G-III Apparel Group, Ltd. (GIII) share fell 19 percent on Friday, June 6 after the apparel giant withdrew its earnings guidance for the year due to “uncertainty around tariffs and related macroeconomic conditions.” G-III’s first quarter results still exceeded targets, led by double-digit growth at DKNY, Karl Lagerfeld and Donna Karan. The company also indicated on a Friday conference call with analysts that its new Converse range starts shipping in August.

“We delivered solid first quarter results with earnings outperformance that exceeded the high end of our guidance,” said Morris Goldfarb, G-III’s chairman and CEO, on the call. “Our first quarter results were driven by double-digit growth of our key owned brands, DKNY, Karl Lagerfeld and Donna Karan, mostly offsetting the lost sales of the exited Calvin Klein jeans and sportswear license business.”

PVH, the parent of Calvin Klein and Tommy Hilfiger, said in early 2023 that it would unwind its licensing arrangements with G-III for Calvin Klein and Tommy Hilfiger women’s wholesale apparel in the U.S. by 2027.

Net sales for the first quarter ended April 30 decreased 4.3 percent to $583.6 million. Sales topped guidance that called for sales of approximately $580.0 million.

Net income was $7.8 million, or 17 cents per share, compared to $5.8 million, or 12 cents per diluted share, in the prior year’s quarter.

Non-GAAP net income per diluted share was 19 cents compared to 12 cents in the same period last year. Earnings topped guidance calling for earnings in the range of 5 cents to 15 cents. Non-GAAP net income in the latest quarter excludes $1.0 million, or 2 cents a share, in one-time severance expenses related to a closed warehouse.

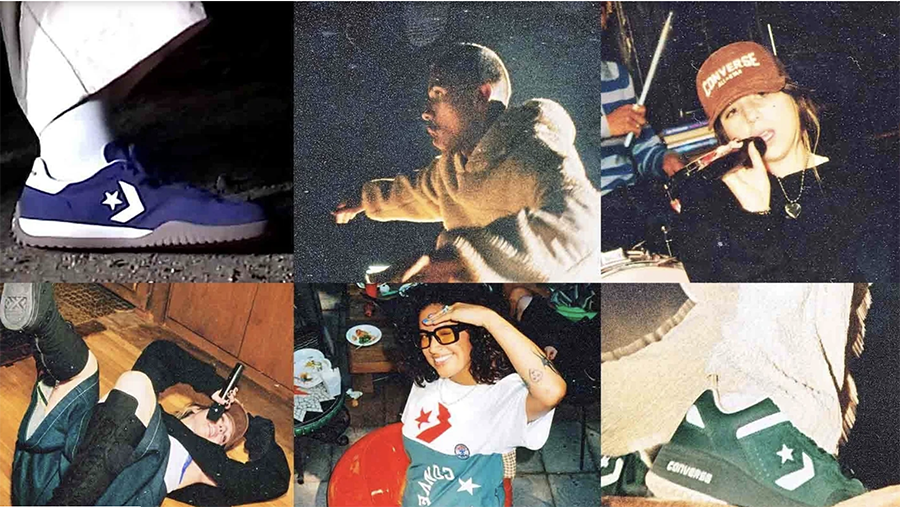

Converse Launch

Among other brands, Goldfarb said G-III remains on track to launch a Converse activewear and lifestyle range this fall. The company secured the license last fall.

The license agreement with Nike, Inc. subsidiary Converse, Inc. is for the design and production of men’s and women’s apparel for distribution globally.

“This new partnership represents a significant opportunity to expand our active lifestyle category while leveraging our core capabilities to build a global apparel business,” Goldfarb said after the deal was first inked in September 2024.

“Our Converse fall order book for North America and Western Europe is building nicely with first orders set to ship in August,” said Goldfarb. “Converse provides access to a differentiated consumer and distribution network where our fashion brands have little or no presence. This includes big box, sports specialty and sporting goods stores as well as Western Europe and through the brand’s global distribution network, including the over 1,000 Converse stores that G-III can potentially service.”

Asked on the call about taking proce increases as part of the company’s plan to recover part of the tariff hit, Goldfarb said the launch of Converse will offer an opportunity to take price as there is no competition in the market and nothing in the pipeline, or work with existing factories to sharpen prices for the new product launch.

“There’s virtually no apparel – or adult apparel – in the pipeline or in the past for Converse,” Goldfarb noted, emphasizing the ‘adult’ gender as kids’ is currently in the market. “So our pricing can be adjusted and hopefully, that gets accepted. Getting it past our retailers or our customers is an easier process because there’s no real reference point. The consumer is really what we look at. What will they accept. And the other area of opportunity is the fact that we’ll be distributing to a different level of retailer and a big percentage of our business.”

He went on to say the sourcing arm is the same as they are currently using.

“The factories are very much the same and our negotiating ability with the factories is as strong as anybody in the industry or my bet is we’re much stronger<” he shared. “It’s always been a focus of this company. We’re keyed in on developing factories, partnering with them regardless of what country it is. We have a reputation for not abandoning a vendor. That goes a long way in this type of environment.”

BCBG Launch

A BCBG collection is also set to launch this fall while Goldfarb said Nautica Jeans, Halston and Champion outerwear all “had a good spring season and are scaling in size.”

Shift from PVH to Owned Brands

As for its PVH licenses, for this year, Goldfarb said G-III expects its go-forward brands led by DKNY and Karl Lagerfeld will largely offset the sales decline in the exited Calvin Klein jeans and sportswear licenses which represented $175 million in sales last year.

Looking ahead to fiscal 2027, G-III is proactively preparing for the expiration of several key PVH licenses, including Calvin Klein outerwear and athleisure as well as Tommy Hilfiger outerwear, sportswear and athleisure.

“Over the course of our long-standing partnership, we have played a pivotal role in building the Calvin Klein and Tommy Hilfiger North American women’s wholesale business, contributing to over $15 billion in cumulative wholesale sales,” said Goldfarb. “As PVH transitions to managing these categories directly or through new licenses, they will face the dual challenge of building the necessary infrastructure and onboarding new partners while G- III has the opportunity to capture market share and accelerate growth of our portfolio.”

Tariff Update

The company reaffirmed its net sales outlook for fiscal 2026. However, due to uncertainty around tariffs and related macroeconomic conditions, the company withdrew its net income, non-GAAP net income and adjusted EBITDA guidance for fiscal 2026 issued on March 13, 2025.

Based on the tariff rates in place on June 5, 2025, the company anticipates the unmitigated cost of tariffs on goods imported into the U.S. will result in additional expense of approximately $135 million, which is expected to primarily be weighted to the second half of the year.

“We’re actively working to reduce the impact through a combination of strategies, including continued sourcing diversification, vendor negotiations, selective retail price increases, disciplined inventory management, cost savings and operational efficiencies. Starting with sourcing and vendor negotiations,” said Goldfarb. “We’re leveraging our scale with our long-standing suppliers to negotiate discounts to partially offset cost increases without compromising the high-quality value-driven assortments G-III is always known for.”

He noted that China will represent less than 20 percent of G-III’s production by year-end, down from nearly 90 percent several years ago. G-III is also actively negotiating with retailers and will selectively raise prices.

“With over 30 in-demand brands across categories, price points and channels, our portfolio offers strong pricing power,” said Goldfarb. “Consumers are willing to pay more when quality and value are clear. This is evident in the strong AURs and growing demand for our newer brands like Donna Karan and Karl Lagerfeld, whose distribution is extremely limited in the off-price channel. Because these brands, along with our new licensed initiatives are new to the market, this gives us the opportunity to set higher initial price points.”

Fiscal 2026 Outlook

Net sales are still expected to be approximately $3.14 billion. This compares to net sales of $3.18 billion for fiscal 2025. As previously planned, the company continues to expect sales in the first half of fiscal 2026 to be lower as compared to the previous year, with acceleration expected in the second half of fiscal 2026.

Second Quarter Fiscal 2026 Outlook

Net sales for the second quarter of fiscal 2026 are expected to be approximately $570.0 million. Net sales are expected to be negatively impacted by supply chain challenges and timing shifts in certain programs into the second half of this year. This compares to net sales of $644.8 million in last year’s second quarter. Gross margins are expected to be comparable to the prior year’s second quarter.

Net income for the second quarter of fiscal 2026 is expected to be between $1.0 million and $6.0 million, or diluted earnings per share between 2 cents and 12 cents. This compares to net income of $24.2 million, or 53 cents per diluted share, in last year’s second quarter.

Image courtesy G-III Apparel Group, Ltd.