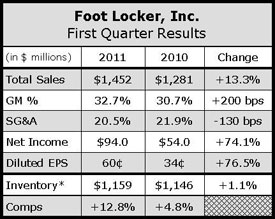

Powered by a 12.8 percent comp store sales gain and 200 basis points of improvement in gross margins, Foot Locker, Inc. first quarter profits surged 74.1 percent to $94 million, or 60 cents a share, clobbering Wall Street’s consensus estimate of 44 cents a share.

Sales increased 13.3 percent to $1.45 billion. Excluding foreign currency fluctuations, total sales increased 12.0 percent for the Q1 period ended April 30.

On a conference call with analysts, company EVP and CFO Bob McHugh said the strong comps far exceeded the retailers outlook provided in March. Said McHugh, “This significant breakout on the top line encourages us that our key strategic initiatives are working.”

February’s comps grew low double-digit comps, marking the third year in a row with solid gains in the period. March comps were up high-single-digits, despite the shift of Easter from March to April. With Easter’s help, April’s comps exceeded 20 percent growth.

McHugh said the international divisions matched the initial outlook by producing a mid-single-digit comp increase. Foot Locker Europe was the strongest performer, while Foot Locker Canada “struggled a bit” with the anniversary of last year’s Vancouver Olympics and a much later arrival of spring in Canada this year compared to 2010.

The star performer was the U.S. region, with comps surging in the teens despite the “slight drag” caused by the year-over-year decline in toning footwear. Foot Locker’s direct-to-customer segment, which includes Eastbay, topped 20 percent comps for the quarter with store banner websites delivering “especially strong comps,” McHugh said.

First quarter footwear comps were up double-digits in the U.S. with gains across men’s, kids and women’s. Strength in other categories, especially lightweight running, more than offset toning weakness in women’s. Accessory comps in the U.S. were up double-digits, but apparel delivered the strongest category gain, up 20 percent in the U.S.

The 200 basis points gross margin improvement reflected sales leverage on buying and occupancy expenses. Merchandising margins were up 50 basis points, in line with expectations and driven by apparel. McHugh said footwear margins are still higher than the apparel margins in the domestic businesses, but the gap is closing.

Comps are now expected to increase in the mid-single-digits over the last three quarters of the year versus its previous outlook of low- to mid-single-digits. Given the strong first quarter, Foot Locker expects comps in the upper mid-single-digit comp for the full year. Gross margins are expected to improve 40 to 60 basis points over the remainder of the year versus the 30 to 50 basis points previously forecast.

On the call, Ken Hicks, chairman, president and CEO, said Foot Locker benefited in Q1 from its “clear leadership of the basketball category.” Events surrounding the NBA All-Star game in Los Angeles marked “a very successful, high-profile event for us.” As a result, Foot Locker had “good double-digit gains in basketball in February, with several of the player-endorsed marquee shoes selling really well.”

He added, “It is great news for the category that there are some strong new players like Derrick Rose, John Wall, and Kevin Durant to go along with Kobe, LeBron, Howard, Wade and others.”

Beyond Nike, Adidas, Reebok and Under Armour are also supporting the category with “very compelling” player-endorsed basketball products. The House of Hoops basketball concept has been rolled out to 29 stores with a goal to reach 40 by the close of 2011.

The Foot Locker divisions (Foot Locker, Lady Foot Locker and Kids Foot Locker) and Champ Sports are also benefiting from an increased emphasis on running. In addition to Nike Free and Nike Lunar, Reebok’s Zig and Flex, and Adidas CLIMA, Under Armour, K-Swiss, Saucony and others are “keeping the category full of new technology profiles and colors,” Hicks said. The retailers technical running positioning has been strengthened by brands such as Asics, Brooks and Mizuno. Said Hicks, “The growth rate of running has been very good, even higher than basketball in the quarter, although both are on an upswing.”

Hicks also believes each of the company’s banners are benefiting from better differentiated merchandising assortments, pointing to an integrated presentation of the Nike Fresh Air campaign in Foot Locker as well as the introduction of the Nautica brand at Footaction. As evidence of progress, he noted that both urban and suburban stores showed double-digit sales growth in the quarter. Said Hicks, “We feel these results help validate our belief that each of our domestic banners has a different set of core customers.”

He said the apparel’s 20 percent comp gain included gains in men’s, women’s and kids. “The margins were up significantly as well, as our apparel inventory is fresh as it has been in a long time,” added Hicks. Most of apparel’s progress came on the branded and licensed side, especially from Nike, Adidas and Under Armour. Improvements in private label apparel are expected to be more evident during back-to-school.

Despite the progress, Hicks noted that with sales and profits still down from several years ago, the company continues to work on improving conversion rates, lower operating costs, or negotiate better lease terms.

He also said CCS “remains below our standards.” A new managing director has been hired to lead CCS and merchandising and operational steps have been taken. Said Hicks, “We know from looking at the results of some of our competitors, and even within some of our own brands, that the skate customer is out there. We probably didnt evolve the CCS business as fast as we should have.”

The company also plans to further differentiate its banners through traditional and online or viral marketing campaigns. A rebranding campaign is being launched for Champs while Sneakerpedia.com online community for sneakerheads was just launched to support the Foot Locker chain. Upgraded mobile commerce sites were also unveiled during April for each of its banners.

Despite the positive trends in the athletic cycle, Hicks said the company remains “mindful of the pressures our customers face” given high unemployment in many markets and slow wage growth in the face of inflation. He also expects price increases will come in the latter part of the year and indicated the company is “working to ensure retail prices increase only in sensible ways.” However, he added, “Given the strength of the current athletic cycle “with lots of exciting new product technology, we believe these price increases will in general be accepted by our customers, despite the macroeconomics headwinds.”