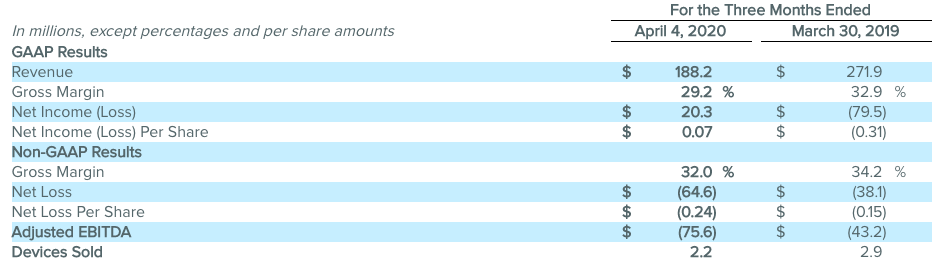

Fitbit Inc. reported that it sold 2.2 million devices in the first quarter, down 26 percent year-over-year, leading to a 30.8 percent in revenue decline to $188.2 million. That missed Wall Street’s expectations by $80.4 million.

The company also reported GAAP net income per share of 7 cents (beat by 33 cents), non-GAAP net loss per share of 24 cents (missed by 8 cents), GAAP net income of $20 million, non-GAAP net loss of $65 million, cash flow from operations of $82 million, and non-GAAP free cash flow of $86 million for its first quarter of 2020.

“Our mission to help people around the world get healthier has never been more important. The emergence of COVID-19 has underscored the critical role that Fitbit, as a trusted brand, can play in providing people with much-needed support throughout the COVID-19 crisis and beyond,” said James Park, co-founder and CEO. “While COVID-19 has impacted our business, and there continues to be uncertainty around consumer demand and the economy, we are moving quickly to develop innovative products and services that can help people during this time. We launched our most innovative tracker, Fitbit Charge 4, and with consumers looking for more support and guidance at home during this time, we provided a free 90-day trial and access to Premium content, resulting in a substantial increase in Premium subscribers.”

First Quarter 2020 Financial Summary

First Quarter 2020 Financial Highlights

- Sold 2.2 million devices, down 26 percent year-over-year, driven by the introduction of one new product in the first quarter of 2020 versus three new products in the first quarter of 2019. Average selling price decreased 11 percent year-over-year to $81 per device. Approximately 76 percent of the year-over-year decline in price was due to an increase in reserves for product returns, rebates and promotions, and price protection in connection with the impact of COVID-19.

- U.S. revenue represented 54 percent of total revenue or $102 million, down 24 percent year-over-year.

- International revenue represented 46 percent of total revenue and declined 37 percent to $86 million: Americas excluding U.S. revenue declined 30 percent to $11 million, EMEA revenue declined 35 percent to $57 million, and APAC revenue declined 47 percent to $18 million (all on a year-over-year basis).

- New devices introduced in the past 12 months, Fitbit Charge 4, Fitbit Ace 2, Fitbit Versa 2, and Fitbit Aria Air, represented 60 percent of revenue.

- GAAP gross margin was 29.2 percent and non-GAAP gross margin was 32.0 percent. Both GAAP and non-GAAP gross margin were negatively impacted by higher reserves associated with COVID-19 and higher ending and obsolescence costs, partially offset by a non-recurring tariff exclusion benefit.

- GAAP operating expenses represented 96 percent of revenue, increasing 5 percent year-over-year to $181 million driven by costs related to the pending acquisition by Google LLC; non-GAAP operating expenses represented 78 percent of revenue, declining 3 percent year-over-year to $146 million driven by lower media spend and lower employee costs.

- A non-routine GAAP tax benefit of $145 million from net operating loss carrybacks due to changes in the tax law as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

First Quarter 2020 Operational Highlights

- Smartwatch devices sold grew to 54 percent of revenue, up from 42 percent in the first quarter of 2019. Trackers devices sold declined to 42 percent of revenue, down from 57 percent in the first quarter of 2019.

- We introduced Charge 4, our most advanced health and fitness tracker to date with Active Zone Minutes, Sleep tools, Fitbit Pay, and built-in GPS.

- Our Fitbit Health Solutions business was 14 percent of revenue, or $27 million.

- Inventory in the channel was flat year-over-year, but with the expected reduction in demand, weeks of supply increased sharply year-over-year.

- We provided a 90-day free trial to Fitbit Premium to give users more tools to stay healthy while sheltering in place and saw a significant increase in the number of free Fitbit Premium trials. We have also seen a significant increase in paid Fitbit Premium subscribers in the quarter, helping drive Fitbit Premium revenue up 195 percent year-over-year, but still representing an immaterial amount of our total revenue.

- We introduced a COVID-19 resource tab in our free app that provides access to helpful information, tools and resources, such as connecting with a doctor virtually.

- We announced a broader research effort in coordination with health industry leaders like Stanford Medicine and The Scripps Research Institute, to study how data from wearables can detect, track, and contain infectious diseases like COVID-19.

COVID-19-Related Impact To Financials

- Our business during the first quarter of 2020 was negatively impacted by the outbreak of COVID-19, which caused disruptions in the development, manufacture, shipment, and sales of our products.

- We increased reserves for product returns, rebates and promotions to retailers and distributors, and price protection by approximately $16 million.

- We increased credit loss allowances by $6 million.

- The current circumstances are dynamic and unprecedented, and the impacts of COVID-19 on our business operations, including the duration and severity of the effect on overall consumer demand, cannot be predicted. However, we expect COVID-19 and associated mitigation efforts to continue to have a significant negative impact on our results in 2020, including our liquidity, although the nature and extent will depend on future developments that are evolving and highly uncertain.

Additional Highlights and Information

- Fitbit announced its entry into a Merger Agreement with Google on November 1, 2019. Upon close of the all-cash transaction, which is subject to customary closing conditions, Fitbit stockholders will receive $7.35 per share in cash, valuing the company at a fully diluted equity value of approximately $2.1 billion.

- Fitbit stockholders approved the transaction on January 3, 2020.

- Regulatory review of the transaction is ongoing. We expect Fitbit and Google to secure the necessary regulatory approvals and to close the transaction in 2020; however, the extent to which COVID-19 may impact the timing of receipt of these approvals is uncertain and cannot be predicted. Prior to closing, we do not expect to provide additional updates on the regulatory process other than during the release of future earnings reports.

- Due to the pending acquisition by Google, Fitbit does not plan to host an earnings conference call nor provide next-quarter or full-year guidance.

Photo courtesy Fitbit