Fitbit, which on November 1 said it agreed to be acquired by Google, reported a net loss of $51.9 million in the third quarter against a loss of $2.1 million a year ago. Sales were down 11.8 percent.

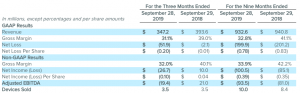

Fitbit, Inc. (FIT) reported revenue of $347 million, GAAP net loss per share of 20 cents per share, non-GAAP net loss per share of 10 cents a share, a GAAP net loss of $52 million, a non-GAAP net loss of $27 million, cash used in operations of $41 million and free cash flow of $56 million for its third quarter of 2019.

“In Q3 we continued to make good progress shifting our business towards the faster growing smartwatch category with the introduction of Versa 2, expanding Fitbit Health Solutions, and deepening our relationship with consumers with the launch of Premium,” said James Park, co-founder and CEO. “The continued success of the Fitbit brand is built on the trust of our users, and our commitment to strong user privacy and security will not change. I’m excited about the combination of Fitbit and Google and look forward to closing the transaction and further advancing our vision and mission, accelerating innovation in the category and ultimately helping more people around the world get healthier.”

Third Quarter 2019

Third Quarter 2019 Financial Highlights

- Sold 3.5 million devices. Overall revenue declined 12 percent year-over-year driven by a 12 percent decline in pricing and flat year-over-year growth in devices sold. Average selling price per device sold was $96.

- Smartwatch revenue increased year-over-year and represented 58 percent of revenue. With no new trackers launched in the third quarter and facing a difficult comparison from the launch of Charge 3 last year, tracker revenue declined and represented 39 percent of total revenue. Accessory and non-device revenue represented 3 percent of revenue.

- Fitbit Health Solutions revenue grew 10 percent in the quarter, producing $73 million in revenue for the year-to-date period, up 31 percent year-over-year.

- Consumer direct business Fitbit.com grew 23 percent to $27 million.

- U.S. revenue represented 60 percent of total revenue or $207 million, down 10 percent year-over-year.

- International revenue represented 40 percent of total revenue and declined 14 percent to $141 million: APAC revenue grew 19 percent to $41 million; EMEA revenue declined 20 percent to $83 million; Americas excluding U.S. revenue declined 33 percent to $17 million (all on a year-over-year basis).

- New devices introduced in the past 12 months, Fitbit InspireTM, Fitbit Inspire HRTM, Fitbit Ace 2TM, Fitbit Versa Lite EditionTM, and Fitbit Versa 2 TM represented 61 percent of revenue.

- GAAP gross margin was 31.1 percent and non-GAAP gross margin was 32.0 percent. Both GAAP and non-GAAP gross margin were negatively impacted by lower average selling prices driven by increased promotions, the mix shift to smartwatches, higher hosting costs, higher warranty costs, and fixed cost de-leveraging.

- GAAP operating expenses represented 46 percent of revenue, declining 7 percent year-over-year to $160 million, and non-

- GAAP operating expenses represented 41 percent of revenue, declining 4 percent year-over-year to $143 million.

Third Quarter and Other 2019 Operational Highlights

- Active users grew 9 percent year-over-year.

45 percent of activations came from repeat users; of the repeat users, 52 percent came from users who were inactive for 90 days or more. Active users increased year-over-year. - Fitbit devices will be expanding to 59 Medicare Advantage plans in 2020 as a fully covered benefit from 42 plans.

Fitbit announced two disease detection partnerships, Fibricheck and Bristol-Meyers Squibb Pfizer Alliance, to target chronic condition areas and raise awareness and support from screening to diagnosis for heart rhythm irregularities and atrial fibrillation. - Fitbit launched Fitbit Premium, a paid membership in the Fitbit app that uses consumer’s unique data to deliver personalized, actionable guidance. The offering can be purchased separately at $9.99 per month, $79.99 per year, or bundled together with a device.

Fitbit Acquisition by Google

On November 1, 2019, Fitbit announced that it had entered into a definitive agreement to be acquired by Google LLC in an all-cash transaction that values the company at a fully diluted equity value of approximately $2.1 billion. Under the terms of the agreement, the company’s stockholders will receive $7.35 per share in cash upon the closing of the transaction. The transaction is expected to close in 2020, subject to customary closing conditions, including approval by Fitbit’s stockholders and regulatory approvals.

Due to the pending acquisition by Google, Fitbit does not plan to host an earnings call nor provide forward-looking guidance.

Additional Information and Where to Find It