Foot Locker, Inc. saw shares jump more than 10%  last week after surprising Wall Street with better-than-expected bottom line results and management offered up a solid plan for turning around a very tough athletic footwear business in the mall. The increase in share price also came despite the downgrade by one analyst that viewed the second quarter results, combined with the tighter credit markets, as an indicator that a sale of the company was not on the immediate horizon.

last week after surprising Wall Street with better-than-expected bottom line results and management offered up a solid plan for turning around a very tough athletic footwear business in the mall. The increase in share price also came despite the downgrade by one analyst that viewed the second quarter results, combined with the tighter credit markets, as an indicator that a sale of the company was not on the immediate horizon.

What Foot Locker did provide was a candid assessment of the current state of the market, where they feel they went wrong, and a legitimate plan — much of it already in place — to get them heading in the right direction again. At the core of the plan is the full scale liquidation of older product and slower-moving styles. In some cases, the liquidation appeared to also target entire brands that the worlds-largest-athletic-specialty-retailer did not see as a cornerstone of their new direction. The move to clean out goods heading into the back-to-school season was certainly painful — cutting domestic merchandise margins by 620 basis points that in turn contributed to the loss for the period - but it also gave the retailer the cleanest inventory position it has had in a few years. Management estimated that the margin hit for the quarter amounted to approximately $50 million, or 20 cents per share, in higher markdowns.

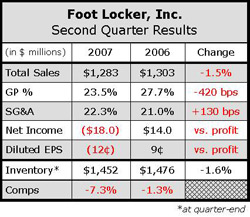

Total inventory was down 3.2% at quarter-end when accounting for currency fluctuations. It was estimated that inventory older than 12 months was down 40% at quarter-end compared to the end of Q2 last year. Still, management said they had fewer markdowns than initially planned for the liquidation event and delivered a net loss of 12 cents per diluted share for the second quarter instead of the 18 cents to 20 cents per share loss forecast.

Part of the go-forward strategy will be to focus more intently on what is working for Foot Lockers various divisions. That strategy will include increased flow of key marquee product from key vendors, while moving to a weekly fill-in strategy with Classics.

To get a feel for what may work one only has to look as far as Europe to see the moves made there in the last year to move the business in the right direction. Consolidated international operating profits were up in double-digits for the quarter led by “strong gains” at Foot Locker Europe. International comparable store sales were down in the mid-singles, with the weakest sales results coming out of Europe. Foot Locker Canada was said to be “flat” for the quarter, while Australia comps increased in the low-double-digits. International merchandise margins were up 300 basis points for the period as the company scales back its promotional cadence in Europe.

The retailer is starting to see the return of technical running as fashion in Europe and expects to receive double the amount of technical running product in Europe in Q3 this year versus last years period. Court shoes, sandals, and slides also did well in Q2.

Company chairman and CEO Matt Serra said the low-profile fashion athletic category “has clearly peaked” in Europe.

The U.S. Foot Locker business, which is comprised of Foot Locker, Kids Foot, and Lady Foot, posted a high-single-digit decrease in comps for the quarter. Footaction and Champs Sports were also down in the high-singles. The DotCom business, which includes all of the on-line and catalog properties, including Eastbay, was down in the mid-single-digits for the period. Overall U.S. footwear comps were down 7.5% for Q2 and apparel & accessories comped down 9%.

Pairage sales of footwear were up 3% in Q2. Average selling prices were down nearly 10% due to the liquidation efforts.

Mr. Serra said the quarter was also affected by the summer fashion shift to sandals, slides, and flip-flops; a continuing fashion shift to brown shoes; a lack of newness in the athletic category; and a shift in the BTS period to August in a few states. He said the successes in the quarter included brand Jordan, Nike Shox running, “some” Nike Air Max product, adidas Bounce, New Balance Zip and the high-end of the Asics offering. The stronger percentage increases came from the sandals, canvas and brown shoe categories. Classics premium product like Nike Air Force 1, Prestige and Cortez also continued to sell well. Serra also said they were seeing a revival in womens technical running. Apparel sales were led by private label polos, cargo shorts, and plaid shorts.

Mr. Serra said that for the third quarter all U.S. divisions are expected to receive anywhere from 15% to 30% of additional marquee product from “our key supplier,” presumably Nike, versus Q3 last year.

>>> What a difference a few years makes. Foot Locker is now tied at the hip with Nike and the two giants appear to have a solid understanding of what the other needs to succeed. There wasnt much Nike on the sale

>>> Combine the move to walk away from weaker brands and categories with the closure of 250 weak doors, there may just be light at the end of this tunnel…