Gildan Activewear reported first-quarter earnings slumped 29.3 percent despite a 15.9 percent gain in sales. The company also slightly narrowed its EPS guidance for the full year to reflect further foreign currency devaluation.

Consolidated Results for the Three Months Ended April 5, 2015 (First Calendar Quarter of 2015)

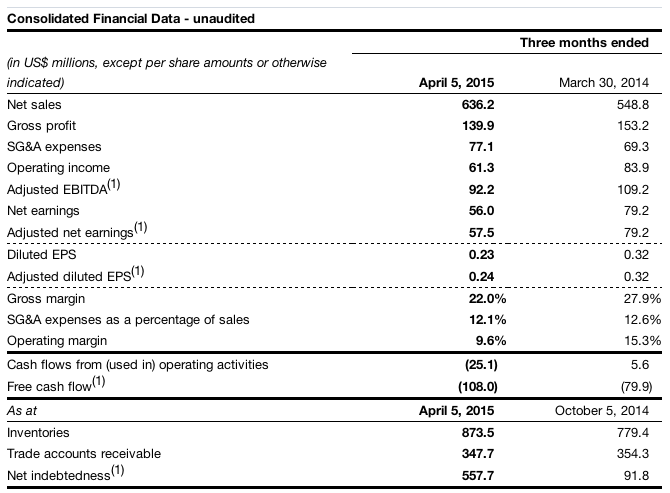

Gildan today reported net earnings of U.S. $56.0 million or U.S. $0.23 per share on a diluted basis for the three months ended April 5, 2015, compared with net earnings of U.S. $79.2 million or U.S. $0.32 per share in the corresponding quarter last year. Before reflecting minor restructuring and acquisition-related costs, Gildan reported adjusted net earnings of U.S. $57.5 million or U.S. $0.24 per share for the three months ended April 5, 2015, compared with adjusted net earnings of U.S. $79.2 million or U.S. $0.32 per share for the same period last year. Adjusted EPS for the quarter were as projected in the company's guidance of adjusted EPS of U.S. $0.23 – U.S. $0.24 on a post-split basis, provided on February 4, 2015.

Consolidated net sales in the first calendar quarter of 2015 amounted to U.S. $636.2 million, up 15.9 percent from U.S. $548.8 million in the corresponding quarter of the prior year, reflecting an increase of approximately 14 percent in Printwear sales and sales growth of approximately 20 percent in Branded Apparel. Consolidated net sales in the quarter were in line with the company's guidance of net sales in excess of U.S. $630 million.

The EPS impact of higher sales revenues was more than offset by lower gross margins in both operating segments, as further explained below under “Segmented operating results”, together with increased SG&A and financing expenses, partially offset by lower income taxes.

During the three months ended April 5, 2015, the company utilized U.S. $108 million of cash to finance capital expenditures of U.S. $83.6 million and seasonal working capital requirements. Capital investments were primarily for new yarn-spinning facilities in the U.S., cost reduction projects and the expansion of the company's printwear distribution centre in Eden, N.C. The company ended the quarter with cash and cash equivalents of U.S. $60.3 million and outstanding bank indebtedness of U.S. $618.0 million, including approximately U.S. $104 million to finance the acquisition of Comfort Colors.

Segmented operating results

Net sales for the Printwear segment for the quarter amounted to U.S. $431.3 million, up U.S. $52.8 million or 13.9 percent from U.S. $378.5 million in the corresponding quarter of the prior year. The increase in Printwear segment sales in the quarter was due to strong unit sales volume growth in U.S. and international printwear markets and more favourable product-mix. These factors were partially offset by lower net selling prices, due to the strategic pricing actions taken by the company on December 4, 2014, and the negative effect of the decline in international currencies relative to the U.S. dollar.

Printwear sales reflected good growth in sales of high-valued activewear products, partially due to seasonally colder weather. In addition, the company is achieving success in its strategy to increase its presence in the fashion basics segment of the U.S. printwear channel, including the repositioning of the Anvil® brand and the addition of the Comfort Colors® brand. Printwear sales included approximately one month of sales for Comfort Colors, which was acquired on March 2, 2015. The increase in unit sales volumes in the U.S. printwear market in the quarter also included the impact of anticipated inventory replenishment by U.S. distributors. At the end of the quarter, inventory levels for the Gildan® brand in the U.S. distributor channel were at the same level as the prior year. International printwear sales were up 25 percent due to continuing penetration in Europe and Asia and the company's recent entry into new markets in Latin America.

Operating income in Printwear for the three months ended April 5, 2015 totalled U.S. $84.0 million, down from U.S. $92.2 million in the same period last year. Operating margins for Printwear were 19.5 percent compared with 24.4 percent in the corresponding quarter of last year. The decline was mainly due to the timing of printwear selling price reductions, which were implemented in advance of anticipated manufacturing cost savings from the company's yarn-spinning investments and other capital projects, and while the company was still consuming higher-cost cotton in inventories. In addition, operating margins in the quarter were negatively impacted by the continued decline in international currencies relative to the U.S. dollar.

Net sales for Branded Apparel were U.S. $204.9 million, up 20.3 percent from U.S. $170.3 million in the same quarter of last year. The increase in Branded Apparel sales was due to organic sales growth of Gildan® and Gold Toe® branded programs, as well as licensed and global lifestyle brands and the acquisition of Doris, partially offset by lower sales of private label and retailer inventory destocking. Sales of Gildan® branded products increased by approximately 20 percent. During the three-month period ended March 31, 2015, the Gildan® brand remained in the no. 3 position in men's underwear and achieved a market share of 7.3 percent, according to the NPD Group's Retail Tracking Service. Sales of Gold Toe® branded products also increased by approximately 12 percent. Sales of Gildan® and Gold Toe® branded products included strong growth in activewear.

Operating income in Branded Apparel was U.S. $2.2 million in the three months ended April 5, 2015, compared to operating income of U.S. $13.3 million in the corresponding quarter of the prior year. The low operating margins in the quarter were primarily attributable to the consumption of high-cost opening inventories, which included the impact of transitional manufacturing costs relating to the integration of new retail products during 2014 and higher cotton costs.

Outlook

The company narrowed its guidance range for adjusted diluted EPS for the 12 months ending January 3, 2016 to U.S. $1.50 – U.S. $1.55 compared with its initial guidance of U.S. $1.50 – U.S. $1.57, to reflect the impact of the further devaluation of international currencies relative to the U.S. dollar. The company continues to project consolidated net sales slightly in excess of U.S. $2.65 billion. Sales growth in Printwear is projected to be approximately 12 percent compared to calendar 2014, including the impact of the acquisition of Comfort Colors, and sales growth in Branded Apparel is projected to be in excess of 20 percent. Adjusted EBITDA is now projected to be U.S. $525 – U.S. $540 million for the 12 months ending January 3, 2016.

The company is projecting adjusted EPS of U.S. $0.43 – U.S. $0.45 for the June quarter, on projected sales revenues of approximately U.S. 750 million, compared with adjusted EPS of U.S. $0.47 on sales revenues of U.S. $693.8 million in the corresponding quarter of the prior year. The June quarter will include fewer shipping days than the prior year, which included the impact of an extra week to realign the 52-week fiscal year with the calendar year. As previously projected, results in the first half of calendar 2015 will continue to be negatively impacted by the misalignment between the timing of lower Printwear selling prices and the benefit of lower manufacturing and cotton costs. Operating margins in Printwear are also projected to be negatively impacted by the further weakening of international currencies relative to the U.S. dollar. Branded Apparel segment sales growth is projected to continue to be strong in the second quarter of calendar 2015 and operating margins in Branded Apparel are projected to improve compared to the second quarter of the prior year in spite of higher brand marketing and advertising expenses. The company expects to resume its trajectory of EPS growth in the second half of the calendar year, when it begins to benefit from manufacturing cost savings from its yarn-spinning investments and other capital investment projects, and fully benefits from the decline in the cost of cotton.

The company is continuing to achieve new Gildan® and Gold Toe® branded retail programs and is also making significant progress in converting its remaining private label programs to the Gildan® brand. The company expects that retailer private label will comprise less than 10 percent of its sales to retailers by the end of the calendar year. The company has also obtained underwear programs with new retailers, as well as new programs for the Secret Silky®, Kushyfoot®, Soleution® and Gildan® brands which leverage the Doris acquisition in the U.S. market.

The company continues to believe that it is well positioned for earnings growth in calendar 2016. The company expects to benefit in calendar 2016 from continuing volume growth and further manufacturing cost reductions, including the benefit of ramping up the company's new yarn-spinning facilities combined with lower cotton costs.

Capital expenditures for the 12 months ending January 3, 2016 are still projected to be approximately U.S. $250 – U.S. $300 million relating to the company's continuing investments in yarn spinning and cost reduction projects, textile capacity expansion, the expansion of sewing facilities to support growth in retail and the expansion of the Eden, N.C. distribution centre. The company believes that it continues to be on track to achieve its projected 3-year target of U.S. $100 million in annual cost savings from its major capital investment projects.