Genesco Inc. reported a sharp increase in third quarter earnings as the Lids headwear chain benefited from strength in MLB and action sports brands, Journeys capitalized from new casual trends, and the overall bottom-line benefited from expense leverage. With comps ahead 11% through the first three weeks of November, Genesco raised its guidance for the year.

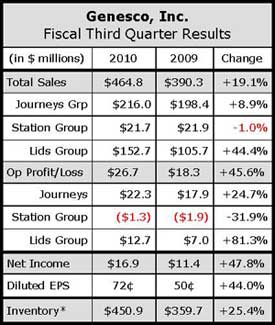

Fiscal third quarter earnings climbed 47.8% to $16.9 million, or 72 cents per diluted share. Excluding charges related to fixed asset impairments in both periods, earnings grew 47.2% to $18.1 million, or 77 cents per diluted share, with results easily exceeding Wall Street's consensus estimate of 59 cents. Total net sales jumped 19.1% to $464.8 million with comps ahead 9% for the period. Excluding the acquisition of five companies Sports Fan-Attic, Sports Avenue, Great Plains Sports, Brand Athletics and Anaconda Sports – over the last twelve months, sales improved 12% for the quarter.

“The strong trends we witnessed at the start of back-to-school continued through September and October and, as a result, our third-quarter performance was better than we expected,” said company Chairman, President and CEO Bob Dennis, on a conference call with analysts.

At the Journeys Group segment, revenues climbed 8.9% to $216.0 million as comps grew 9%. Operating profits increased 24.6% to $22.3 million; operating margins improved 130 basis points to 10.3% of sales. The comp gain was driven by an ongoing shift away from athletic towards casual. Dennis said casuals were especially strong, but the overall athletic business was “up nicely” in the quarter. Skate was said to be “especially strong.” He also believes the skate performance is partly due to less competition as many independent skate shops continue to struggle. After a slow start in a warm October, boot sales accelerated in November, helping drive an overall November comp increase of 15% in the Journeys Group through Nov. 20.

Dennis said they were “very optimistic” about Journeys' fourth quarter prospects based on current trends.

Journeys Kidz' comps were up 9% in Q3 and were running up 17% through Nov. 20. Shi by Journeys' comps gained 5% and were ahead 17% so far in November. Journeys entry into Canada is reportedly surpassing initial projections.

At the Lids Sports Group segment, sales jumped 44.4% to $152.7 million, driven by a 13% comp increase, 14 new stores and several acquisitions, including the 48 Sports Avenue stores acquired in the quarter. Excluding acquisitions, sales grew 20% for the quarter. Operating earnings surged 81.4% to $12.7 million, reflecting a 170 basis point improvement in operating margin due to expense leverage.

MLB merchandise performed “better than expected” in Q3 at the core Lids headwear stores with excitement over the playoffs, according to Dennis. But the World Series matchup was estimated to have dragged down November comps by about 5% to 6%. Comps were up 4% in November through Nov. 20. For the overall fourth quarter last year the World Series had a favorable impact on comps of about 2% to 3% related to the Yankees’ victory.

Action sports brands was “also a standout” for the Lids headwear chain in the quarter. The NFL “got off to a good start” with new sideline and fashion product generating early demand and competitive parity within the league helping sustain the performance thus far in the fourth quarter.

Dennis indicated that past comments on Lids Sports Group's plans to become the largest player in both the licensed sports merchandise category and team dealer market through its four businesses – Lids headwear stores, Lids Locker Room and clubhouse stores, Lids Team Sports and Lids.com received an “overwhelmingly positive” reception from the investment community. At the same time, however, the CEO noted that he also heard from some that due to a lack of publicly traded or sizable competitors, analysts are finding it challenging to model. As such, Dennis last week broke out Lids Sports Groups by channel: retail, team dealers and Internet.

Retail, by far the largest channel, consists of 970 stores: 885 Lids headwear stores, 59 Lids Locker Room stores and 32 clubhouse stores. Genesco sees the potential to add at least another 200 headwear stores while expanding its embroidery program beyond its current penetration of about 500 stores.

The Locker Room stores primarily mall-based locations averaging about 3,000 square feet is “pretty fragmented” other than a few regional chains. Through acquisitions and new stores, Genesco sees a long-term opportunity to grow Lids Locker Room to at least 500 locations.

Clubhouse stores, which came as part of the Sports Avenue acquisition, are team specific stores selling similar merchandise as Lids Locker Room, but focused on a single team. Current partnerships include the Yankees, Chicago Cubs and St. Louis Cardinals, as well as universities such as Auburn, Kansas and Kentucky.

The average 2,500 sf store is located in downtown areas near college campuses and stadiums, but there's also opportunities for mall-based stores and kiosks and booths around stadiums on game days. Genesco estimates the number of potential license relationships under the Clubhouse model is roughly 250.

Regarding the team dealer channel, the acquisitions of Brand Innovators and Anaconda Sports earlier this year have given Genesco a sales presence in 43 states. GCO estimates the annual sales run rate for the Team Sports business is around $100 million.

Regarding the Internet, Lids.com, focused primarily on headwear was the retailer’s only website until the current year. Sports Avenue added 12 team and sports-related websites and Lids is just exploring cross-selling opportunities across its web banners.

The combination of Lids.com and its newly acquired websites is expected to have an annual sales run rate of approximately $28 million.

Underground Station Group's sales in the quarter dipped 1.0% to $21.7 million with comps ahead 3% while its operating loss was cut to $1.3 million from $1.9 million. At Johnston & Murphy Group, sales advanced 12.4% to $45.4 million on a 9% comp gain while operating income improved to $1.8 million from $1.66 million.

The 20 basis point overall gross margin dip was due primarily to the recent acquisitions of two team dealers companies as wholesale businesses typically carry lower margins. Genesco's retail businesses in aggregate saw improved gross margin.

Adjusting for acquisitions, sales increased 12% and inventories increased 16%.

Genesco increased guidance for 2010 from the previous range of $2.10 to $2.20, to $2.38 to $2.43 – a 27% to 30% increase over 2009's adjusted earnings per share of $1.87. For 2011, EPS growth is projected to advance 12% to 15% with comps ahead in the low single-digits.