Foot Locker, Inc. saw sales and comps inch up for the fiscal second quarter ended August 5. This was a clear improvement sequentially from the small comp sales decline in the first quarter and a strong move toward reversing the near double-digit decline of a year ago.

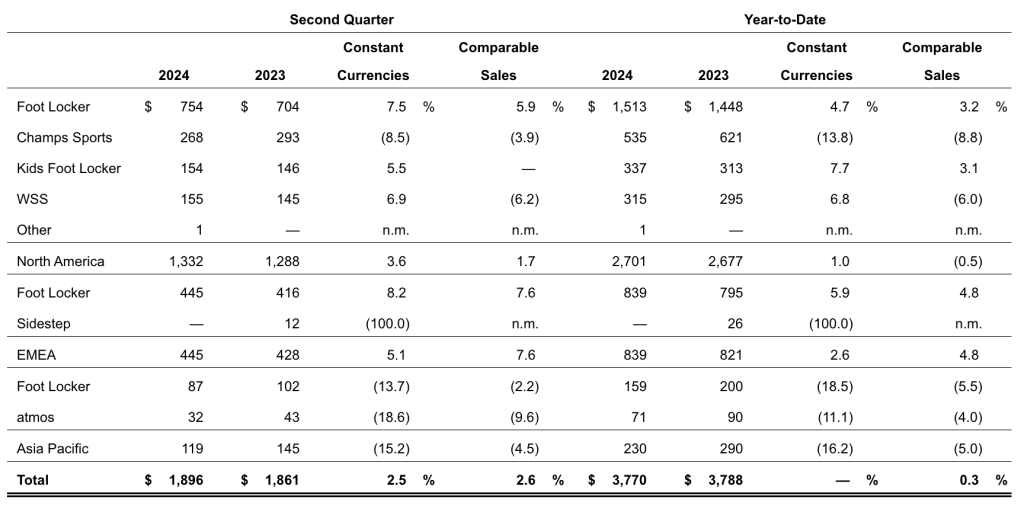

The retailer reported that total sales for the second quarter increased by 1.9 percent, to $1.90 billion, as compared with sales of $1.86 billion in the second quarter of 2023. Excluding the effect of foreign exchange rate fluctuations, total Q2 sales increased by 2.5 percent in constant-currency terms.

A non-recurring charge associated with the rollout of the company’s enhanced FLX Rewards Program in the U.S. reduced sales by $11 million.

Comparable sales increased by 2.6 percent for the quarter, led by 5.2 percent growth in global Foot Locker and Kids Foot Locker comparable sales.

Sales by Region and Banner

(in US$ millions)

Income Statement Summary

Gross margin increased 50 basis points compared to the prior-year period, including a 40-basis point drag from the non-recurring FLX Rewards Program charge in the second quarter. Excluding the impact of the non-recurring FLX Rewards Program, gross margin improved by 90 basis points compared with the second quarter of 2023. This improvement was led by reduced markdown levels and occupancy leverage.

SG&A, as a percentage of sales, increased by 130 basis points year-over-year, driven by technology investments, brand-building expenses and higher inflation, partially offset by savings from the cost optimization program and ongoing expense discipline.

Second quarter net loss was $12 million compared to a net loss of $5 million in the corresponding prior-year period. On a non-GAAP basis, net loss was $4 million, compared to a net income of $4 million in the corresponding prior-year Q2 period.

Second quarter loss per share was 13 cents, compared to a net loss of 5 cents per share in the second quarter of 2023. Non-GAAP earnings decreased to a loss of 5 cents per share in the second quarter, compared to non-GAAP earnings per share of 4 cents in the corresponding prior-year period. GAAP and non-GAAP second-quarter earnings per share included a 9 cents per share negative impact from the non-recurring FLX charge in the quarter.

“The Lace Up Plan is working, as evidenced by our return to positive total and comparable sales growth as well as gross margin expansion in the second quarter,” offered company President and CEO Mary Dillon. “Our top line trends strengthened as we moved through the quarter, including a solid start to Back-to-School. We were also particularly pleased to deliver stabilization in our Champs Sports banner. As planned, we relaunched our enhanced FLX Rewards Program in the United States during the quarter and have been encouraged by initial results. Our strategies are building momentum as we look to the remainder of the year, and we are reaffirming our full-year Non-GAAP EPS outlook.”

Balance Sheet Summary

At quarter-end, the company’s cash and cash equivalents totaled $291 million, while total debt was $445 million. As of August 3, 2024, the company’s merchandise inventories were $1.6 billion, 10.0 percent lower than at the end of the second quarter last year. Excluding the effect of foreign currency fluctuations, merchandise inventories decreased by 9.2 percent year-over-year.

Store Base Update

During the second quarter, the company opened five new stores and closed 31 stores. It also remodeled or relocated 14 stores and refreshed 67 stores to current design standards in the quarter, incorporating key elements of new brand design specs. As of August 3, 2024, the company operated 2,464 stores in 26 countries in North America, Europe, Asia, Australia, and New Zealand. In addition, 213 licensed stores were operating in the Middle East and Asia.

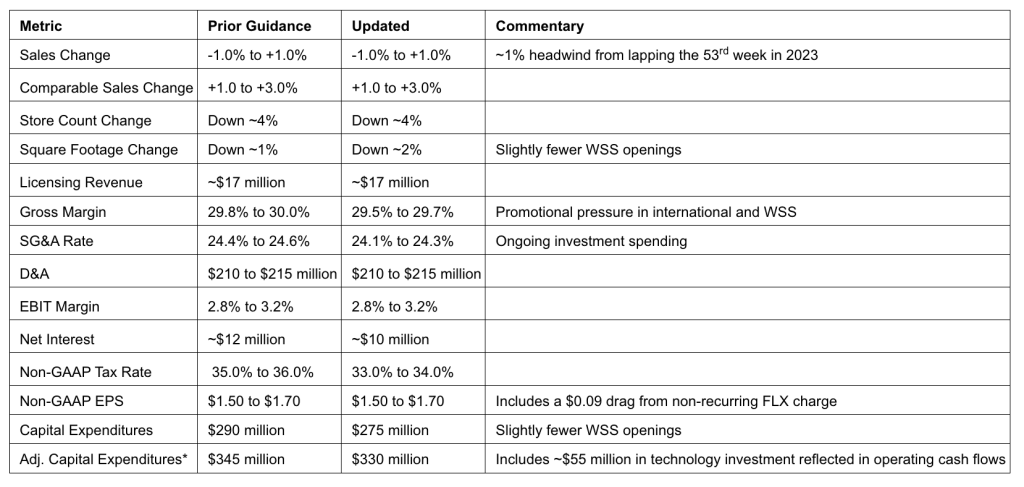

2024 Outlook

The company is reaffirming its full-year 2024 outlook, representing the 52 weeks ending February 1, 2025.

Image and Charts courtesy Foot Locker, Inc.

Image and Charts courtesy Foot Locker, Inc.

See below for additional coverage from SGB Media on Foot Locker’s Q2 brand and banner performance, the announced HQ move and store closures, and progress against the turnaround plan.

EXEC: Wall Street Reacts as Foot Locker CEO Talks Turnaround Plan and Positive Q2 Comps

EXEC: Foot Locker Gives Q2 Nod to Nike in Basketball, Adidas and New Balance in Lifestyle

EXEC: Foot Locker Exiting New York for Sunnier Environs; Shakes Up Europe and Asia Model