Canadian Tire Corporation Delivers Another Record Year

Same store sales for fourth quarter up in all retail banners over a strong Q4 2013:

2.8 percent at Canadian Tire

4.9 percent at FGL Sports (9.4 percent at Sport Chek)

1.2 percent at Mark's

Fourth quarter diluted earnings per share (EPS) up 5.1 percent or 12.8 percent after normalizing for non-operational costs despite dilutive effects of selling 20 percent of Financial Services business

2014 annual revenue of $12.5 billion, income before tax (IBT) of $878.2 million and diluted EPS of $7.59 exceed strong results achieved in 2013

Financial Services achieves a record $5 billion in gross ending accounts receivable

TORONTO, Feb. 26, 2015 /CNW/ –

Canadian Tire Corporation, Limited (TSX:CTC, TSX:CTC.a) today released fourth quarter and full year results for the period ended January 3, 2015. Reported results include an additional week of operations while same store sales are reported on a comparative basis.

“We delivered another record fourth quarter and impressive annual results, despite unseasonable weather compared to last December. We continue to put the numbers on the board by effectively executing our strategic priorities and I'm proud of how our team has continued to innovate and adapt in a rapidly changing retail environment. We're entering 2015 in a position of operational strength,” said Michael Medline, President and CEO, Canadian Tire Corporation.

“Our investments in digital are paying off in-store and through marketing campaigns, both of which are exciting our customers and driving sales. That said, we have a long way to go in e-commerce and you will see us put our brand and our assets to work as we continue to evolve and become a world-class online retailer,” concluded Medline.

CONSOLIDATED OVERVIEW

FOURTH QUARTER

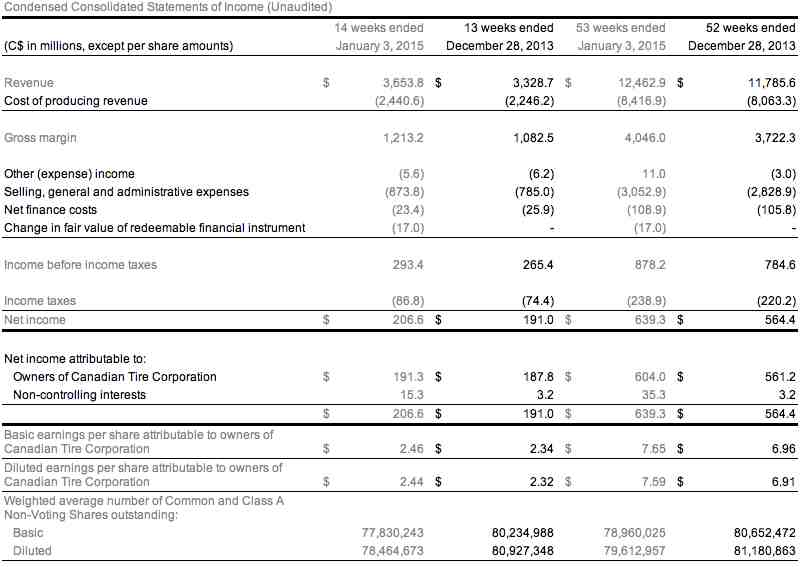

Consolidated revenue increased 9.8 percent or $325.1 million to $3.7 billion in the fourth quarter over the same period last year, as a result of higher shipments at Canadian Tire, strong sales at FGL Sports and increased sales at Mark's.

Fourth quarter consolidated retail sales increased 7.3 percent, up $289.6 million to $4.3 billion. This is attributed to enhanced assortments and successful marketing campaigns that drove higher sales at all retail banners as well as an additional week of retail sales during the quarter.

Diluted EPS was $2.44 in the quarter, up 5.1 percent over the fourth quarter of 2013 and up 12.8 percent after normalizing for the non-operational costs associated with the fair value adjustment on the Scotiabank redeemable financial instrument and costs related to the formation of CT REIT in the prior year. EPS performance reflects strong revenue and gross margin contribution from both the Retail and Financial Services segments.

FULL YEAR

Consolidated revenue for the full year increased 5.7 percent over 2013 to $12.5 billion, reflecting a strong contribution from the Retail segment, led by Canadian Tire and FGL Sports.

Consolidated retail sales for 2014 were up 4.8 percent, or $631.3 million, to $13.9 billion, due to sales growth across the retail banners.

Diluted EPS for the year increased 9.8 percent to $7.59, or 13.1 percent after normalizing for the non-operational costs associated with the fair value adjustment on the Scotiabank redeemable financial instrument, the premium on the early redemption of medium term notes in Q2 2014 and costs related to the formation of CT REIT in the prior year. EPS performance reflects strong revenue and gross margin contribution from both the Retail and Financial Services segments.

RETAIL SEGMENT OVERVIEW

FOURTH QUARTER

Retail segment income before income taxes was up 21.8 percent, or $41.7 million, to $234.5 million in the fourth quarter of 2014 compared to 2013, or 19.5 percent after normalizing for the one-time costs associated with the formation of CT REIT in the prior year.

Canadian Tire retail saw fourth quarter retail sales increase 8.3 percent and same store sales were up 2.8 percent over 2013. Retail and same store sales at FGL Sports were up 15.0 percent and 4.9 percent respectively for the quarter due to increases across all categories and led by strong same store sales of 9.4 percent at Sport Chek. Mark's retail sales in the fourth quarter grew 5.4 percent and same store sales were up 1.2 percent over the prior year. Petroleum retail sales decreased 3.6 percent in the quarter, due to the sharp decline in gas prices and lower gasoline volumes.

FULL YEAR

Retail segment earnings before income taxes increased 14.7 percent to $531.5 million for the full year compared to 2013, or 15 percent after normalizing for non-operational costs associated with the early redemption of medium-term notes and the formation of CT REIT.

For the full year, Canadian Tire retail sales were up 4.4 percent over 2013 results and same store sales increased 2.4 percent. FGL Sports' 2014 retail sales were up 11.5 percent (17.7 percent at Sport Chek) and same store sales increased 6.9 percent (10.6 percent at Sport Chek) over a strong 2013. Mark's full year retail and same store sales were up 4.5 percent and 3.1 percent, respectively, over 2013.

CT REIT OVERVIEW

As disclosed in the Q4 2014 CT REIT release issued on February 23, 2015, CT REIT completed two land acquisitions, two developments and six intensifications in the fourth quarter at a total cost of $36.1 million. On a full year basis, CT REIT completed thirteen property acquisitions, two land acquisitions, two developments and six intensifications at a total cost of $264.6 million.

In its first full year of operations, CT REIT exceeded its financial forecast and ended the year well-positioned for 2015.

FINANCIAL SERVICES OVERVIEW

Financial Services posted strong fourth quarter gross average credit card receivables growth of 7.0 percent, driven by increased average account balances and credit charges.

Income before income taxes for the quarter was flat compared to the strong growth achieved in 2013. Fourth quarter 2014 earnings results reflected increased investments in receivables via deferred financing and balance transfer offers that result in immediate revenue deferral.

For the full year, income before income taxes was up 7.8 percent over 2013 reflecting strong gross average accounts receivable growth and investment in account acquisition.

CAPITAL ALLOCATION

CAPITAL EXPENDITURES

Total capital expenditures for 2014 were $721.8 million compared to $544.1 million in 2013, reflecting increased store network growth and accelerated information technology project spending, investment in additional distribution capacity and investments related to properties acquired by CT REIT from vendors other than CTC.

QUARTERLY DIVIDEND

On February 26, 2015, the company declared quarterly dividends payable to holders of Class A Non-Voting Shares and Common Shares at a rate of $0.525 per share payable on June 1, 2015 to shareholders of record as of April 30, 2015. The dividend is considered an “eligible dividend” for tax purposes.

Over the course of 2014, the company declared dividends to shareholders of $154 million, an increase of 29 percent over the prior year. The current annual dividend rate on Common shares and Class A Non-Voting shares of the company is $2.10 per share.

SHARE REPURCHASE

During 2014, CTC purchased Class A Non-Voting Shares at a cost of $283.7 million, including $83.7 million in connection with its announcement in October that it intended to repurchase a further $400 million of its Class A Non-Voting Shares through to the end of 2015. In addition, the company repurchased Class A Non-Voting Shares at a cost of $6.9 million for anti-dilutive purposes during the year.