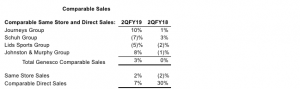

Genesco Inc. reported a surprise profit in the second quarter as the company showed the company’s first overall positive store comp in eight quarters. The comp gains were led by Journeys Group, up 10 percent and Johnston & Murphy, 8 percent. Lids’ comps were down 5 percent but improved sequentially versus the first quarter.

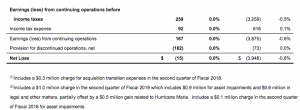

GAAP earnings from continuing operations reached $67,000, or 1 cent a share, for the three months ended August 4, 2018, compared to a loss of $3.9 million, or 20 cents, last year.

Excluding non-recurring items, adjusted earnings came to $810,000, or 4 cents a share, against a loss of $2.0 million, or 10 cents, a year ago. Wall Street had expected a loss of 3 cents on average.

Revenues grew 6.0 percent to $654 million ahead of Wall Street’s consensus target of $641.1 million

Robert J. Dennis, chairman, president and chief executive officer, said: “Our second quarter performance was highlighted by our strongest quarterly comparable sales increase in more than two years. Sales trends at Journeys and Johnston & Murphy accelerated compared with solid first quarter results driven by positive store comps at both businesses, leading to our first overall positive store comp in eight quarters. This positive store comp allowed us to leverage expenses, which along with the move of an important back-to-school sales week into the second quarter due to the calendar shift, led to a significant improvement in overall profitability versus the prior year period. Comparable sales at the Lids Sports Group remained negative, although trends once again improved on a sequential basis. Similarly, Schuh’s comp result was meaningfully better versus the first quarter; however, it was still negative as several factors in the U.K. combined to create a challenging selling environment during the second quarter.

“The third quarter so far has seen an acceleration in comparable sales over the second quarter driven by the continued strength of our U.S. footwear businesses during the heart of the important back-to-school season. We are encouraged by the momentum at Journeys and Johnston & Murphy but remain cautious in our outlook for Lids and Schuh over the remainder of the fiscal year due to the lack of visibility into improving trends. Longer-term, we continue to believe that the work we are doing to transform our operating model in response to changing consumer behavior, and the evolving retail environment will lead to enhanced profitability and greater shareholder value.”

Second Quarter Review

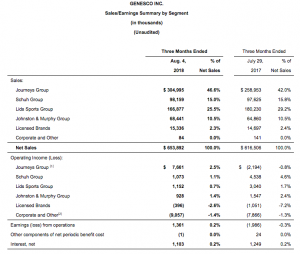

Net sales for the second quarter of Fiscal 2019 increased 6 percent to $654 million from $617 million in the second quarter of Fiscal 2018. Comparable sales increased 3 percent, with stores up 2 percent and direct up 7 percent. Direct-to-consumer sales were 10 percent of total retail sales for the quarter, up a little over last year.

Second quarter gross margin this year was 49.2 percent compared with 49.7 percent last year. The 50 basis point decrease reflects primarily increased markdowns to clear slower-moving product at Schuh and Johnston & Murphy’s wholesale operations, as well as at Journeys due in part to the shift in the calendar, partially offset by better full price selling in the company’s other business segments.

Selling and administrative expense for the second quarter this year was 48.8 percent, down 120 basis points, compared to 50.0 percent of sales for the same period last year. The decrease as a percentage of sales reflects the leveraging of rents, selling salaries and several other expense categories on higher sales, partially offset by higher bonus accruals.

Genesco’s GAAP operating income for the second quarter was $1.4 million this year compared with an operating loss of $2.0 million last year. Adjusted for the excluded Items in both periods, operating income for the second quarter was $2.4 million this year compared with an operating loss of $1.6 million last year. Adjusted operating margin was 0.4 percent of sales in the second quarter of Fiscal 2019 and (0.3) percent last year.

The effective tax rate for the quarter was 35.5 percent in Fiscal 2019 compared to -18.9 percent last year. The adjusted tax rate, reflecting Excluded Items, was 37.6 percent in Fiscal 2019 compared to 31.9 percent last year. The higher adjusted tax rate for this year reflects the inability to recognize a tax benefit for certain overseas losses, partially offset by the lower U.S. federal income tax rate following the passage of the Tax Cut and Jobs Act in December 2017.

GAAP earnings from continuing operations were $0.2 million in the second quarter of Fiscal 2019, compared to a loss of $3.9 million in the second quarter last year. Adjusted for the excluded Items in both periods, second quarter earnings from continuing operations were $0.8 million in Fiscal 2019, compared with a loss of $2.0 million last year.

Cash, Borrowings and Inventory

Cash and cash equivalents at August 4, 2018 were $49.8 million, compared with $43.5 million at July 29, 2017. Total debt at the end of the second quarter of Fiscal 2019 was $83.3 million compared with $190.9 million at the end of last year’s second quarter, a decrease of 56 percent. Inventories decreased 9 percent in the second quarter of Fiscal 2019 on a year-over-year basis.

Capital Expenditures and Store Activity

For the second quarter, capital expenditures were $12 million, which consisted of $7 million related to store remodels and new stores and $5 million related to direct to consumer, omnichannel, information technology, distribution center and other projects. Depreciation and amortization was $19 million. During the quarter, the company opened eight new stores and closed 31 stores. Excluding Locker Room by Lids in Macy’s stores, the company ended the quarter with 2,540 stores compared with 2,621 stores at the end of the second quarter last year, or a decrease of 3 percent. Square footage was down 2 percent on a year-over-year basis, both including and excluding Lids Locker Room departments in Macy’s stores.

Fiscal 2019 Outlook

For Fiscal 2019, the company is reiterating its previously announced full-year guidance and expects:

- Comparable sales to be up 1 percent to 3 percent and

- Adjusted diluted earnings per share in the range of $3.05 to $3.45.2