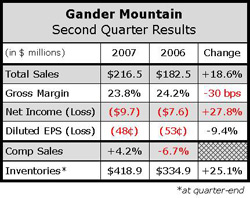

Gander Mountain saw strong top line growth in  overall terms and on a comp store basis, but contracting margins caused the retailers net loss for the second quarter to expand considerably. By region, GMTN saw strong sales in its southern and eastern stores and is still targeting aggressive expansion in these two regions. Total square footage year-over-year increased 12% to 5.7 million square feet. There were three new stores added for the quarter. The opening in St. Augustine, Tex. was the companys largest spring opening ever. Ganders comp store base at the end of the quarter was 94 stores.

overall terms and on a comp store basis, but contracting margins caused the retailers net loss for the second quarter to expand considerably. By region, GMTN saw strong sales in its southern and eastern stores and is still targeting aggressive expansion in these two regions. Total square footage year-over-year increased 12% to 5.7 million square feet. There were three new stores added for the quarter. The opening in St. Augustine, Tex. was the companys largest spring opening ever. Ganders comp store base at the end of the quarter was 94 stores.

By category, Gander saw strong sales in firearms, archery, fishing, marine products and accessories. Private label penetration increased to 10.8% compared to 10.0% last year and 9% in Q2 of 2005. Management highlighted the fishing category as a growth sector due to the addition of higher end rod/reel combo sales. Firearms were also highlighted, thanks to Wal-Mart exiting the category in over 1,000 of its stores. Part of the gross margin contraction was due to GMTN entering into the marine powersports category, which carries a margin in the mid teens. The other aspect involved missteps in apparel.

The highest profile summer merchandising initiative at Gander Mountain was the rollout of an expanded boat and motor presentation at 34 stores during the quarter with Tracker Marine, Crestliner, Mercury and Yamaha boats. This initiative was described as the largest new product launch in the companys history. In camping, the general camping and outdoor cooking categories were positive against a soft overall category performance for the quarter.

The apparel business, one of Ganders highest margin categories, was soft in the quarter which led to lower gross margin performance. Gander has hired Rick Rusch to take over the apparel department and improve sales in the category. He currently has a three tiered plan. First, GMTN will implement a more consistent approach to its assortment by identifying core products and merchandising them year-round rather than in two very large deliveries. Second, the company will approach seasonal items on a five season basis to keep stores supplied with fresh product. Third, GMTN will be implementing “increased disciplines” around the management of clearance activity.

Earlier in the quarter, Gander won a decision concerning its direct marketing trademarks (See SEW_0729) and now intends to re-enter the direct marketing business. Management said that it will take “several quarters” to develop this business and plans include spending $600,000 to $1 million to get the business rolling. Management said that a site could launch as early as Q4 of this year or Q1 next year, but an exact launch date will be announced sometime this fall. Current plans call for a presence of several thousand SKUs with seasonally relevant categories. Gander will handle fulfillment initially through a converted store in Minnesota. It should also be noted that Cabelas, the other party in the lawsuit, plans to appeal the decision.

As a percent of sales, store operating expenses increased from 20.0% in the second quarter to 20.2% in the comparable quarter this year. As a percent of sales, G&A increased 14 basis points to 5.4%. Both expense items were primarily due to the company's new incentive compensation program. The higher expenses and lower margins added up to an increased net loss for the quarter. An additional 6 million outstanding shares kept the diluted loss per share down for the quarter. Management provided no guidance for Q3 of the full year.