Foot Locker, Inc. reported fourth-quarter earnings below year-ago levels, but sales and earnings were ahead of Wall Street estimates. The sneaker retailing giant forecasted same-store sales would fall 3.5 percent to 5.5 percent; however, today, during its Investor Day conference, Foot Locker said it would outline a new long-term growth strategy that calls for same-store growth between 3 percent to 4 percent from fiscal years 2024 through 2026 and significantly higher EPS growth.

Sales in the fourth quarter of $2.33 billion topped Wall Street’s consensus estimate of $2.15 billion. Adjusted EPS of 97 cents a share easily exceeded Wall Street’s consensus estimate of 51 cents.

“Our team delivered a great finish to the year with strong fourth-quarter results that capitalized on resilient Holiday demand and a compelling assortment and inventory position from our brand partners,” said Mary Dillon, president and chief executive officer. “We are entering 2023 with a focus on resetting the business – simplifying our operations and investing in our core banners and capabilities to position the company for growth in 2024 and beyond.”

Dillon continued, “We are proud of Foot Locker’s role in influencing and serving the global sneaker community, and next year, we will celebrate the 50th anniversary of the iconic Foot Locker brand. We are incredibly excited to introduce our “Lace Up” plan with a new set of strategic imperatives and financial objectives that are designed to set us up for success for the next 50 years.”

Fourth Quarter Results

- Comparable-store sales grew by 4.2 percent, driven by increased traffic and improved access to high-quality inventory, resulting in broad-based strength across brands and regions;

- Total sales decreased by 0.3 percent, to $2,334 million, compared with sales of $2,341 million in the fourth quarter of 2021. Excluding the effect of foreign exchange rate fluctuations, total sales for the fourth quarter increased by 3.6 percent;

- Gross margin declined by 290 basis points compared with the prior-year period, driven mainly by higher markdowns on increased promotional activity across the industry;

- SG&A decreased by 10 basis points as a percentage of sales compared with the prior year, with savings from the cost optimization program, offset by inflation;

- Net income decreased to $19 million as compared with $103 million in the fourth quarter of fiscal 2021. Non-GAAP net income decreased to $92 million from $148 million in the fourth quarter of fiscal 2021; annd

- EPS decreased to $0.20 per share, versus $1.02 in the fourth quarter of fiscal 2021. Non-GAAP EPS decreased to $0.97 per share compared with EPS of $1.46 in the fourth quarter of fiscal 2021.

Balance Sheet

At quarter-end, the company’s cash and cash equivalents totaled $536 million, while debt on its balance sheet was $452 million. The company’s total cash position, net of debt, was $84 million, as compared with $347 million last year. As of January 28, 2023, the company’s merchandise inventories were $1.6 billion, 29.8 percent higher than at the end of the fourth quarter last year.

Dividend and Share Repurchases

During the fourth quarter of 2022, the company paid a quarterly dividend of $0.40 per share. For the full-year 2022, the company repurchased 4.1 million shares for a total of $129 million and paid a total of $150 million in dividends. The Board of Directors declared a quarterly cash dividend on the company’s common stock of $0.40 per share, which will be payable on April 28, 2023, to shareholders of record on April 14, 2023.

Store Base Update

During the fourth quarter, the company opened 21 new stores, remodeled or relocated 45 stores, and closed 101 stores. As of January 28, 2023, the company operated 2,714 stores in 29 countries in North America, Europe, Asia, Australia, and New Zealand. In addition, 159 franchised stores were operating in the Middle East and Asia.

Asia Business Model

As part of its efforts to simplify its business model and focus on core banners and regions, the company announced today that it is transforming its business model in Asia through the following actions:

- Closing its stores and e-commerce in Hong Kong and Macau;

- Converting currently owned and operated stores and e-commerce in Singapore and Malaysia to a license model;

- Continue to operate stores in South Korea; and

- Continue to pursue growth in the region through license partners.

MAP Active, Indonesia’s leading lifestyle retailer, a partner of Foot Locker in Indonesia and the Philippines, will take over the company’s store and e-commerce operations in Singapore and Malaysia to expand market growth and in new markets in the region over time.

2023 Financial Outlook

Fiscal year 2023 represents the 53 weeks ending February 3rd, 2024. The company’s full-year 2023 outlook, which includes the 53rd week, is summarized below:

- Sales Change: Down 3.5 percent to 5.5 percent including ~1 percent from the extra week;

- Comparable Sales Change: Down 3.5 percent to 5.5 percent;

- Square Footage Change: Down ~4 percent;

- Licensing Revenue: ~$20 million;

- Gross Margin: 30.8 percent to 31.0 percent;

- SG&A Rate: 22.6 percent to 22.8 percent;

- D&A: ~$205 million;

- Interest: ~$12 million;

- Tax Rate: 31.5 percent to 31.7 percent;

- Non-GAAP EPS: $3.35-$3.65 including $0.15 from the extra week; and

- Adj. Capital Expenditures: ~$305 million.

The company provided earnings guidance only on a non-GAAP basis and does not provide a reconciliation of the company’s forward-looking capital expenditures and diluted earnings per share guidance to the most directly comparable GAAP financial measures because of the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations.

Investor Day, March 20, 2023

At today’s Investor Day, senior management will outline the company’s “Lace Up” plan, designed to drive the next phase of Foot Locker, Inc.’s growth and create value for stakeholders, including investors, employees and communities. The plan is guided by the following strategic pillars:

- Expand Sneaker Culture: Serve more sneaker occasions, provide more choice, and drive greater distinction.

- Power Up the Portfolio: Create more distinction among banners, including re-launching the Foot Locker brand and opening new formats, shifting off-mall and closing underperforming stores.

- Deepen Customer Relationships: Reset the company’s loyalty program and elevate customer relationships through enhanced analytical capabilities.

- Be Best-in-Class Omni: Improve the customer experience online through the full shopping experience.

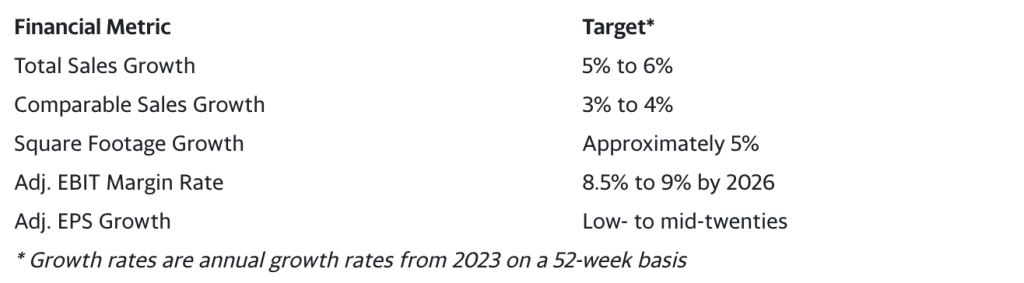

In connection with its new strategic direction, the company set the following long-term financial targets for fiscal years 2024 through 2026.

Photo/Graphic courtesy Foot Locker