Garmin Ltd. reported sales fell 9 percent and earnings were also down in the second quarter ended June 27 but results came in well above Wall Street’s targets. Revenues jumped 17 percent in the Fitness segment and increased 4 percent in the Marine segment while sliding only 4 percent in the Outdoor segment.

Highlights for the second quarter 2020 include:

- Total revenue of $870 million, a 9 percent year-over-year decrease, as strength in fitness and marine partially offset declines in outdoor, aviation and automotive. Analysts on average were expecting sales of 658.78 million.

- Gross margin and operating margin were 59.3 percent against 60.3 percent and 21.7 percent against 26.8 percent, respectively

- GAAP EPS was 96 cents a share ($1.17) and pro forma EPS was 91 cents ($1.16). Wall Street was expecting earnings of 91 cents a share.

- Recently announced the acquisition of Firstbeat Analytics, a provider of physiological analytics technology for health, fitness and athletic performance

- Introduced solar charging technology into its Instinct product line increasing its battery life and added solar charging technology to additional fēnix 6 models

- Garmin Autoland achieved Federal Aviation Administration (FAA) certification for general aviation aircraft in the Piper M600, marking the beginning of a new era in general aviation safety technology

- Expanded its exclusive relationship with Regulator Marine, adding Fusion Entertainment as standard equipment

- Launched new series of oversized dēzl truck navigators (in thousands, except per share data)

“Garmin delivered strong second-quarter financial results in a period filled with unprecedented challenges,” said Cliff Pemble, president and chief executive officer of Garmin Ltd. “Business conditions rapidly improved from April lows driven by popular fitness, marine, and outdoor products. Garmin said it believes these results affirm the resilient nature of our business and the strong utility of our products.”

Fitness

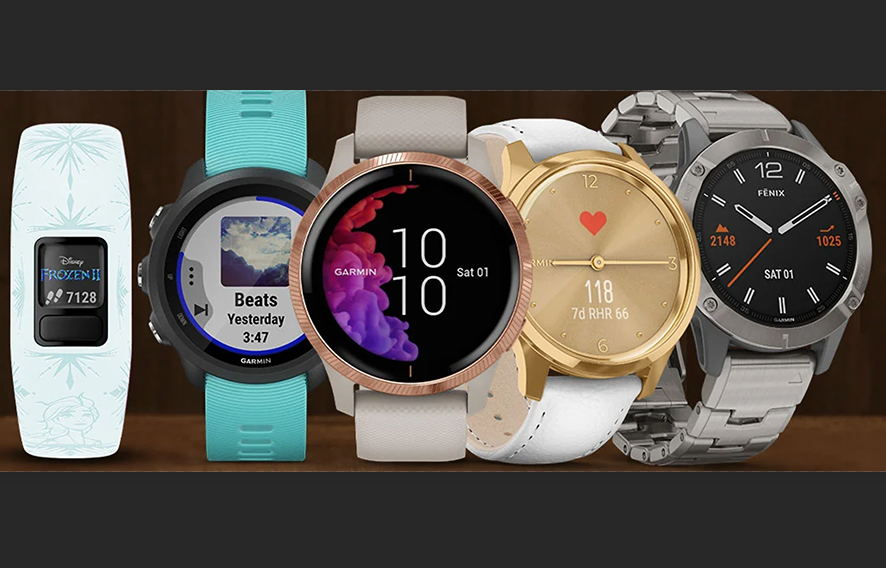

Revenue from the fitness segment grew 17 percent in the second quarter driven by strong demand for its advanced wearables and cycling products. Gross margin and operating margins were 53 percent and 24 percent, respectively. Garmin launched new Edge cycling products that add performance insights, safety and tracking features to monitor health stats and provide training guidance to its cycling customers. Garmin recently acquired Firstbeat Analytics, establishing Garmin as a global leader in physiological analytics. Garmin continued to see opportunities for innovative new products within the fitness segment.

Marine

Revenue from the marine segment grew 4 percent in the second quarter across multiple categories led by chartplotters and Panoptix sonar technology. Gross margin and operating margins were 59 percent and 28 percent, respectively. Regulator Marine expanded its exclusive relationship with Garmin, selecting the Fusion Apollo series stereos as standard equipment on its offshore sportfishing center console boats. Also, Garmin launched quatix solar, its first marine smartwatch featuring solar charging technology.

Outdoor

Revenue from the outdoor segment decreased 2 percent in the second quarter as declines in handhelds were mostly offset by strong demand for adventure watches. Gross margin and operating margins were 65 percent and 33 percent, respectively. Garmin recently expanded its solar charging technology to the Instinct, fēnix 6 and 6S and tactic Delta adventure watch allowing customers to “Do What They Love Longer” through increased battery life and functionality.

Aviation

Revenue from the aviation segment declined 31 percent in the second quarter as COVID-19 negatively impacted OEM and aftermarket product categories, and the ADS-B market rapidly matured. Gross margin and operating margins were 73 percent and 12 percent, respectively. During the quarter, Garmin received FAA certification for the Garmin Autoland system in the Piper M600 marking the beginning of a new era for general aviation safety technology. Garmin continued to invest in additional certifications and new products that will make general aviation safer and more accessible.

Auto

Revenue from the auto segment declined 46 percent during the second quarter, as COVID-19 significantly impacted driving activity and production of new vehicles. Gross margin was 47 percent, and Garmin experienced an operating loss of $10 million in the quarter. During the quarter, it launched the oversized dēzl GPS truck navigators featuring large, easy-to-read HD touchscreens, load-to-dock guidance and truck routing for professional truck drivers. Garmin also launched the RV 890 navigator geared for the RV and camping lifestyle with a large high-resolution touchscreen display and revamped voice assistant to simplify the overall interaction with the navigator.

Additional Financial Information

Total operating expenses in the second quarter were $327 million, a 2 percent increase over the prior year. Research and development increased by 11 percent, primarily due to engineering personnel costs. Selling, general and administrative expenses increased 3 percent, driven primarily by personnel-related expenses. Advertising decreased 29 percent, driven by lower media spend in the quarter.

The effective tax rate in the second quarter of 2020 was 6.8 percent. Excluding the impact of a $14 million income tax benefit due to the release of uncertain tax position reserves associated with the 2014 intercompany restructuring, its pro forma effective tax rate in the second quarter 2020 was 14.0 percent compared to 18.9 percent in the prior-year quarter. The decrease in the pro forma effective tax rate is primarily due to the intellectual property migration transaction.

In the second quarter of 2020, Garmin generated approximately $142 million of free cash flow and paid a quarterly dividend of approximately $109 million. Garmin ended the quarter with cash and marketable securities of approximately $2.7 billion.

Photo courtesy Garmin