Genesco Inc. said last week that based on quarter-to-date results and current trends, its adjusted EPS for the fiscal year are expected to come in at the lower end of a range provided on Dec. 6.

At the time, Genesco said it expected earnings to range between $5.10 to $5.20 a share.

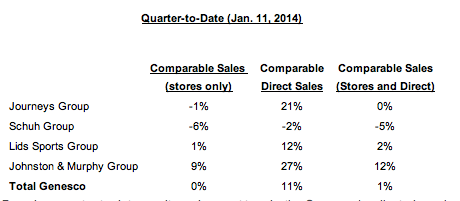

Comparable sales, including both stores and direct sales, increased 1 percent for the quarter-to-date period ended Jan. 11. Direct comps were up 11 percent with store comps flat.

Speaking at ICR Xchange, Robert Dennis, president and CEO, Genesco, said across its concepts, store traffic was generally light while e-commerce was robust. Said Dennis, “This holiday seemed to be almost a tipping point for a shift into e-commerce, because the dollars of e-commerce now are pretty big in our case for the fourth quarter, it represented roughly 9 percent of our retail sales.”

At Journeys Group, comps were flat in the period with store comps declining 1 percent and direct ahead 21 percent. Dennis said Journeys casual segment, which includes boots, “grew nicely and on the athletic side, the fashion athletic side of our shop, we were somewhat more challenged.”

Inventories came in slightly above plan but most seasonal product “moved very well” to largely avoid any inventory hangover.

At Lids Sports Group, comps were up 2 percent with store comps ahead 1 percent and direct ahead 12 percent. Dennis said headwear “improved significantly” for Lids with the snapback business, which has been challenging, having a solid holiday period. Said Dennis, “We have the assortment right sized. We were in the right product. We didn't see as much pop-up competition in the mall as we had last year, so all in all, the hat business worked out quite nicely for us.”

Combined comps of the broader Lids Locker Room concept and Clubhouse, which focuses on one team at stadium kiosks, were up 6 percent during the holiday. Dennis said Lids Locker Room particularly “did very well with the NFL,” and both concepts have strong expansion potential with the goal of building a national footprint. The Clubhouse business continues to explore partnerships with MLB, NFL and colleges.

Lids partnership with Macy’s has led to 26 fan in-store shops inside Macy’s. She said Macy’s “learned the obvious, which is win/loss records make a big difference,” but is benefiting this year from having shops set up in Seattle and Denver.

Lids’ e-commerce business is being particularly boosted by a broadening of assortments far beyond just caps.

At Schuh Group, comps were down 5 percent with 2 percent decline in direct and 6 percent drop at stores. The U.K. juniors footwear chain faced tough comparisons as well as a challenging U.K. holiday selling environment. Johnston & Murphy Group saw a 1 percent comp gain with flat comps and an 11 percent gain in direct.

With its two core businesses, Journeys and Lids, in basically every mall location, growth vehicles continue to be Lids Locker Room, Schuh and Journeys Kidz, which saw a 2 percent comp increase during the quarter period through Jan. 11. But a particular focus across concepts will be on expanding e-commerce.

“We believe that the lower end of the mall universe is going to be threatened by the traffic patterns that we see,” said Dennis. “We keep our lease life short for that set of malls with the expectation that over time there will be some displacement of real estate into the e-commerce channel and that's the way we are thinking about our capital.”

Updating its long-term guidance, its five-year plan now contemplates 9 percent annual sales growth, in line with its history, to reach $3.9 billion in fiscal 2018. Operating margins are expected to climb from 7.5 percent to at least 9 percent over the 5-year period.