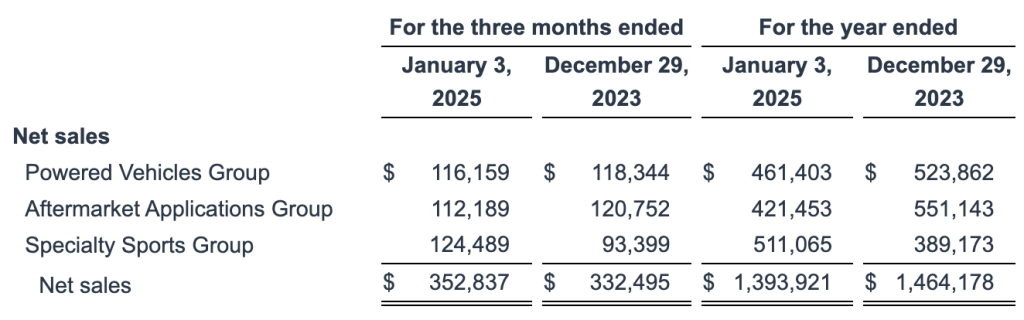

Fox Factory Holding Corp., the parent of Marucci Sports, Fox, Method Race Wheels, and more, saw net sales for the fiscal 2024 fourth quarter come in at $352.8 million, an increase of 6.1 percent from net sales of $332.5 million in the fourth quarter of fiscal 2023. The company said the increase reflects a $31.1 million, or 33.3 percent, increase in Specialty Sports Group (SSG), partially offset by a $8.6 million, or 7.1 percent, decrease in Aftermarket Applications Group (AAG) and a $2.2 million, or 1.8 percent, decrease in Powered Vehicles Group (PVG).

Specialty Sports Group (SSG)

The increase in Specialty Sports Group net sales from $93.4 million to $124.5 million was said to be primarily related to the inclusion of a full-quarter net sales of $41.5 million from Marucci, which the company acquired in November 2023, compared to net sales of $16.8 million included in prior-year comparative quarter, and a $6.4 million increase in Bike sales. Although Bike sales improved compared to the prior-year quarter, the ongoing channel inventory recalibration and, to a lesser extent, lower end consumer demand remain headwinds.

The segment’s Adjusted EBITDA margin of 22.4 percent was said to be down sequentially by 190 basis points due to inventory optimization efforts in the fourth quarter, as well as incremental investments the company is making at Marucci ahead of the upcoming MLB baseball season.

“As with the previous quarter, we’re seeing varied recovery rates in our Bike business across different geographies, channels, and customers, with this uneven pattern likely to continue through 2025,” shared company CEO Mike Dennison on a conference call with analysts.

“Similar to the chassis inventory optimization work we completed in the AAG in the third quarter, we took action in our Bike business to better align inventory with current demand levels,” he continued. “While the inventory rebalancing significantly impacted our SSG segment margins in the fourth quarter, our working capital will benefit from a healthier inventory position and better alignment between production and demand as we enter 2025.”

Additionally, Dennison said the consolidation of the company’s Taiwan operations, combined with strategic sourcing projects and cost-saving opportunities, will provide additional levers for margin improvement beginning this quarter and gaining strength as the business moves move forward.

“Our expansion in the entry premium bike segment continues to progress, with growing strength among our top OEM customers helping to offset softness with smaller OEMs,” the CEO noted. “While the European market demonstrated strength in early 2024, a reluctance to end the year with inventory weighed on purchasing habits in Q4. Throughout the last year, we have implemented enhanced forecasting and planning processes with our strategic OEM partners to ensure better alignment between our production capabilities and their demand patterns, which continues to improve our visibility.”

Dennison said the company has been hard at work developing several new products that will be announces and launched in 2025.

“Some of these we believe are going to revolutionize the way people think about suspension and bikes,” he teased. “We are excited to get these products out on the trails and in our enthusiasts’ hands.”

The Marucci business commenced its new position as MLB’s official bat partner as on January 1.

“We have expanded our bat manufacturing capacity as well as designed new products to drive incremental sales and reinforce our market-leading position in the MLB with Marucci and Victus. Incidentally, both of these brands had record market share in the MLB for 2024,” Dennison shared.

“Additionally, we have made growth investments in our softball business to further capitalize on the fastest-growing team sport in America,” the CEO continued. “We have aligned and coordinated our Fox and Marucci engineers to accelerate new product advancements that we can drive additional growth. These near-term investments weigh on our Q4 margins as we focus on long-term success.”

Looking to the balance sheet in the SSG segment, CFO Dennis Schemm said bike inventory increased slightly, offset by action on end-of-year inventory that it converted into finished goods for sale into the aftermarket.

In the Q&A session of the call, Dennison took a nuumber of questions on Marucci and the MLB deal and what it means for growth.

“When you look back at ‘24, and you’ll do the math, we had three record quarters out of four with Marucci,” he noted. “They had a record year. A lot to celebrate, a lot of really good learning, by the way learning in some mistakes that were made in ‘24 that we learned from. When I look back, I like to think that it didn’t quite hit the number I had expected for it in ‘24. But again, three record quarters out of four isn’t too bad in the market that we all had in ‘24.”

For 2025, the CEO said he thinks Marucci is a double-digit growth business.

“I think the MLB helps that even further. And the products that we’re coming out with in softball and some of these other spaces are really, really good. So I’m pretty excited. I’m very bullish. Marucci is one of our growers this year, for sure, even in light of the macro dysfunction.”

In response to a question on the upside potential and timing, Dennison said the timing question is easier because Major League Baseball season kicks off at the end of the first quarter and into the second quarter where it really grows and then into the summer and into the fall.

“So we see a lot of the growth coming in kind of Q2, Q3 relative to that relationship, but there’s a lot of hard work being done now to get prepared for that,” Dennison said. “Obviously, capacity planning, things like that. In terms of putting a number to it, I think we’re a little premature for that.”

He said they are really changing the way MLB thinks about that partnership, and said MLB is excited about the changes that Fox is bringing to them.

“So it’s kind of a whole new day, and I think both MLB and Fox/Marucci are really trying to figure out how big it can be, and it’s positive signs, let me tell you, but I think there’s a lot of work to do. So before we really start to put a number to it, let us actually grow into that relationship and deliver bats and get it going, and then we’ll come back to you with what that means in an upside,” he concluded.

Aftermarket Applications Group (AAG)

The decrease in AAG net sales from $120.8 million in the 2023 fourth quarter to $112.2 million in the 2024 Q4 period was reportedly driven by lower upfitting sales due to product mix, chassis availability, higher interest rates impacting dealers and consumers, and higher inventory levels at dealerships. Still, the company highlighted that the segment generated growth of 11.9 percent on a sequential basis from the 2024 third quarter reflecting the company’s strategic initiatives to improve performance.

Powered Vehicles Group (PVG)

The decrease in PVG net sales from $118.3 million in Q4 2023 to $116.2 million in Q4 2024 was said to be primarily due to lower industry demand in power sports and automotive because of higher interest rates and higher inventory levels.

Income Statement Summary

Gross margin was 28.9 percent of net sales for Q4 2024, a 120-basis point increase from gross margin of 27.7 percent in the fourth quarter of fiscal 2023. The increase in gross margin was said to be primarily due to amortization of acquired inventory valuation markup from the Marucci acquisition in prior year, which was fully recognized by the end of the first quarter of fiscal 2024 and did not impact the current year’s fourth quarter.

Adjusted gross margin, which excludes the effects of amortization of acquired inventory valuation markup and organizational restructuring expenses, increased 20 basis points to 29.2 percent from the same prior fiscal year period.

“Sequentially, our gross margin is down 100 basis points, primarily because of our strategic growth investments in Marucci and bike inventory actions that Mike commented on earlier,” Schemm noted.

Total operating expenses were $90.6 million, or 25.7 percent of net sales, for Q4 2024, compared to $81.0 million, or 24.4 percent of net sales, in the fourth quarter of fiscal 2023. Operating expenses increased by $9.6 million year-over-year, said to be primarily driven by the recognition of a full quarter of Marucci operating expenses following the November 2023 acquisition, partially offset by a decrease in other acquisition and integration-related expenses.

Adjusted operating expenses were $76.4 million, or 21.7 percent of net sales, in Q4 2024, compared to $68.5 million, or 20.6 percent of net sales, in the fourth quarter of the prior fiscal year.

Tax benefit was $4.1 million in Q4 2024, compared to tax benefit of $3.1 million in the fourth quarter of fiscal 2023. The decrease in the Company’s income tax expense was primarily due to a decrease in pre-tax income.

Net loss attributable to Fox stockholders in Q4 2024 was $0.1 million, compared to net income attributable to Fox stockholders of $4.1 million in the fourth quarter of fiscal 2023. Loss per diluted share for Q4 2024 was $0.00, compared to earnings per diluted share of 10 cents for the fourth quarter of fiscal 2023.

Adjusted net income in Q4 2024 was $12.8 million, or 31 cents of Adjusted earnings per diluted share, compared to Adjusted net income of $20.3 million, or 48 cents of Adjusted earnings per diluted share, in the 2023 fourth quarter.

Adjusted EBITDA in Q4 2024 was $40.4 million, compared to $38.8 million in the fourth quarter of fiscal 2023.

Adjusted EBITDA margin in Q4 2024 was 11.5 percent of net sales, compared to 11.7 percent in the fourth quarter of fiscal 2023.

Balance Sheet Summary

As of January 3, 2025, the company had cash and cash equivalents of $71.7 million, compared to $83.6 million as of December 29, 2023. The decrease in cash and cash equivalents was driven by the Marucci acquisition, debt payments, and capital expenditures, partially offset by a decrease in pre-paids and other current assets driven by lower chassis deposits due to inventory optimization efforts.

Inventory was $404.7 million as of January 3, 2025, compared to $371.8 million as of December 29, 2023. Inventory increased by $32.9 million driven by higher raw materials and finished goods due to an imbalance in expected versus fulfilled orders and an intentional build of high moving stocking units in the company’s aftermarket businesses to fulfill demand during the holiday selling period.

As of January 3, 2025, accounts receivable and accounts payable were $165.8 million and $144.1 million, respectively, compared to $171.1 million and $104.2 million, respectively, as of December 29, 2023. The change in accounts receivable is due to higher sales in fiscal quarter ended January 3, 2025 compared to fiscal quarter ended December 29, 2023. The change in accounts payable reflects the timing of vendor payments.

Pre-paids and other current assets were $85.4 million as of January 3, 2025, compared to $141.5 million as of December 29, 2023.

Total debt was $705.1 million as of January 3, 2025, an improvement of $38.4 million compared to $743.5 million in the prior-year period ended December 29, 2023, and a $63.3 million improvement versus third quarter ended September 27, 2024.

Working capital improvements, especially the reduction in chassis prepayments, drove debt pay-down as we continue to focus on generating free cash flow to reduce debt and interest expense.

Fiscal 2025 Guidance

For the first quarter of fiscal 2025, the company expects net sales in the range of $320 million to $350 million and adjusted earnings per diluted share in the range of 12 cents to 32 cents per share.

For the fiscal year 2025, the company expects net sales in the range of $1.385 billion to $1.485 billion, Adjusted earnings per diluted share is forecast in the range of $1.60 to $2.60, and a full year Adjusted tax rate in the range of 15 percent to 18 percent.

“Underpinning our full-year guidance are several key assumptions, including continued growth in AAG as we move past specific OE concerns such as quality issues and disruption from model-year changeovers, continued momentum in Marucci benefiting from our new Major League Baseball partnership taking effect in our upcoming schedule of exciting new bat launches both in softball and in baseball, a gradually stabilizing environment in PVG and bike, with performance consistent with 2024 levels in terms of absolute dollars,” Schemm added.

“Really, in our opinion ‘25 looks a lot like 2024, except for we really believe these investments that we’ve been making in Marucci on the engineering side and with the MLB license and partnership there, that’s going to help us in the back half of the year,” the CFO continued. “The work that we’ve done getting those chassis in place in our dealership expansion efforts in AAG is going to help us as well in the second half, combined with the product innovation roadmap and the launches that we have planned really beginning now are going to really start paving the way in the second half for stronger growth. And so, really to get to that high end, it’s really seeing really strong execution, delivery, and acceptance of that product roadmap. So we’re just trying to be as realistic as we can, taking into consideration the macro and these high interest rates still that are weighing us down.”

The company said guidance does not include any effects from the ongoing tariff developments, but Dennison also said the company has limited exposure in the targeted countries.

“Our teams have spent considerable time analyzing these potential and planned tariffs,” he said. “As you can imagine, it’s a complex and fluid environment. Our current manufacturing footprint is well-positioned relative to these policy shifts, with no significant presence in Mexico, Canada, or China, with the exception of some of our wheels and all of our aluminum baseball bats, which are manufactured in China.”

In both of those categories, he said they are executing plans to mitigate the potential impacts through cost reductions and pricing adjustments.

“Our bike business operates out of Taiwan, and therefore the majority of aluminum tariffs, would be felt by our customers as they import our products or completed bikes into the U.S.,” Dennison said. “The impact to the U.S. bike industry is yet to be fully understood by our OEM customers.”

Adjusted earnings per diluted share exclude the following items net of applicable tax: amortization of purchased intangibles, litigation and settlement-related expenses, acquisition and integration-related expenses, organizational restructuring expenses, and strategic transformation costs.

A quantitative reconciliation of adjusted earnings per diluted share for the first quarter and full fiscal year 2025 is not available without unreasonable efforts because management cannot predict, with sufficient certainty, all of the elements necessary to provide such a reconciliation. For the same reasons, the company is unable to address the probable significance of the unavailable information, which could be material to future results.

Image courtesy Marucci Sports