related costs in both years, the company reported an adjusted net loss of U.S. $37.6 million or U.S. $0.31 per share for the three months ended January 4, 2015 compared with adjusted net earnings of U.S. $43.3 million or U.S. $0.35 per share for the three months ended December 29, 2013. The adjusted net loss for the quarter was in line with the company's previously projected net loss of approximately U.S. $0.30 per share.

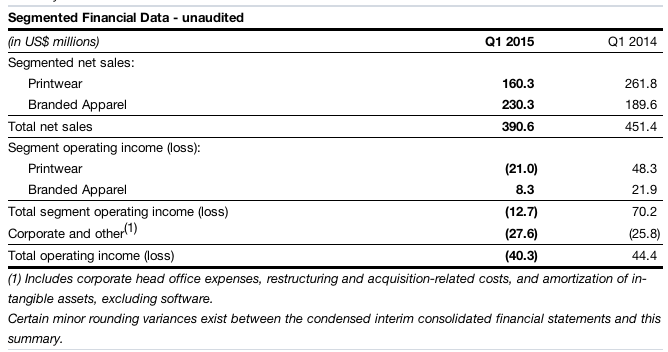

Consolidated net sales in the fourth calendar quarter of 2014 amounted to U.S. $390.6 million, down 13.5 percent from U.S. $451.4 million in the fourth calendar quarter of the prior year, due to lower Printwear sales partially offset by growth of over 20 percent in Branded Apparel sales. The company had projected net sales for the quarter of approximately U.S. $400 million.

The decline in the company's sales and earnings compared to last year was primarily due to the impact in the quarter of the strategic pricing actions in Printwear, which the company announced on December 3, 2014 in order to reinforce its leadership position in the industry. The company lowered base selling prices significantly and reduced and simplified its discount structure, in order to be responsive to distributors and enhance their ability and visibility to plan their business, and position the company to drive unit sales volume and earnings growth in calendar 2015 and beyond. The selling price reductions reflect the pass through of a portion of the cost savings from the company's capital investments in new yarn-spinning facilities and other capital investment projects, which are expected to be generated over the next three years. The price reductions also reflect the further reduction in the price of cotton futures that occurred in the latter half of calendar 2014, even though the company will not benefit from current low cotton futures until the second half of calendar 2015.

The company applied the benefit of the reduction in selling prices to existing distributor inventories, resulting in a distributor inventory devaluation charge of U.S. $47.5 million, which was reflected as a deduction from sales in the quarter.

Net sales for the Printwear segment amounted to U.S. $160.3 million, down from U.S. $261.8 million in the corresponding quarter of the prior year. The decrease in Printwear sales reflected lower net selling prices, including the impact of the distributor inventory devaluation discount of U.S. $47.5 million, and increased inventory destocking by U.S. distributors, which more than offset the approximate 15 percent increase in international printwear sales which was achieved in spite of the decline in the value of international currencies relative to the U.S. dollar.

The Printwear segment incurred an operating loss of U.S. $21.0 million in the quarter, compared with operating income of U.S. $48.3 million in the same quarter last year. The operating loss in Printwear was due to the lower unit sales volumes and negative margins for the quarter as a result of the distributor inventory devaluation charge and the timing of the reduction in net selling prices which was implemented in advance of manufacturing cost savings from the company's yarn-spinning investments and other capital projects, and while the company is still consuming high-cost cotton in cost of sales.

Net sales for Branded Apparel were U.S. $230.3 million, up 21.5 percent from U.S. $189.6 million in the same quarter of last year. The growth in sales for the Branded Apparel segment was primarily due to the acquisition of Doris, organic growth in Gildan® branded programs, particularly sales of branded underwear which increased by approximately 90 percent compared to the fourth calendar quarter of last year, and growth in licensed brands. These positive factors were partially offset by lower sales for Gold Toe® brands due to the timing of shipments and inventory destocking by certain retail customers. Excluding the impact of Doris, organic sales growth in Branded Apparel was approximately 8 percent, in spite of the decline in Gold Toe® sales.

Operating income in Branded Apparel was U.S. $8.3 million in the three months ended January 4, 2015, compared to operating income of U.S. $21.9 million in the corresponding quarter of the prior year due to lower operating margins, which more than offset the positive impact of the growth in sales revenues. The decline in operating margins in the quarter was primarily attributable to the consumption of high-cost opening inventories, which included the impact of transitional manufacturing costs relating to the integration of new retail products during 2014, and higher marketing and advertising expenses compared to the same period last year.

Outlook

Including the impact of Comfort Colors, the company is now projecting consolidated net sales for calendar 2015 to be slightly in excess of U.S. $2.65 billion, compared to the company's initial guidance of consolidated net sales of close to U.S. $2.65 billion provided on December 4, 2014. Printwear sales for calendar 2015 are projected to increase by approximately 5 percent compared to fiscal 2014 or approximately 12 percent compared to calendar 2014. Sales revenues for Branded Apparel are projected to increase by approximately 30 percent compared to fiscal 2014 or approximately 23 percent compared to calendar 2014. The company is maintaining its guidance for adjusted diluted EPS for the 12 months ending January 3, 2016 of U.S. $3.00 – U.S. $3.15. The company also reconfirmed its guidance for adjusted EBITDA of U.S. $525 – U.S. $545 million.

The company's updated sales and earnings guidance for the 12 months ending January 3, 2016 includes the impact of the acquisition of Comfort Colors, which the company announced today concurrent with this earnings press release. The in-year EPS accretion in the balance of calendar 2015 from the acquisition of Comfort Colors is projected to be approximately U.S. $0.05, after reflecting the amortization of intangible assets and a non-recurring acquisition-related inventory charge. The earnings impact of the acquisition of Comfort Colors is projected to be offset by the impact of the rapid decline in international currencies relative to the U.S. dollar. While the company is implementing price increases in international markets to offset weaker exchange rates, these price increases will essentially only take effect in the second calendar quarter of 2015.

As previously projected, results in the first half of calendar 2015 will continue to be negatively impacted by the misalignment between the timing of lower Printwear selling prices and the benefit of lower manufacturing and cotton costs. The company expects to resume its trajectory of EPS growth in the second half of the calendar year, when it begins to benefit from manufacturing cost savings from its yarn-spinning investments and other capital investment projects, and fully benefits from the decline in cotton costs. In addition, certain high-valued printwear products will be shipped later than previously projected due to the impact of the changes in the company's distributor incentive programs.

The company is projecting adjusted EPS of U.S. $0.46 – U.S. $0.48 for the March quarter, on projected sales revenues in excess of U.S. $630 million, compared with EPS of U.S. $0.64 on sales revenues of U.S. $549 million in the corresponding quarter of the prior year. The benefit of projected higher unit sales volumes in Printwear and higher Branded Apparel sales is projected to be more than offset by lower operating margins in both segments. The projected lower operating margins in Printwear are due to the impact of the significant decline in Printwear selling prices while the company continues to consume high-cost cotton, together with the decline in foreign currencies prior to the implementation of selling price increases in international markets. Operating income for Branded Apparel in the March quarter is projected to decline compared to the corresponding quarter of the prior year, as the positive impact of strong growth in sales revenues compared to last year is projected to be more than offset by lower operating margins due to the consumption of the balance of higher cost opening inventories as well as higher advertising and marketing expenses, which are projected to result in higher SG&A expenses compared to last year.

The company continues to feel confident in its outlook for positive earnings momentum in the second half of calendar 2015 and that it is well positioned for earnings growth in calendar 2016. The company expects to benefit in calendar 2016 from continuing volume growth and further significant manufacturing efficiencies, including the benefit of ramping up the company's new yarn-spinning facilities. In addition, the company currently expects that Printwear selling prices will continue to be in better alignment with cotton costs.

The company is continuing to achieve new branded Gildan® retail programs and obtain distribution in new retailers, as well as convert its retailer private label programs to Gildan® brand. In support of its focus on continuing to build the Gildan® brand equity, the company has reached an agreement with “CMA Entertainer of the Year,” GRAMMY® nominee and the reigning five-time CMA Awards® “Male Vocalist of the Year,” Blake Shelton, to promote the Gildan® brand. Mr. Shelton is also a coach of NBC's reality competition series, The Voice. Mr. Shelton's involvement in supporting and promoting the Gildan® brand is expected to further enhance and strengthen consumer brand awareness in support of Gildan®'s continued growth and strong momentum in the North American retail channel.

Cash Flow and Capital Expenditures

During the three months ended January 4, 2015, the company utilized U.S. $126.7 million of cash due mainly to the net loss for the quarter and capital expenditures of U.S. $97.3 million relating primarily to investments in new yarn-spinning facilities in the U.S., together with cost reduction projects and the expansion of the company's printwear distribution centre in Eden, N.C. The company ended the quarter with cash and cash equivalents of U.S. $85.1 million and outstanding bank indebtedness of U.S. $399.0 million.

The company continues to project capital expenditures for the 12 months ending January 3, 2016 of approximately U.S. $250 – U.S. $300 million relating to its continuing investments in yarn spinning and cost reduction projects, the Rio Nance VI and Costa Rica facilities, the expansion of sewing facilities to support growth in retail and the expansion of the Eden, N.C. distribution centre.

2-For-1 Stock Split to be Effected in Form of Share Dividend

On February 4, 2015, the Board of Directors approved a share dividend of one common share for each issued and outstanding common share of the company, which has the same effect as a two-for-one stock split of the company's outstanding common shares. The company's share dividend on the common shares will be paid on March 27, 2015 to shareholders of record at the close of business on March 20, 2015 and is designated as an “eligible dividend” for Canadian tax purposes.