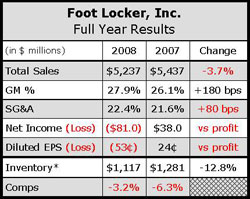

Foot Locker, Inc. reported that total fourth quarter consolidated sales declined 11.1% to $1.32 billion from $1.48 billion in the prior-year quarter. Excluding the effect of foreign currency fluctuations, sales decreased 7.3%. Same-store sales also declined 7.3% for the quarter. By month, comp store sales decreased mid-single-digits in November and December, and high-single-digits in January.

The worlds largest athletic footwear retailer posted a net loss of $126 million, or 82 cents per share, in the fourth quarter compared with a net income of $72 million, or 46 cents, in the year-ago period. The 2008 fourth quarter included non-cash impairment charges and store closing expenses of $1.06. On an adjusted non-GAAP basis, income from continuing operations before the impairment charges and store closing expenses was 24 cents per share, a 60% improvement compared to adjusted, non-GAAP earnings from the prior-year quarter. Analysts were expecting 17 cents a share.

Gross margins improved 330 basis points to 28.7% of sales in Q4, reflecting a less promotional stance in the quarter and cleaner inventories. The reduction in promotional activity was cited as the “primary contributing factor” to increased fourth quarter profits. Merchandise margins expanded 400 basis points and a 70 basis point de-leveraging of buying and occupancy rates. The domestic merchandise margin rate increased 490 basis points and the international merchandise margin rate improved 180 basis points.

Foot Locker management said that the U.S. business, which includes Champs, Footaction, Foot Locker, Kids Foot Locker, and Lady Foot Locker, posted a low-double-digit comp sales decline for the quarter due to declining mall traffic and lower consumer spending. Footwear sales decreased in the mid-single-digits and apparel sales and accessory sales decreased in the high-teens. The men's footwear business declined in mid-single-digits and both women's and kids' footwear business declined double-digits. The men's basketball, premium classics and canvas categories were said to be “strong,” but the U.S. group had declines in “most other categories, including running.” Management said the men's footwear business continued to “show strength in the higher price point performance categories.”

Average footwear selling prices increased in double-digits in the U.S. versus last year due to a higher markdown rates in the prior year and a positive mix shift toward selling a greater percentage of higher priced footwear. FL said U.S. apparel sales continue to be weak, extending a poor athletic trend that they've experienced the last two years. During the fourth quarter, apparel sales were weak across almost all licensed, branded and private label assortments. They indicated success with new branded offerings from TapouT and Under Armour, but those programs were apparently not large enough to offset the sales declines in licensed and private label products.

International comp store sales increased in high-single-digits, with Europe increasing in mid-single-digits, Foot Locker Canada up low-single-digits and Asia Pacific increasing mid-teens.

Foot Locker Europe was said to have generated a “solid sales increase” in footwear and a “strong increase” in apparel for the quarter. The footwear business had “solid gains in higher priced technical running footwear,” but continues to see declines in the low-profile casual category. The sales declines in this category were said to be less significant to the overall business as it becomes as smaller percentage of the overall business. Average selling prices in Europe increased in low- to mid-single-digits, while unit sales were fairly flat.

Foot Locker Europe generated a very strong profit increase for the quarter, with a division profit margin rate back in the double-digits.

Foot Locker Canada profits were said to be in line with plan for the quarter and continue to run at a “very solid double-digit division margin rate.” For the year, Foot Locker Canada generated a solid profit increase and improved slightly on its double-digit division profit margin rate.

Foot Locker Asia-Pacific has seen division profit double over the past two years and “broke into the double-digit division profit rate for the first time in its history during the fourth quarter.” The division also generated the “highest year-over-year sales and profit percentage increase” for the second year in a row.

Sales in the direct-to-customer business increased 14.5% in the quarter, reflecting a mid-single-digit decline in the Foot Locker.com/Eastbay business and the upside of adding the CCS business to the portfolio. The CCS business was accretive to FL earnings in Q4 and generated a double-digit profit margin rate. For the full year, the direct-to-customer business generated an 11% division profit margin rate.

Foot Locker, Inc. ended the year with a total of 17 franchise stores in the Middle East and Korea, an increase of eight stores for the year.

Company Chairman and CEO Matt Serra said February got off to “a very good start,” up low-single-digits. The U.S. business was up close to mid-single-digits and Europe was down in low-single-digits.