While Foot Locker Inc.s Europe business showed signs of strengthening in the third quarter, it wasn't nearly enough to offset a “precipitous” slow down in the U.S. during September and October. As a result, Foot Locker slightly missed its guidance the period and cut its outlook for the full year.

Foot Locker now expects EPS, excluding impairment charges, to range from 50 cents to 63 cents in fiscal 2008, which is down from a range of 70 cents to 85 cents forecast in August. In the year-ago period, Foot Locker earned 43 cents a share.

“The retail industry is currently in unchartered territory, with consumer confidence reaching new lows,” said Matt Serra, Foot Locker's president and CEO, on a conference call. “The consumer has been hit hard by the severe stock market decline, which combined with fears of rising unemployment, have dimmed the outlook for all retailers in the near term. Estimates of mall traffic in the U.S. indicate declines of 10% or higher.”

Serra said Foot Locker's U.S. weakness is being partly offset by significant improvement in Europe.

“Our sales in several key markets in Europe began to comp positively in early September, a trend that has continued into November,” said Serra. “While we are cautious regarding the external outlook in this market, we are very encouraged that our European business may be at a crossroads, with good opportunity to begin to more consistently post improved financial results.”

The overall 1.7% comp sales decline in Q3 reflects low-single-digit declines at its combined U.S. operations as well as in Europe. Footlocker.com and Foot Locker Canada increased low-single-digits. Foot Locker Asia Pacific increased in high-single-digits.

By month, comps increased low-single-digits in August, declined low-single digits in September, and declined mid-single-digits in October. In the U.S., Foot Locker had a low-single-digit comp store sales gain in August, followed by mid-single-digit comp sales declines in both September and October. Conversely, Europe saw a high-single-digit comp store sales decline in August, followed by a combined low-single-digit comp increase in September and October.

In the U.S., footwear sales increased in the low-single-digits, while apparel and accessory sales declined low-single-digits. Average selling prices increased mid-single-digits in both footwear and apparel. In footwear, Foot Locker is benefiting from selling a greater percentage of higher priced marquee footwear, a trend expected to continue through the fourth quarter. Men's and kids footwear both had “solid gains” during the quarter, while women's sales continue to be soft, with high single-digit declines for the period.

Sales of men's basketball shoes were “very strong,” again marked by strength in higher-priced marquee Jordan styles. Sales in men's running increased in the low-single-digit area, led by Nike Shox, adidas Bounce, and Asics. In Classics, strong gains were generated in some specific Nike and adidas styles, with sales declines in other basic products. Gains were also seen in canvas and boots in men's.

In its U.S. apparel business, strong gains in some of its branded categories were offset by continued declines in men's private label, licensed, and women's. Brands such as Under Armour and TapouT are being brought in to revive apparel, but the category is expected to remain soft during the fourth quarter.

Internationally, its Asia Pacific division delivered a “strong” profit increase, Australia is turning in a “very strong performance” for the year, and Canada saw a “solid” division profit increase. Average selling prices internationally increased mid-single-digits, and were also helped by greater sales of marquee footwear. Europe's turnaround since the start of September coincided with some new marking campaigns from both Nike and adidas. The biggest improvement in Europe was apparel, which increased over 20% during the quarter.

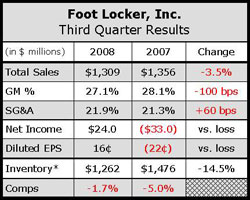

The 100 basis point decline in gross margin reflected a 50 basis point decline in merchandise margins and a 50 basis point decrease due to a higher buying and occupancy rate. The merchandise margin rate for the third quarter was “somewhat below” expectations, but close to its historical third quarter rate.

The latest quarter included a charge of two-cents-a-share related to a short-term investment while last year's third quarter included a 43 cents a share charge for store closings. Excluding these items, net profits fell 18.2% to $27 million, or 18 cents a share, in the latest quarter.

Inventories were down 10% on a selling square foot basis and 11.2% on a constant currency basis.

For the full year, comps are expected to be down low- to mid-single-digits, gross margin rate to improve 175 to 200 basis points, and SG&A expenses to be relatively flat on a constant currency basis with last year. Management said the “most significant risk” to its forecast relates to its U.S. comp performance.